Revenue declines

Losses and low margins

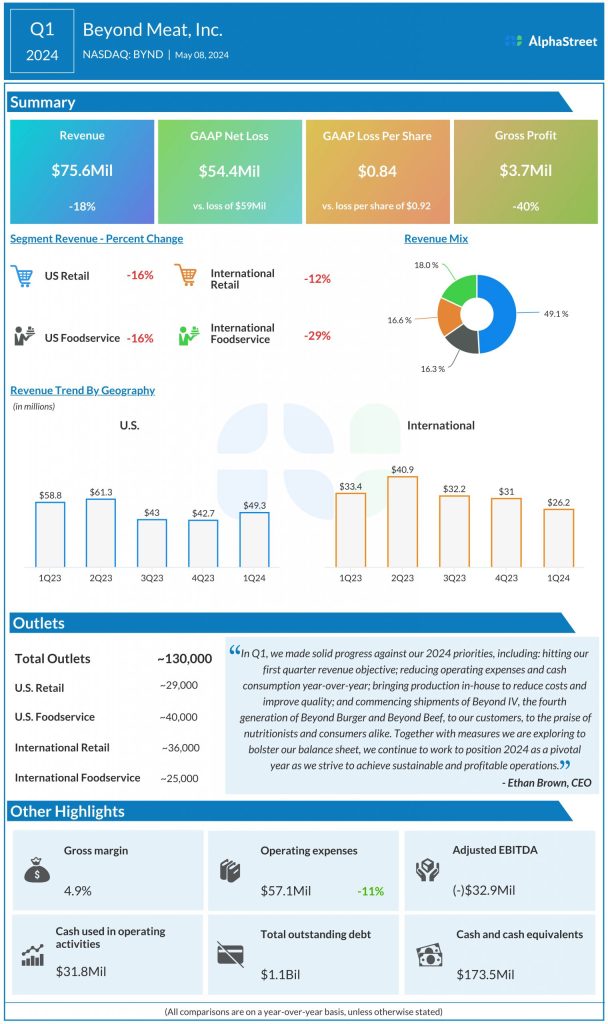

Beyond Meat continues to post losses and its margins are not gaining much traction. In Q1, the company delivered a net loss of $54.4 million, or $0.84 per share, which was, however, narrower than $59 million, or $0.92 per share, last year. Adjusted loss per share also narrowed to $0.72 from $0.92 last year.

The company’s gross margin was 4.9% in Q1, lower than 6.7% reported in the prior-year period. Margins were impacted by lower sales volume and net revenues per pound as well as higher manufacturing costs.

Segment revenue declines

Beyond Meat saw revenues decline across all its segments and channels in Q1 2024. US revenues were down 16% while international revenues were down over 21% YoY. By channel, both the retail and foodservice channels in the US saw revenues decline by 16%, mainly due to lower sales volume and low demand in the plant-based meat category.

Revenues in the international retail channel decreased 12% in Q1, mainly due to the lapping of large orders for chicken products in Europe from a year ago, as well as soft demand in Canada for certain beef and pork items. The international foodservice channel saw revenues decrease nearly 29%, mainly due to the lapping of strong sales to a large QSR customer last year, and soft demand in the UK due to recessionary pressures.

Decrease in distribution points

Beyond Meat has been seeing a drop in its distribution points over the past couple of quarters. Distribution points refer to the number of retail and foodservice outlets where the company’s products are available. In Q1 2024, total distribution points dropped to 130,000 from 146,000 in the same period a year ago.

Outlook

Beyond Meat continues to face challenges from low demand and inflationary pressures. For the second quarter of 2024, revenues are expected to range between $85-90 million. Revenues totaled $102.1 million in Q2 2023. For the full year of 2024, revenues are expected to range between $315-345 million. Gross margin for the full year is expected to be in the mid to high teens range and to be higher in the second half of the year versus the first half.