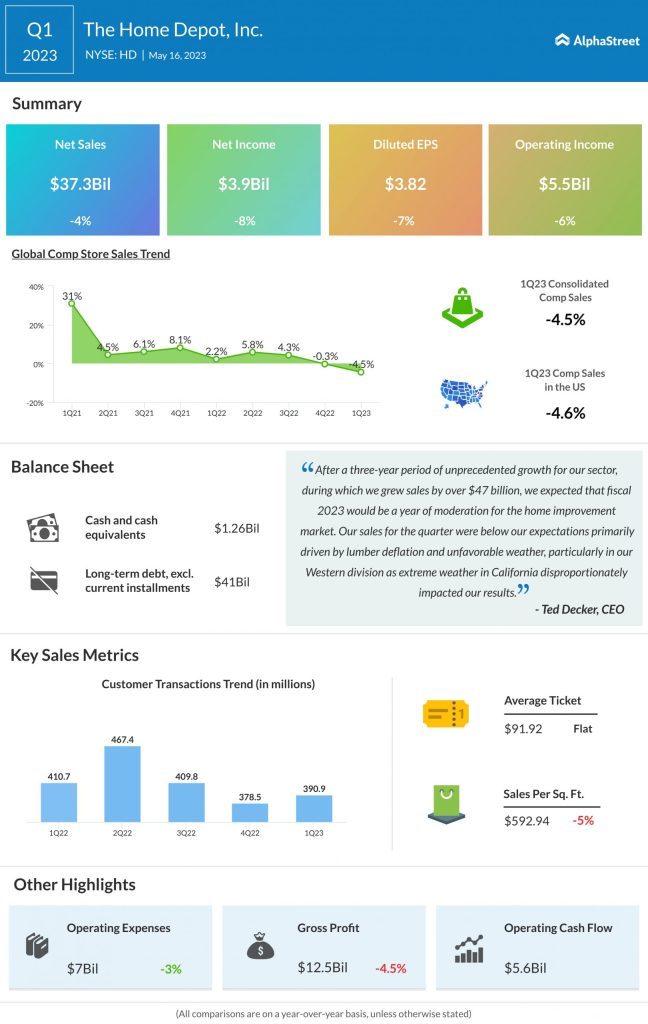

Sales decline

Challenging environment

Home Depot saw a more difficult environment this quarter compared to the previous quarter. It recorded overall negative comps sequentially throughout Q1 and despite some strength in project-related categories like building materials, many of its departments also witnessed negative comps.

Both the Professional and DIY segments were negative in Q1 although DIY outperformed Pro. On its quarterly conference call, Home Depot stated that “while internal and external surveys suggest that Pro backlogs are still healthy and elevated relative to historical norms, they are lower than they were a year ago.”

The company is seeing pressure on big-ticket discretionary purchases and within the Pro backlog, it appears there is more of a shift towards small-ticket outdoor projects from large-scale remodels. Big ticket comp transactions were down 6.5% in Q1.

Despite some strength in Pro-heavy categories like pipe and fittings, Home Depot continued to see softness in big-ticket discretionary categories like patio, grills and appliances, which suggest a deferral of these purchases. It also saw muted demand in categories like flooring, kitchen and bath which indicates the move from larger to smaller projects. In general, the near-term environment remains uncertain.

Guidance cut

Home Depot lowered its guidance for the full year of 2023 due to the further softening of demand, the negative impact of lumber deflation and adverse weather on Q1 results, and the prevailing uncertainty over consumer demand patterns. The company now expects sales and comparable sales to decline 2-5% in FY2023 versus FY2022. It had earlier guided for flat sales and comps. EPS for the year is expected to decline 7-13%.