Kimberly-Clark

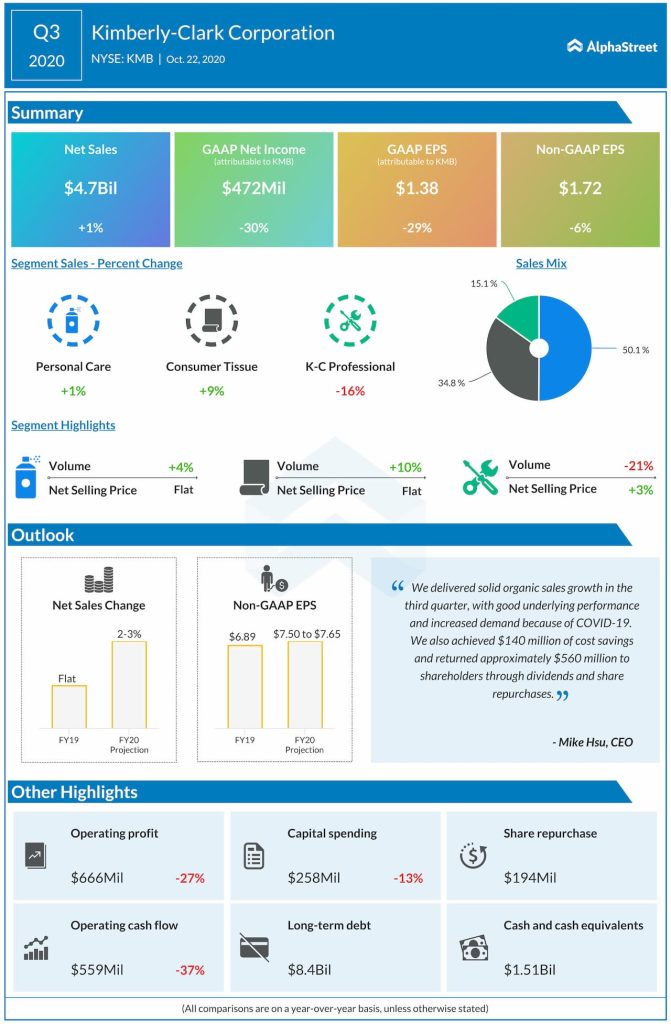

The fact that the personal care products manufacturer is among the least affected by the pandemic makes the stock really attractive. Demand stayed high during the period, which prompted the firm to raise the full-year outlook. When it comes to financial performance, margins were affected by unfavorable foreign exchange rates and COVID-related costs, which is viewed as a short-term headwind.

Efforts are on to expand the face-mask and wiper categories to tap the rising demand. Though the company has been generating sufficient cash to cover the dividend, it makes sense to analyze the cash flow trend before investing, given the volatile market scenario.

Read management/analysts’ comments on Kimberly-Clark’s Q3 report

The management expects the top-line to benefit from contributions from Softex Indonesia in the coming quarters, which is being integrated into the main business. Currently, the target is to return about $2.15 billion to shareholders in the current fiscal year in the form of share repurchases and dividends.

