Jewelry market trends

As stated on the call, October through February is the most popular time of year for engagement ring sales. Signet is seeing favorable engagement trends such as a rise in couples moving in together and a spike in Google searches for engagement rings. The company is seeing an increase in the percentage of couples moving to the engagement phase as well as more positive attitudes towards engagement and marriage among younger consumers.

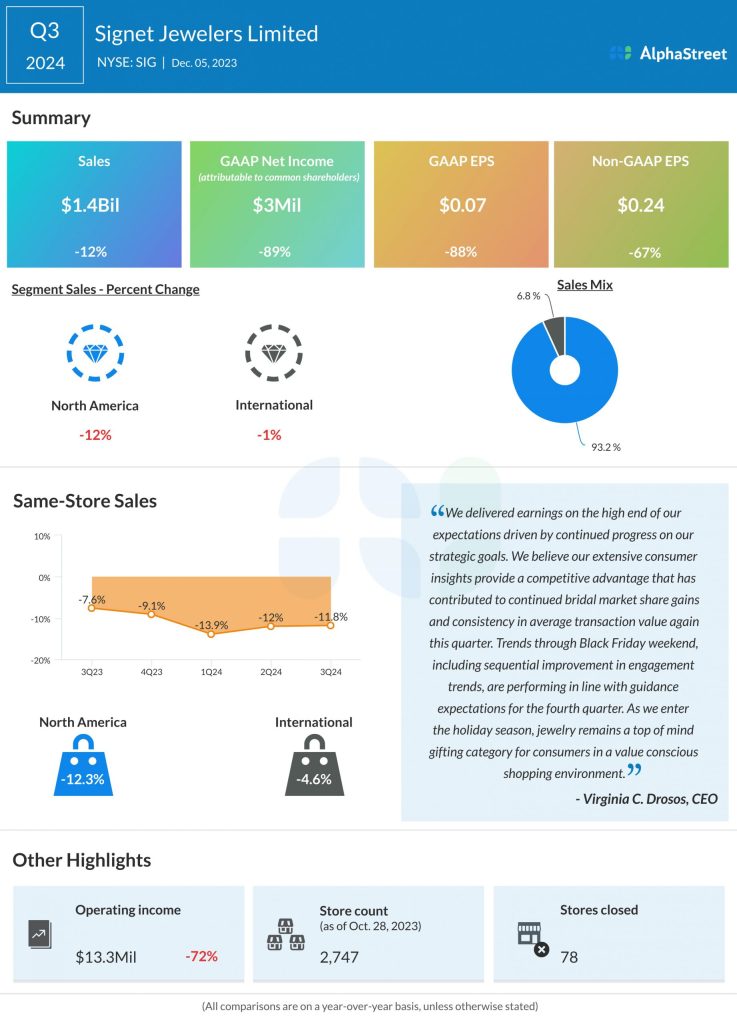

In addition, Signet said the trends seen through the Black Friday weekend, which included a sequential improvement in engagement trends, were in line with its expectations for the fourth quarter of 2024. Looking into the holiday season, jewelry remains a ‘top-of-mind gifting category’ for consumers.

Quarterly performance

Signet saw its net sales for the third quarter of 2024 decrease 12.1% to $1.4 billion compared to the same period a year ago. Same-store sales for the quarter were down 11.8%. Sales decreased nearly 12% in the North America segment with a 12.3% drop in same-store sales. The International segment saw sales decline 1.4%, with same-store sales down 4.6%. Adjusted EPS was down 67% to $0.24.

Outlook

Signet expects to see a recovery in engagements in the fourth quarter of 2024 and a further rebound over the next three years. It expects engagements to be down mid to high single digits compared to the previous year versus down mid-teens year-to-date.

The company has forecasted total sales of $2.40-2.60 billion for Q4 2024. The fourth quarter includes a 53rd week, which is expected to bring in revenue of $80-100 million. Signet lowered its sales guidance for the full year of 2024 to a range of $7.07-7.27 billion from the previous range of $7.10-7.30 billion. EPS for the year is now expected to be $9.55-10.18 versus the prior outlook of $9.55-10.14.