Revenue and earnings

All three social media companies posted double-digit revenue growth in Q1 2021 and their earnings saw an improvement from the year-ago period. However the spike seen in revenues last year is likely to even out in the coming months as trends normalize.

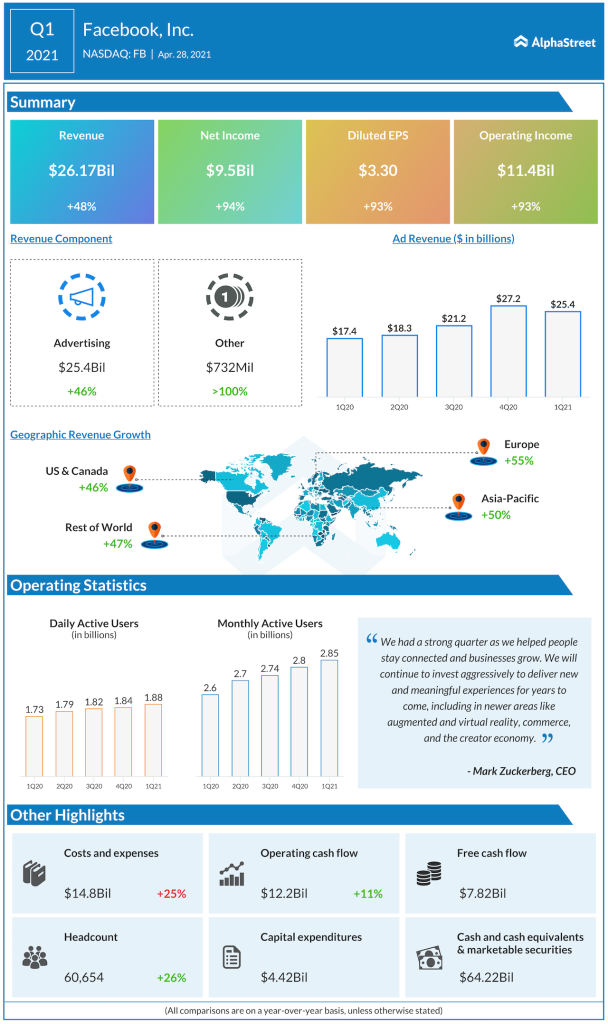

Facebook’s revenue increased 48% year-over-year to $26.1 billion while earnings almost doubled to $3.30 per share. Twitter saw revenue grow 28% YoY to $1.04 billion and the microblogging site reported earnings of $0.08 per share in Q1. Snap’s revenue rose 66% to $770 million and the company delivered break-even earnings on an adjusted basis for the first quarter.

Looking ahead to the rest of the year, Facebook expects its second quarter revenue growth rates to remain stable or see a slight pickup versus a slower growth rate seen last year during the beginning stages of the pandemic. For the latter half of 2021, the company expects its revenue growth rates to slow down significantly compared to the robust growth rates witnessed during the same time last year.

Twitter expects Q2 revenues to range between $980 million and $1.08 billion. Snap projects revenues to come between $820-840 million in the second quarter.

User metrics

The trio witnessed a spike in user numbers last year amid the pandemic-related lockdowns. The growth in users continued during the first quarter of 2021 but these growth rates are expected to slow down as the year progresses and usage levels slip back to pre-pandemic proportions.

Facebook’s daily active users (DAUs) grew 8% to 1.88 billion and monthly active users (MAUs) grew 10% to 2.85 billion YoY in Q1. On a sequential basis, they inched up over 1% and 3% respectively with most of the growth coming from Asia-Pacific and Rest of World.

Snap’s daily active users (DAUs) grew 22% YoY to 280 million in Q1. The company witnessed growth in users both sequentially and YoY in North America, Europe and Rest of World.

Twitter’s average monetizable daily active usage (mDAU) grew 20% YoY and 4% sequentially to 199 million in Q1. US mDAU climbed 1% quarter-over-quarter and 13% year-over-year. International mDAU rose 4% QoQ and 22% YoY.

Twitter expects mDAU to grow in the low double-digits on a year-over-year basis for the rest of 2021 as the spike in usage witnessed last year due to the pandemic is unlikely to be repeated this year.

Advertising

Advertising slumped last year as brands put off their campaigns and cut their ad budgets due to the pandemic and this affected the revenues of social media companies. Advertising witnessed a recovery during the fourth quarter of 2020 and continued to gain momentum through Q1.

Facebook’s advertising revenue grew 46% YoY to $25.4 billion in Q1 helped by increases in the average price per ad and the number of ads delivered. Twitter saw a 32% YoY growth in ad revenue to $898 million. For the rest of 2021, Facebook expects its advertising revenue growth to be driven by price.

Role in ecommerce

Several small and medium sized businesses had to close their stores during the pandemic and were in turn forced to move their operations online in order to stay afloat. Social media companies played a key role in helping these enterprises attract new customers and retain existing ones and in turn generate revenue.

Facebook has helped several businesses move online and it has allowed people to offer their services through its platforms. Its features such as Marketplace, Shops, WhatsApp Catalogs and Payments are all enabling businesses to connect with customers and generate revenues through ecommerce. Currently over 1 billion people visit Marketplace each month while Shops has over 250 million monthly visitors.

Snap is using augmented reality (AR) to improve the online shopping experience in categories like apparel, footwear and accessories by allowing customers to virtually try on the products they wish to buy. The company believes there is massive untapped opportunity for AR in the ecommerce space.

Over the past year, social media companies have discovered new opportunities for monetization on their platforms and they continue to invest in developing new tools and features that will help them take advantage of these opportunities.