The Good

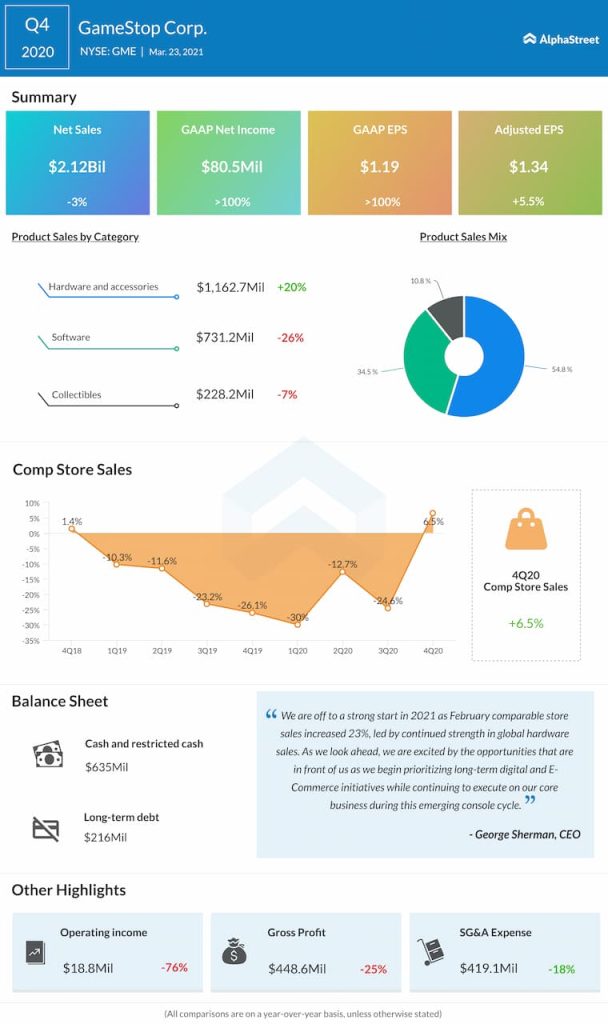

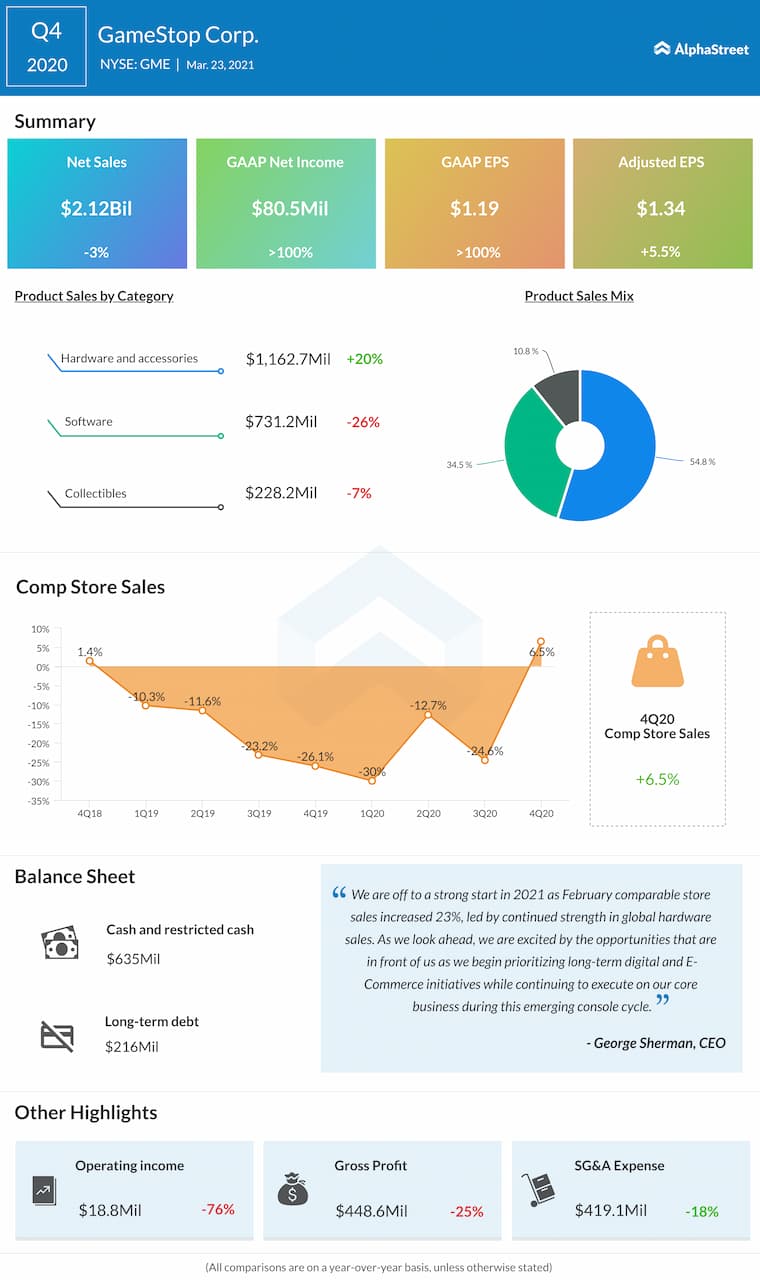

Secondly, comparable store sales grew 6.5% in Q4. This reflects a return to positive comps after nearly two years and that too despite the challenges brought on by the COVID-19 pandemic. Looking into 2021, the company saw a 23% growth in comparable store sales in February helped by strong hardware sales.

Thirdly, GameStop managed to reduce its expenses by 18% in Q4 through its cost optimization efforts, including its store de-densification strategy. Lastly, the company is working on expanding its product offerings across PC gaming, computers, mobile gaming, and gaming TVs. This will help GameStop expand its addressable market and lower its dependence on the console-based gaming market which is prone to cyclicality.

The Bad

GameStop’s total sales fell 3% year-over-year to $2.12 billion, missing market estimates. Adjusted EPS rose over 5% to $1.34 but still fell short of expectations. Analysts were looking for sales of $2.21 billion and EPS of $1.35. GameStop’s sales have been declining over the past few years and this lack of improvement is a cause for concern.

Gross margins fell to 21.1% in Q4 from 27.2% last year. This decline was caused by an increase in mix of lower margin hardware sales, higher freight costs, and credit card processing fees driven by the shift to ecommerce sales.

The Ugly

Wall Street is disappointed with GameStop’s earnings report and the lack of clarity on the company’s future plans. On its quarterly conference call, the company did not provide any details on its transformation plans, its recent stock frenzy or any other significant matter. It also did not take any questions from analysts during the call.

GameStop is not providing guidance for FY2021 and the company will not report comparable store sales this fiscal year as the calculations will be impacted by the pandemic-related store closures. Another issue that has been raising eyebrows is the shakeup in the management team but this could go either way. The new management could build a new strategy for GameStop.

All in all, the lacklustre results and the absence of noteworthy updates has left analysts unhappy and the general sentiment around the stock is pessimistic.

Click here to read the full transcript of GameStop’s Q4 2020 earnings conference call