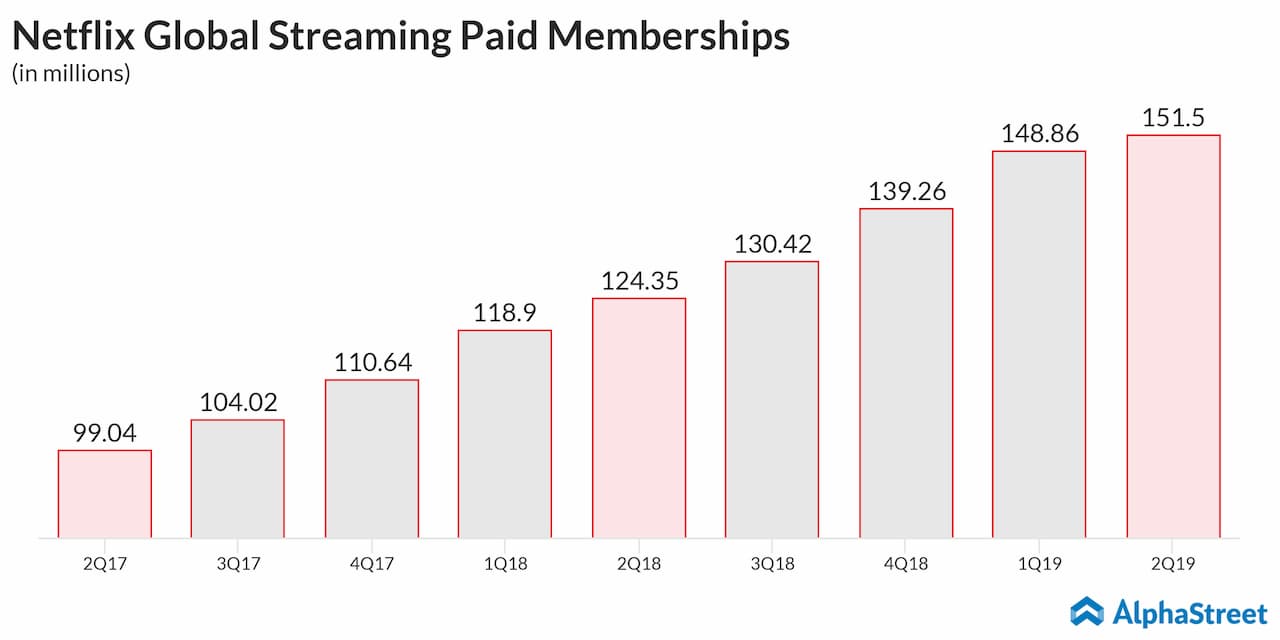

One of the focus areas of the post-earnings interview that followed Netflix’s second-quarter results was the slowdown in membership growth. CEO Reed Hastings attributed the slump to seasonal factors and the nature of the content slate, and announced initiatives to revive the growth momentum. At the end of the quarter, the steamer had more than 151 million subscribers, up 20% from last year. However, the growth rate fell short of expectations, triggering a stock sell-off soon after the announcement.

Resilient to Competition?

Interestingly, the management did not want to link the slowdown in net additions to the growing competition, and it exuded confidence that the business would not be affected by the entry of Disney Plus (DIS) and Apple’s (AAPL) planned streaming service. The stance complemented the company’s long-term view that it faced competition only from linear TV networks, not from other video streaming platforms.

However, Hastings changed his view this week and admitted that competition is a serious concern as far as future growth is concerned. “It’s a Whole New World Starting in November,” he said, apparently referring to the upcoming launches of Apple TV Plus and Disney Puls. In a way, the revelation endorses what investors have feared for long. Netflix’s excessive spending on original content has been a cause for concern for the stakeholders.

Splurge on Content

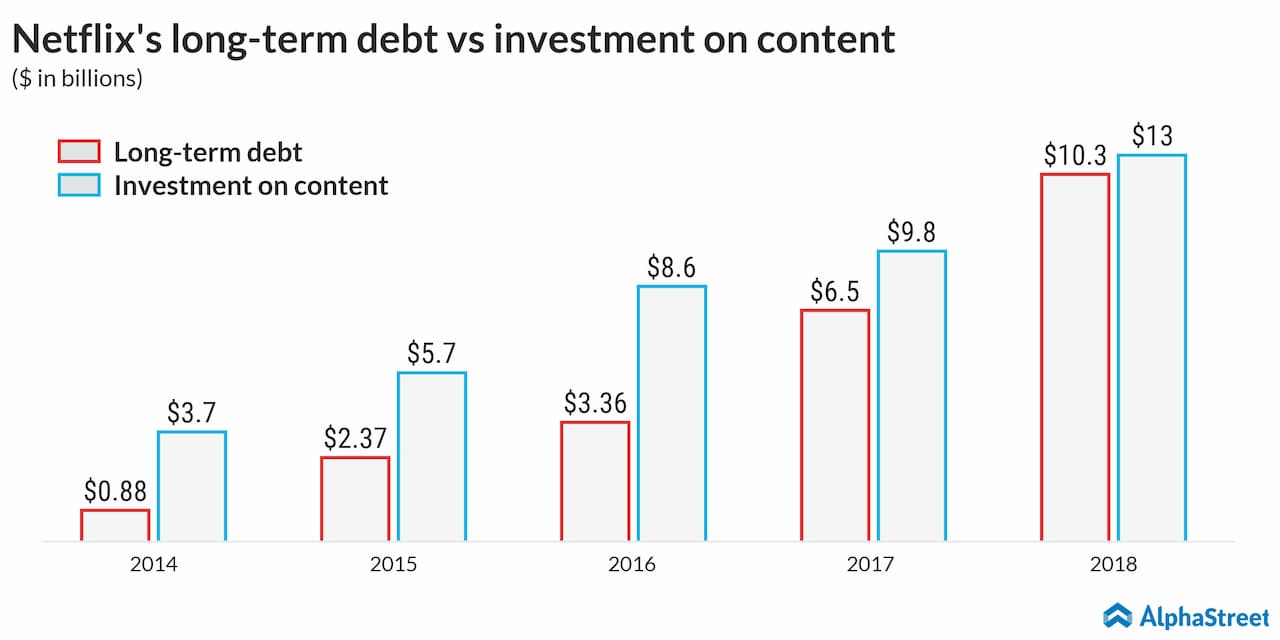

Netflix spent about $13 billion on content acquisition last year, when its long-term debt stood at $10.3 billion. The company might end up spending more this year as it is already facing stiff competition from the likes of Amazon (AMZN) in that area.

On Friday, the already-dampened investor sentiment suffered a fresh blow after analysts cautioned that the ongoing slowdown in mobile app downloads might intensify in the coming months. The drop in the share value validates the average buy rating assigned by market watchers, who have set the target price at $412 representing a 30% upside from the current levels.

Crucial Q3

Since Netflix’s market value is closely linked to its ability to maintain/expand the user base, the next quarterly report will be crucial, considering the headwinds the company is facing. To put it simply, 2020 will be an extremely challenging year for the company.

Though the stock had bounced back from the 12-month low seen towards the end of last year, it pared the gains in recent weeks and closed the last session broadly at the levels seen at the beginning of the year. In the week ended September 20, the stock lost about 9%.