Goldman Sachs (NYSE: GS) reported a 3% drop in second-quarter earnings, hurt by a decline in revenues. The results, however, beat analysts’ estimates and the bank’s shares gained in premarket trading Tuesday.

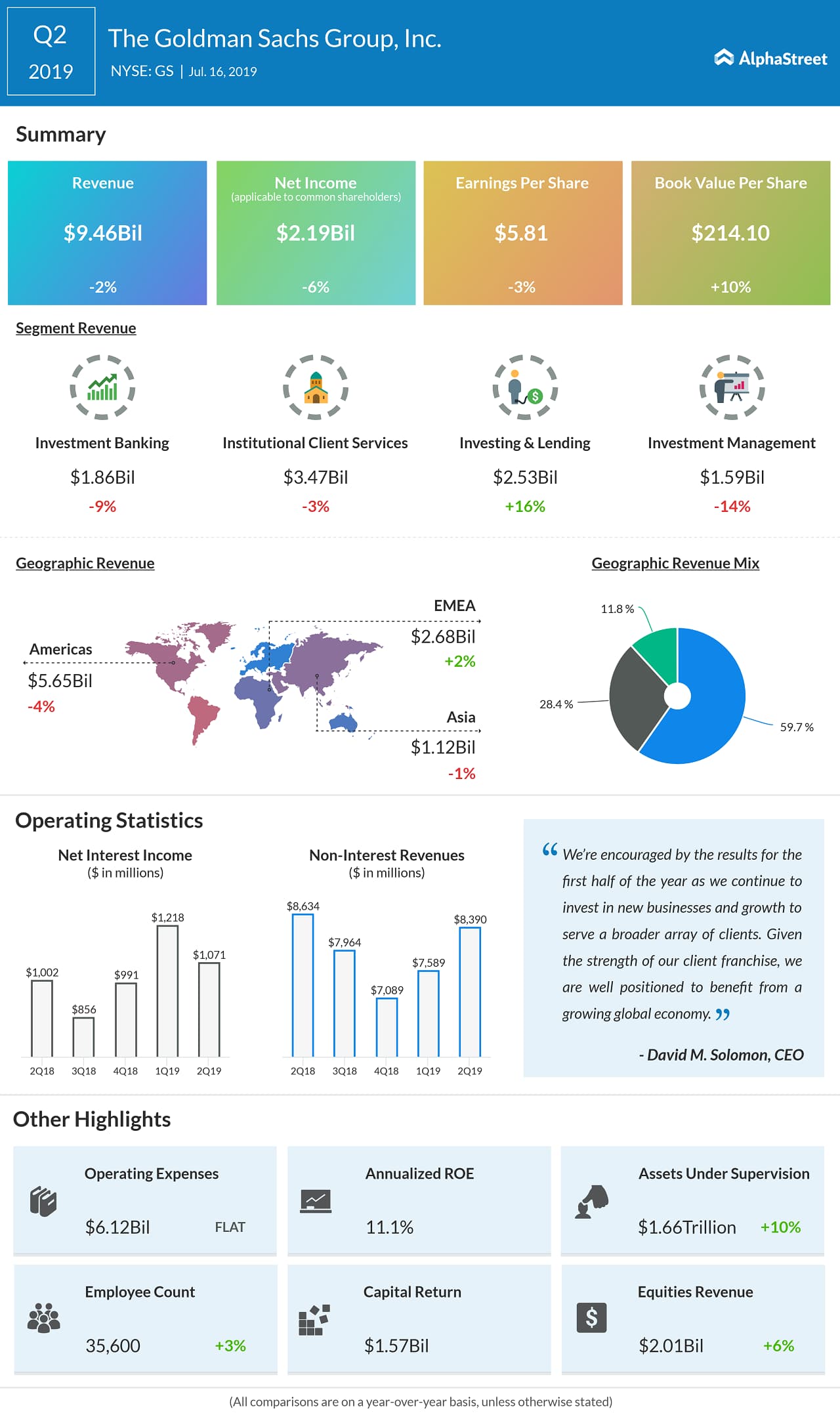

Net income attributable to common shareholders was $2.2 billion or $5.81 per share in the second quarter, lower than $2.35 billion or $5.98 per share reported a year earlier. Analysts had forecast a lower profit for the latest quarter.

Revenues decreased 2% from last year to $9.46 billion during the three-month period but came above analysts’ forecast. The decrease mainly reflects lower revenues in investment management and investment banking, partially offset by higher revenues in investing & lending.

Though investment banking revenue dipped 9% year-over-year to $1.86 billion, it exceeded the consensus estimates. Equities net revenues rose to $2.01 billion – the highest in four years – aided by the strength of equities client execution reflecting higher revenues in cash products and derivatives.

Though investment banking revenue dipped 9% year-over-year to $1.86 billion, it exceeded the consensus estimates

Annualized return on equity was 11.1% in the second quarter. At the end of the quarter, book value per common share was $214.10, up 2.4% from the corresponding period of 2018.

In the June quarter, provision for credit losses decreased 9% annually to $214 million, owing to a dip in provisions related to purchased credit-impaired loans. Meanwhile, total operating expenses remained broadly unchanged year-over-year at $6.12 billion.

Related: Goldman Sachs Group Q1 2019 Earnings Call Transcript

David Solomon, chief executive officer of Goldman Sachs, said, “Given the strength of our client franchise, we are well-positioned to benefit from a growing global economy. And, our financial strength positions us to return capital to shareholders, including a significant increase in our quarterly dividend in the third quarter.”

Shares of Goldman Sachs gained modestly in premarket trading Tuesday, after closing the last trading session down 1%. The stock has gained 23% since the beginning of 2019.