Shares of Hormel Foods Corporation (NYSE: HRL) soared over 13% on Thursday after the company delivered better-than-expected earnings results for the first quarter of 2024 and reaffirmed its outlook for the full year. The foodservice business witnessed significant momentum during the quarter, which is expected to continue through the year. In addition, the international business is expected to see a pickup in FY2024.

Results beat estimates

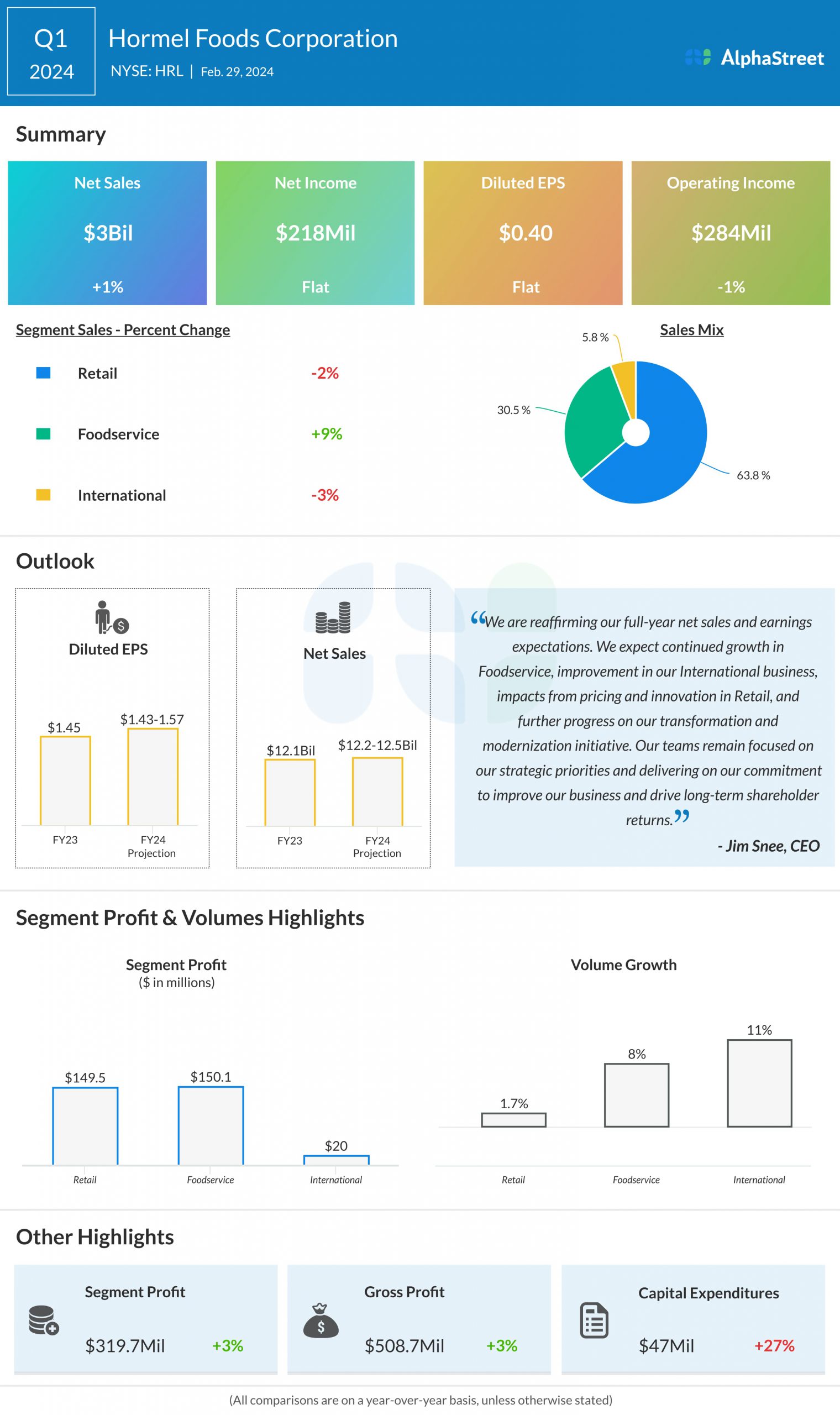

Hormel reported net sales of $3 billion for the first quarter of 2024, which was up 1% year-over-year and ahead of estimates of $2.92 billion. The top line benefited from higher volumes across all segments and strong growth in the Foodservice segment, which more than offset lower sales in Retail and International.

GAAP EPS of $0.40 remained unchanged from last year, as benefits from higher sales and lower logistics expenses were offset by higher SG&A expenses and a higher tax rate. Adjusted EPS of $0.41 surpassed analysts’ projections of $0.34.

Business performance

In Q1, the Retail segment saw sales decline by 2%, mainly due to reductions in contract manufacturing volume and commodity turkey pricing. Volumes rose 2%, driven by value-added meats, bacon, global flavors, and emerging brands. The segment benefited from strong demand for products such as Skippy peanut butter, Planters snack nuts, Wholly dips, and Hormel pepperoni.

In the Foodservice segment, sales rose 9% and volumes grew 8%. This growth was fueled by strong gains in Jennie-O turkey, Hormel Bacon 1 cooked bacon, Austin Blues smoked meats, and Café H proteins. The Heritage Premium Meats group also contributed to the momentum in this segment.

Sales in the International segment fell 3% in Q1, due to lower branded export sales and lower sales in China. Volumes increased 11%, helped by higher commodity exports. The company saw an improvement in foodservice results in China as it lapped last year’s COVID-related disruption, but this was offset by continued weakness in the retail channel.

Reaffirmed guidance

Hormel reaffirmed its sales and earnings outlook for fiscal year 2024. The company expects net sales to grow 1-3% YoY and to range between $12.2-12.5 billion. This outlook assumes volume growth in key categories and impacts from incremental pricing actions. GAAP EPS is expected to be $1.43-1.57 and adjusted EPS is expected to be $1.51-1.65.