Shares of Lennar Corporation (NYSE: LEN) were down over 1% on Monday. The stock has gained 62% this year. The homebuilder delivered revenue and earnings growth for the fourth quarter of 2023 and it holds a fairly optimistic view for the upcoming fiscal year. Here’s a look at how Lennar fared in Q4 and what it anticipates in 2024:

Quarterly numbers

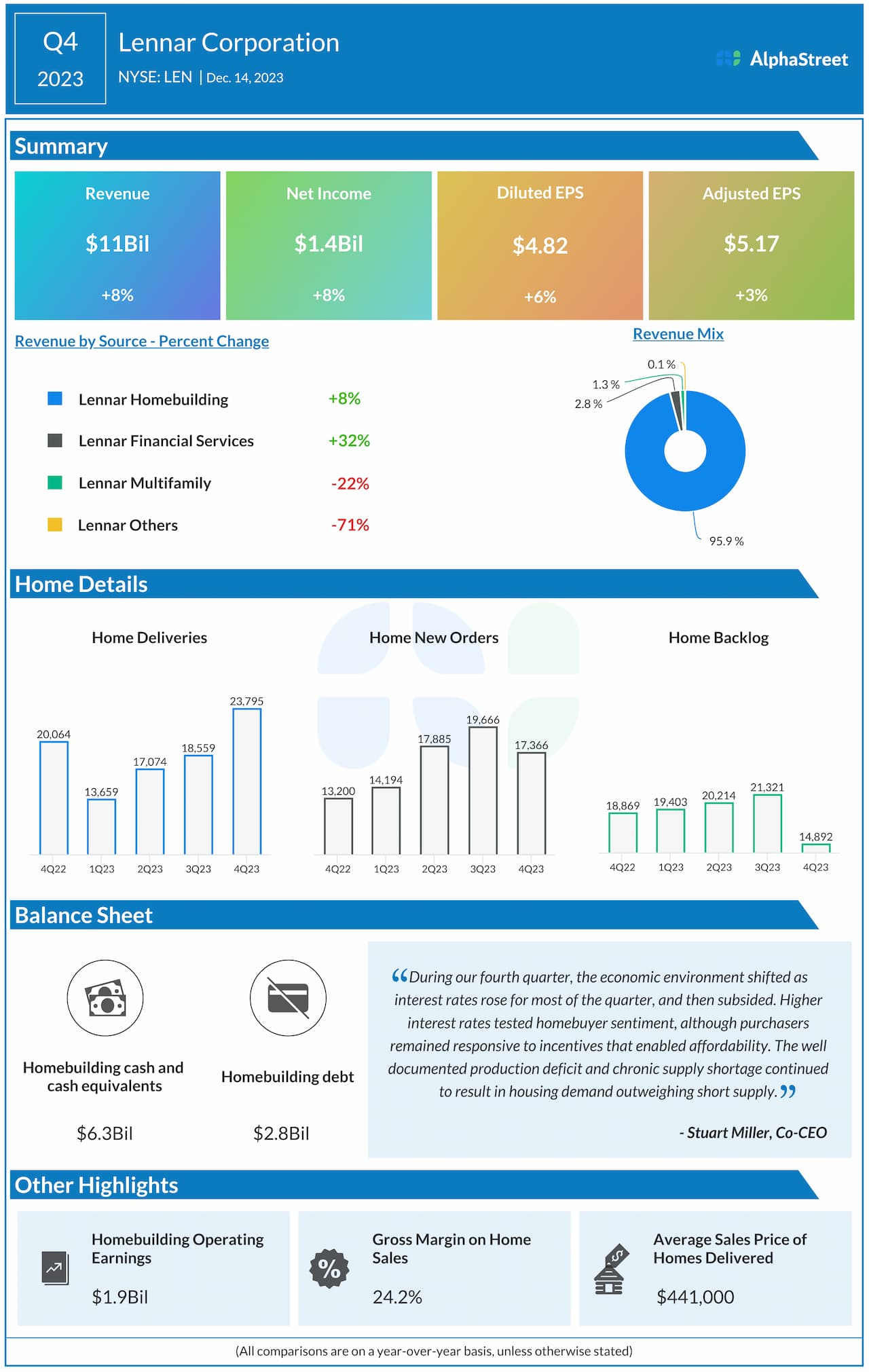

Lennar saw growth in both its top and bottom line numbers in the fourth quarter of 2023. Revenue grew 8% year-over-year to $11 billion. GAAP EPS rose 6% to $4.82 while adjusted EPS increased 3% to $5.17 compared to the prior-year period.

Business performance

As stated on the company’s conference call, throughout 2023, higher interest rates hindered affordability, which in turn constrained demand. There has been a shortage in supply of affordable homes and a rise in pent-up demand for housing. In this environment, Lennar has been focusing on driving volume, meeting demand and finding affordability through pricing and incentives.

The company’s new orders increased 32% to 17,366 homes while its deliveries increased 19% to 23,795 homes in Q4 2023. Housing starts rose 43% to 18,378 in the quarter. Meanwhile, the average sales price of homes delivered dropped 9% to $441,000 due to higher incentives. Gross margin dipped to 24.2% in Q4 from 24.8% last year, due to the drop in average sales price.

Lennar anticipates a lowering in interest rates in 2024. Lower interest rates will allow the company to reduce incentives thereby helping it recover margins. At present, the homebuilder expects margins to be at least consistent with 2023 levels. Gross margin on home sales were 23.3% in FY2023. Lennar also expects to see a 10% growth in deliveries in 2024, which would amount to approx. 80,000 deliveries in the year.

Outlook

For the first quarter of 2024, Lennar expects new orders to range between 17,500-18,000 homes and deliveries to range between 16,500-17,000 homes. The company expects approx. 18,500 starts in Q1. The average sales price is estimated to be about $420,000 and gross margins are expected to range between 21% to 21.25%. EPS is expected to range between $2.15-2.20 in Q1.