Shares of Meta Platforms, Inc. (NASDAQ: META) gained over 1% on Tuesday. The stock has jumped 191% this year. The social media giant delivered revenue and earnings growth during its most recent quarter along with growth in its user base. This, coupled with its investments in artificial intelligence (AI), have generated significant optimism around the company’s growth trajectory.

Top and bottom line growth

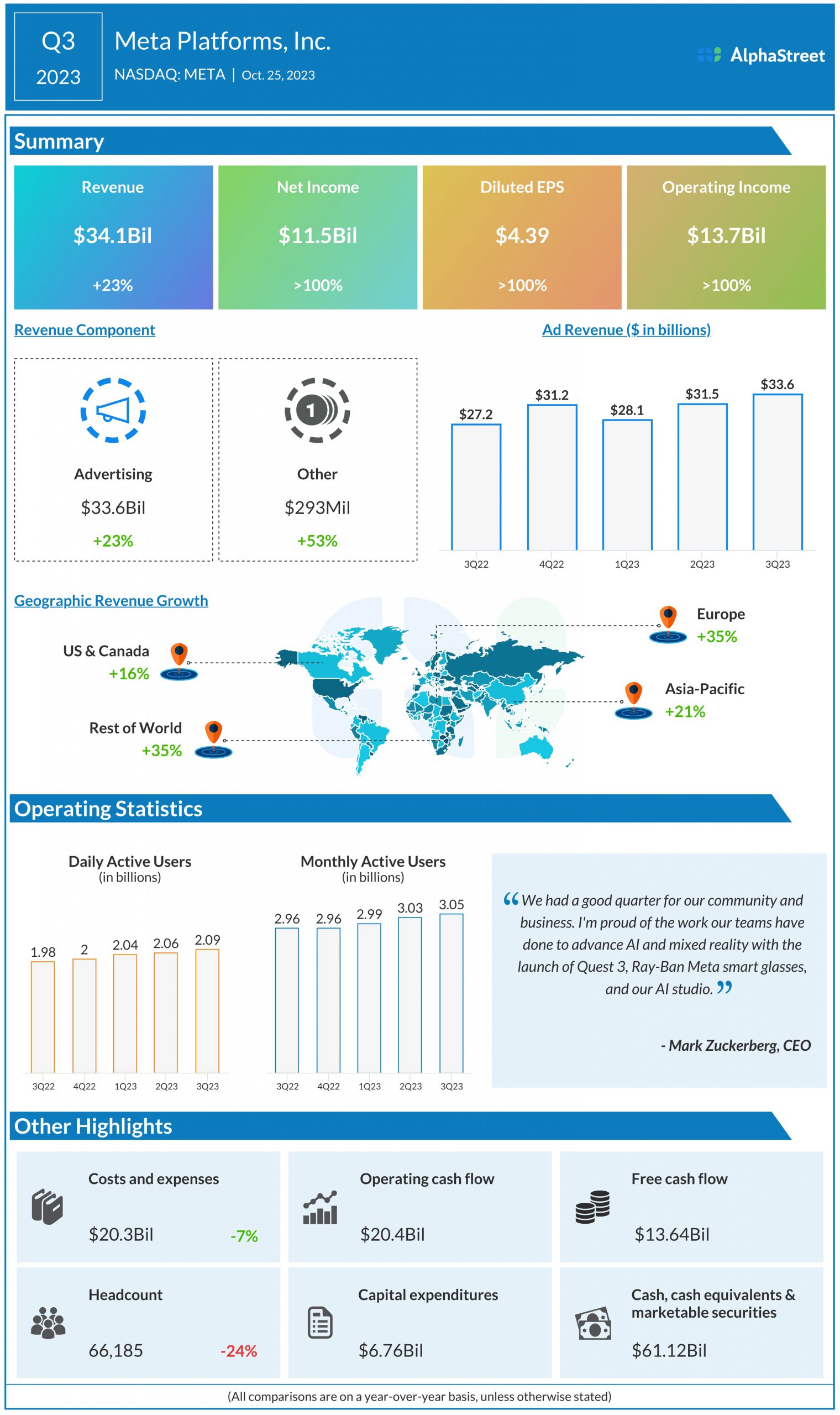

In the third quarter of 2023, Meta’s revenue grew 23% year-over-year to $34.15 billion. Net income jumped more than 160% to $11.6 billion, or $4.39 per share, versus last year. For the fourth quarter of 2023, total revenue is expected to range between $36.5-40 billion. This compares to revenue of $32.2 billion reported in Q4 2022.

User growth

Meta continues to see growth in its user base. In Q3, its family daily active people (DAP) and monthly active people (MAP) both rose 7% YoY to 3.14 billion and 3.96 billion, respectively. Within the Family of Apps, Facebook continues to see strong engagement. Daily active users (DAUs) on Facebook increased 5% to 2.09 billion while monthly active users (MAUs) grew 3% to 3.05 billion.

On a geographical basis, Facebook is seeing stronger user growth in the Asia-Pacific and Rest of World regions compared to the US & Canada and Europe regions both on a YoY and sequential basis.

Strong balance sheet

Meta’s balance sheet remains strong. The company had $61.12 billion of cash, cash equivalents and marketable securities as of September 30, 2023. Cash flow from operations was $20.4 billion and free cash flow was $13.64 billion in the third quarter of 2023.

Artificial Intelligence

On its Q3 call, Meta stated that AI will be its biggest investment area in 2024 and that generative AI will increasingly be important going forward. AI-driven feed recommendations are helping drive incremental engagement. In 2023, the company saw a 7% increase in time spent on Facebook and a 6% increase on Instagram due to recommendation improvements.

Meta is using AI across its ads systems and suite of products. It continues to adopt advanced ad models and make use of AI to generate ads products that enable higher automation for advertisers. These efforts have helped drive better performance for advertisers. The company’s Advantage + Shopping solution is gaining traction, mainly in the area of online commerce.

Meta expects its capital expenditures for full-year 2024 to range between $30-35 billion, driven by investments in servers, including non-AI and AI hardware, and data centers. The company expects total expenses in 2024 to range between $94-99 billion, driven by higher infrastructure-related costs and a growth in payroll expenses. Meta plans to de-prioritize a couple of non-AI projects to shift people towards AI projects.