Broadcom

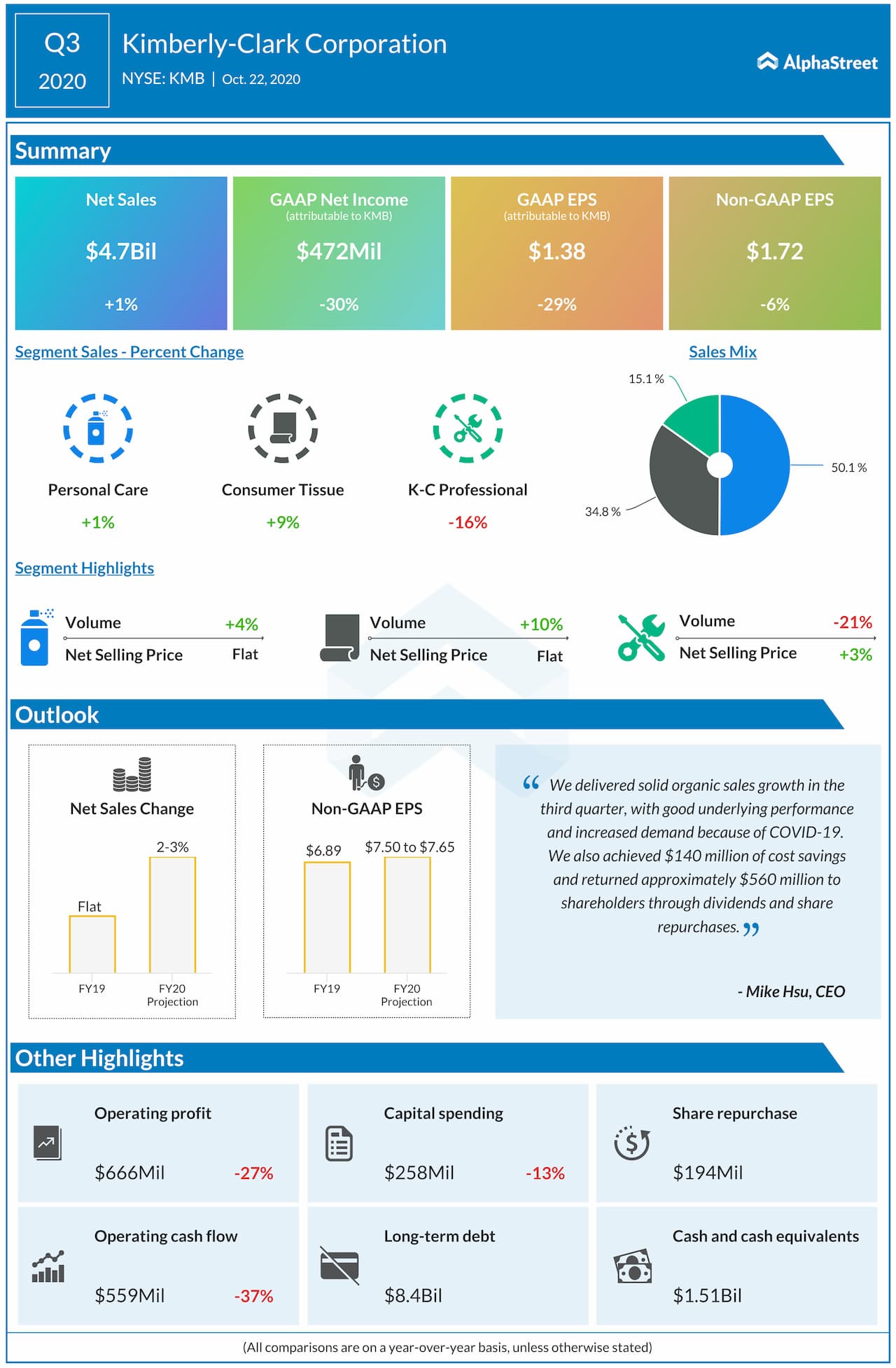

Another Wall Street firm that has hiked the dividend on a regular basis is Broadcom Inc. (NASDAQ: AVGO). Last month, the semiconductor company declared a dividend of $3.60 per share, which represents an 11% increase. It has grown more than three-fold in the past four years. What makes Broadcom stand out is the consistent uptick in financial performance over the years and the increase in market value. That, combined with the impressive dividend yield, has been luring long-term investors.

The stock hit a new peak this month after the tech firm reported better-than-expected earnings and revenues for the October-quarter. It is likely to sustain the momentum in the foreseeable future, thanks to the mass migration of enterprises to digital platforms due to the pandemic. Investors who can afford the stock would be keen to add it to their portfolios, given the encouraging target price that represents more than 10% growth.

The company, which has maintained a healthy cash balance for a long time, generated about $12 billion in free cash flow in fiscal 2020. That says a lot about the strong prospects of the management maintaining the shareholder-return policy, under which it returned about 50% of the free cash flow to shareholders in the past. Last month, Broadcom shares crossed the $400-mark for the first time. It had traded slightly above $300 at the beginning of 2020.

Chevron Corp.

