Streaming plans

On its quarterly conference call, Disney stated that making its profitable streaming business a significant growth driver for the company was central to its strategy. Disney leads viewership in the US across all formats from movies to television to streaming and its interconnected business model gives it a significant advantage.

The popularity of Disney’s franchises and tentpole films continue to drive engagement on its streaming platform while also leading to a rise in viewership for related titles in its library. The addition of strong content paves way for further growth.

Disney is also seeing growth in bundle subscriptions, with Hulu on Disney+ driving strong engagement. The company ended the quarter with 174 million Disney+ Core and Hulu subscriptions. DIS will strengthen this offering with the launch of the ESPN tile on Disney+ in December, providing Trio Bundle subscribers access to all ESPN+ sports content. It will also launch ESPN’s flagship DTC offering in early fall 2025. These content offerings are anticipated to boost engagement and lower churn while also providing further advertising potential.

On its call, Disney said that more than half of its new US Disney+ subscribers are choosing the ad tier. Entertainment DTC ad revenue grew 14% in Q4, driven by Disney+. The company said it expects advertising to be a driver of DTC revenue going forward.

Q4 performance and outlook

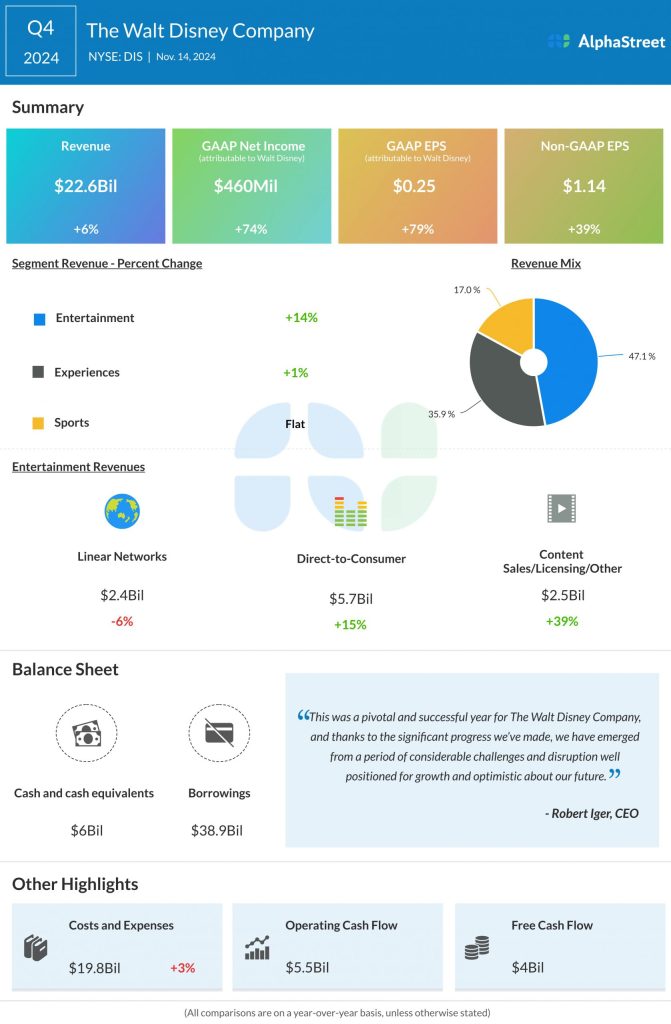

In Q4 2024, Disney’s revenues grew 6% year-over-year to $22.6 billion while its adjusted earnings rose 39% to $1.14 per share. Both the top and bottom line numbers exceeded expectations.

For fiscal year 2025, DIS expects high single-digit adjusted EPS growth compared to fiscal year 2024. It expects Entertainment DTC operating income to increase approx. $875 million versus FY2024. The company also anticipates a modest decline in Disney+ Core subscribers during the first quarter of 2025 compared to the fourth quarter of 2024.

Looking ahead to fiscal years 2026 and 2027, Disney forecasts double-digit growth in adjusted EPS for both periods.