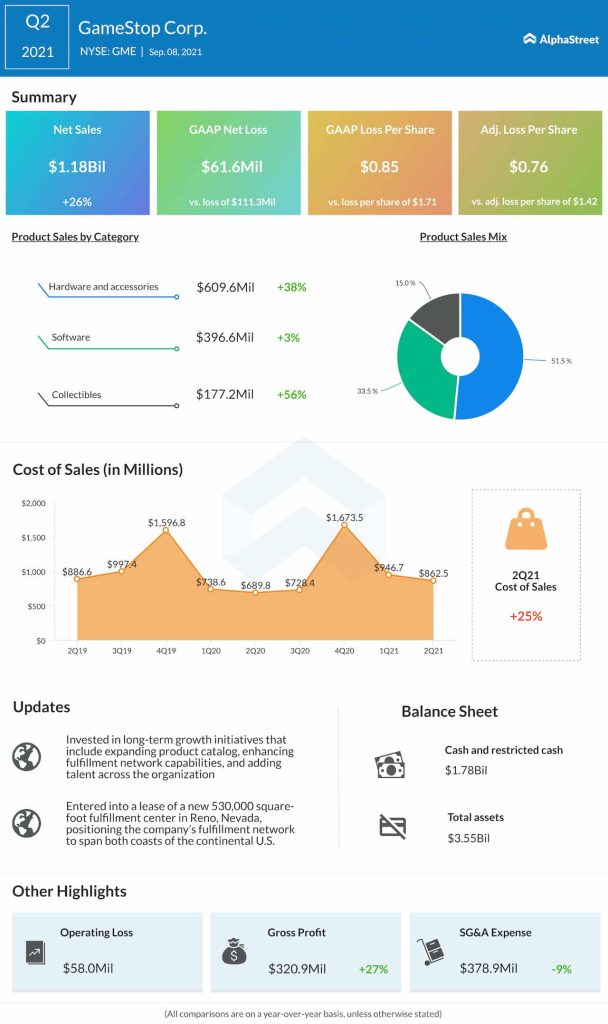

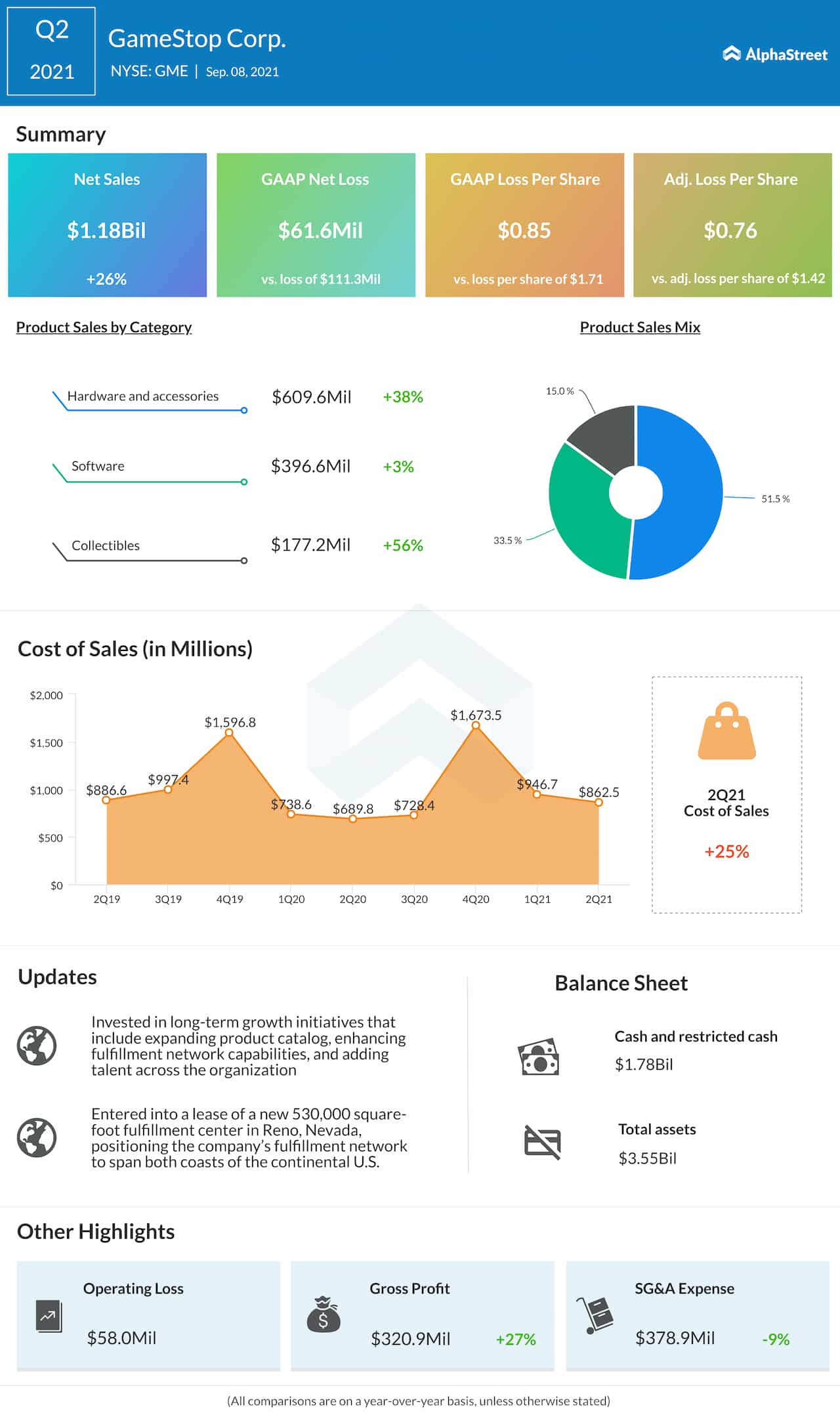

Adjusted net loss improved to $0.76 per share in the July quarter from $1.42 per share in the comparable period of 2020. The latest number missed the estimates.

On an unadjusted basis, it was a net loss of $61.6 million or $0.85 per share, compared to a loss of $111.3 million or $1.71 per share in the second quarter of last year. The improvement reflects a 25% increase in net sales to $1.18 billion. Analysts had forecast a slower top-line growth.

Read management/analysts’ comments on GameStop’s Q2 earnings

Shares of Gamestop closed Tuesday’s trading lower and lost further in the after-hours. The stock has gained 24% in the past 30 days alone.