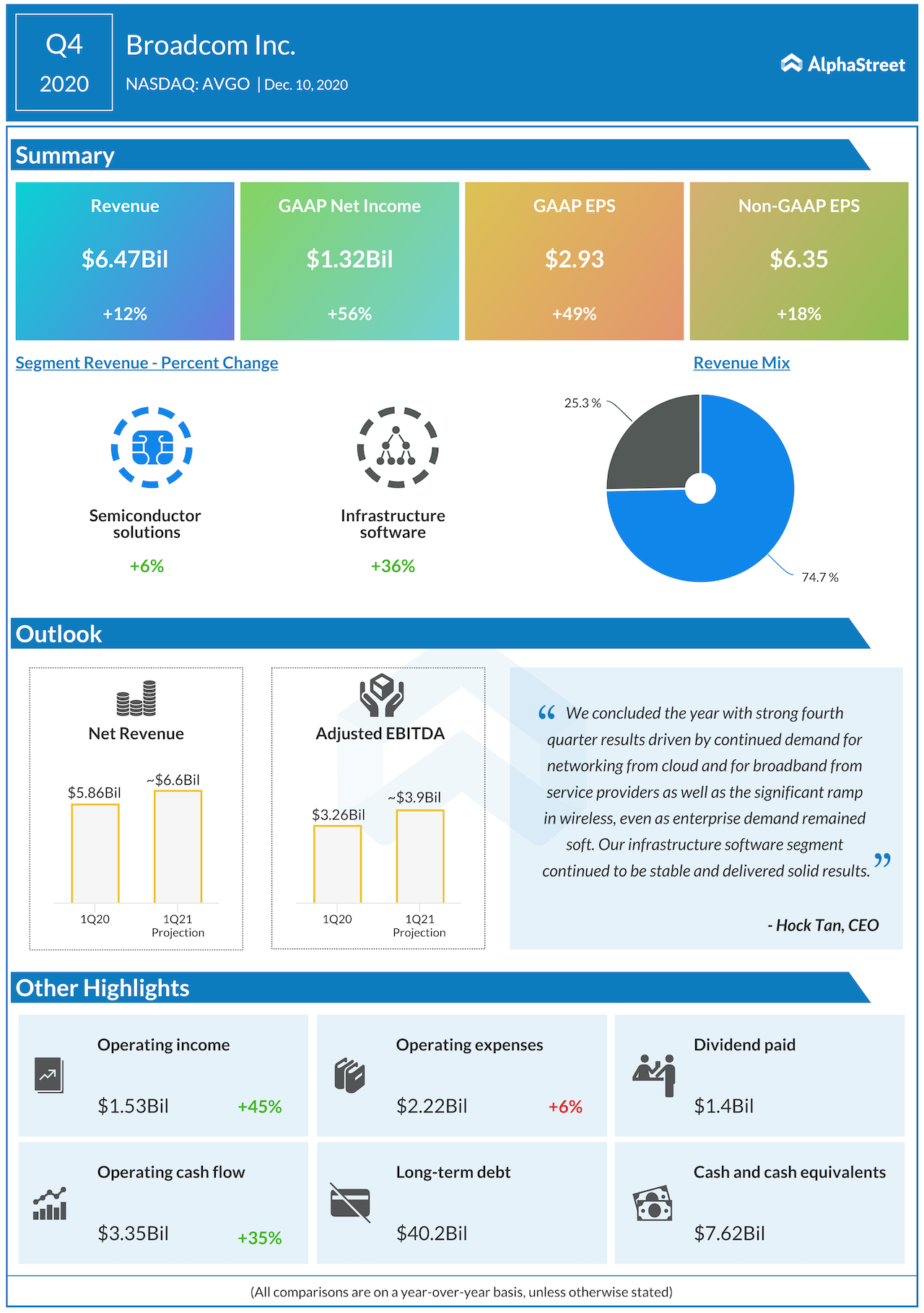

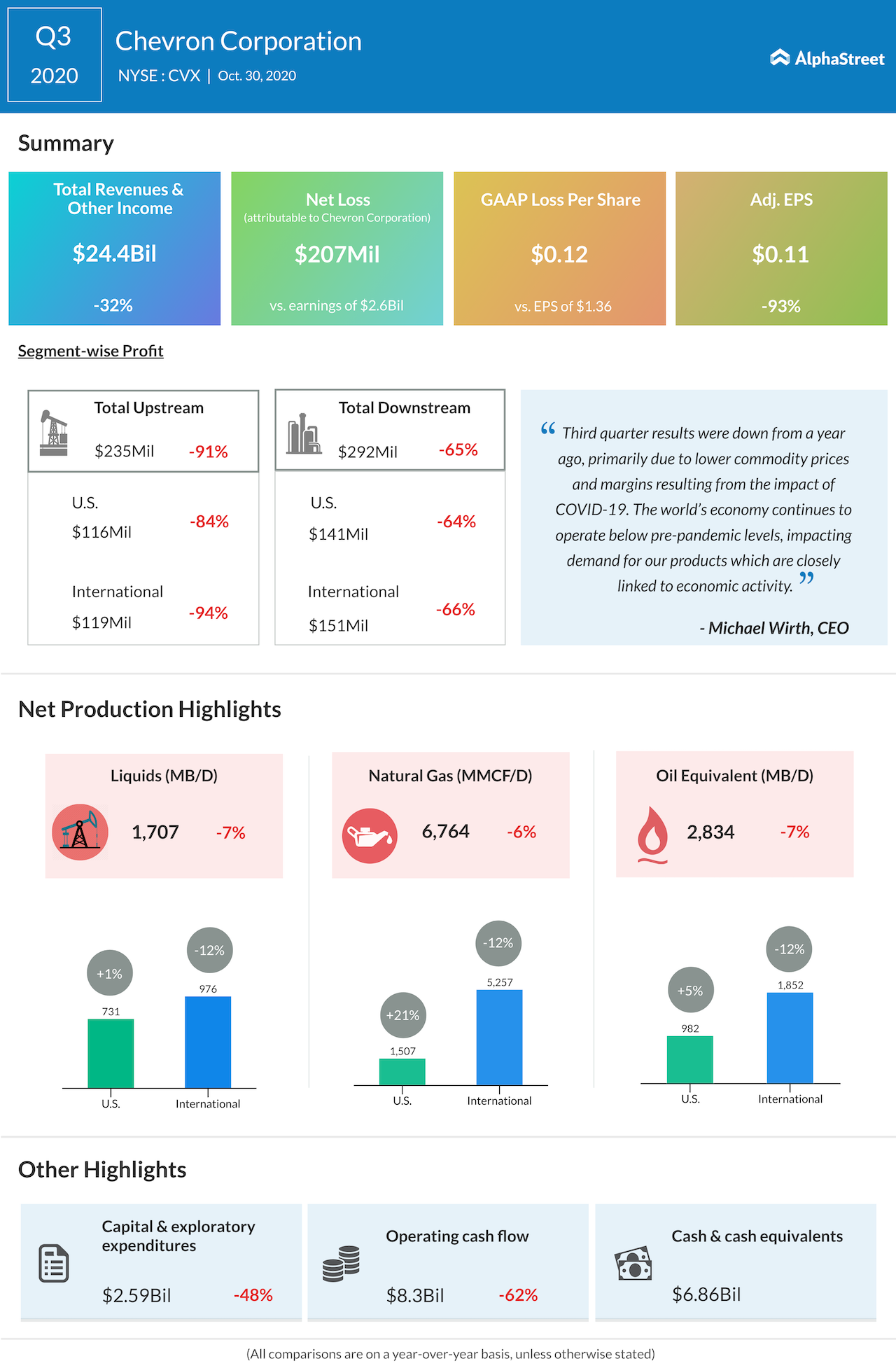

Oil giant Chevron Corp. (NYSE: CVX) is a company that maintained its promising dividend policy even in times of adversity. Unlike the technology and retail industries, the energy sector was hit hard by the coronavirus, which forced the companies to scale down operations and reduce the workforce. Chevron reported a loss for the last two quarters amid faltering revenues, but it was widely expected given the virus-induced challenges facing the sector. Notably, the latest numbers beat expectations.

On the positive side, the company looks poised to enter 2021 on a high note, after improving its position since the early days of the virus crisis. It is a fact that the fossil fuel industry is highly vulnerable to macro uncertainties as demand is influenced by the performance of the broad economy.

Chevron’s commitment to capital discipline is a positive sign as far as shareholders are concerned. The stock dropped about 25% and slipped below $100 since the beginning of the year, but the dividend grew about 8% during that period. That is because the management ‘maintained consistent financial priorities and took action in the early days of the pandemic to allocate capital.’

Read management/analysts’ comments on Broadcom’s Q4 earnings

Importantly, Chevron’s budget allocation for 2021 shows the firm is well-prepared to deal with the current slowdown. The focus is on prioritizing investments that offer long-term returns. Next year, the business is expected to benefit from the integration of Noble Energy, which joined the Chevron fold earlier this year.