Semiconductor company Broadcom, Inc. (NASDAQ: AVGO) ended fiscal 2023 on a positive note, delivering strong results for the fourth quarter. In the new fiscal year, the company’s focus will be on integrating the recently acquired VMware.

A few weeks ago, Broadcom’s stock set a new record and traded close to $1,000, but soon retreated and pared a part of those gains. It has been in an upward spiral since last year and regularly outperformed the broad market. Despite the high valuation, AVGO will continue to be a favorite among long-term investors including those looking for income, thanks to regular dividend hikes and the bigger-than-average yield.

Results Beat

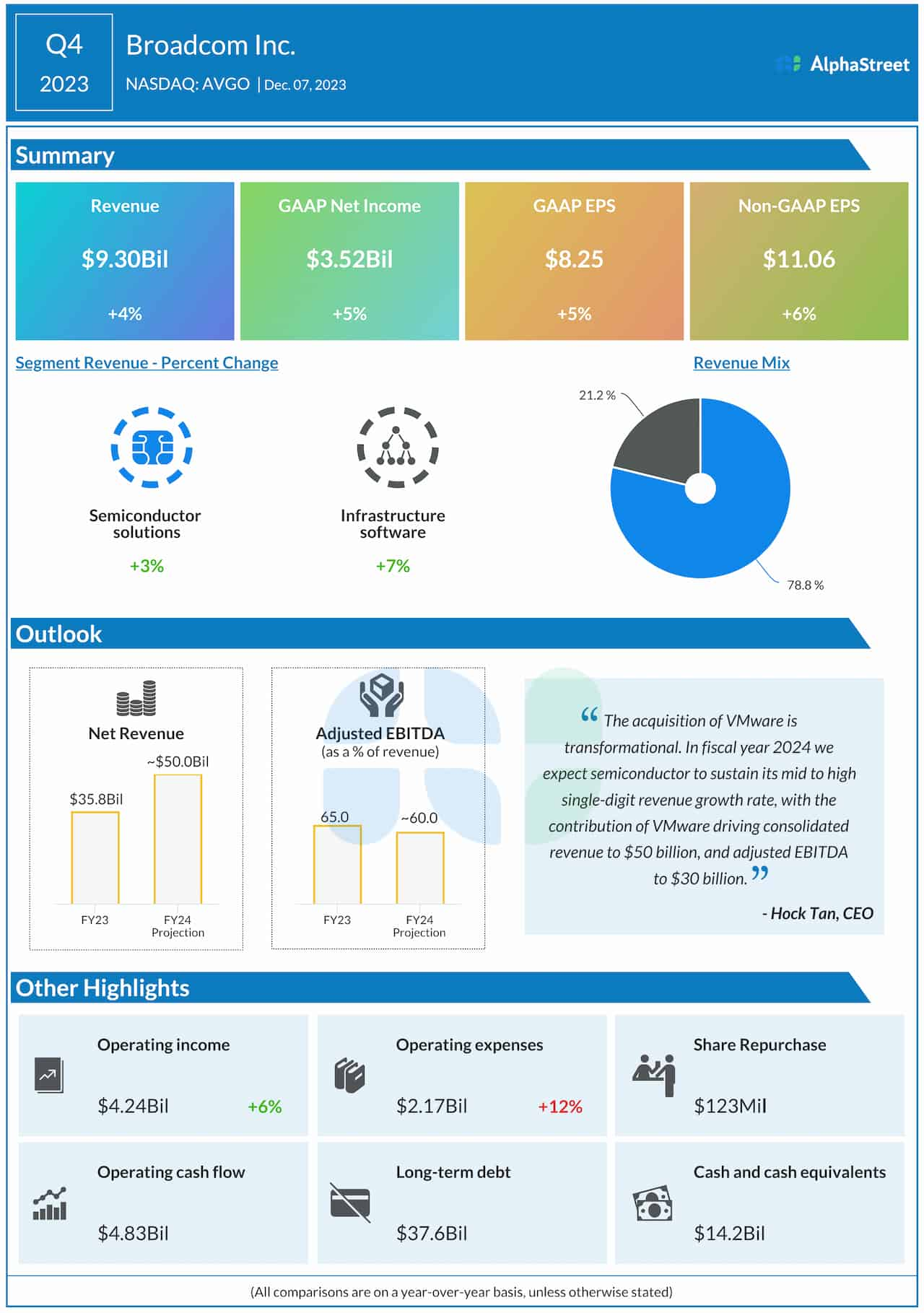

In the final three months of FY23, revenue of the core Semiconductor Solutions division rose 3% from last year while Infrastructure Software revenue moved up 7%. At $9.30 billion, total revenue was up 4%. Consequently, fourth-quarter earnings, adjusted for non-recurring items, increased 6% year-over-year to $11.06 per share. The company has a good track record of delivering better-than-expected results consistently, including in the fourth quarter. It ended the quarter with an impressive free cash flow of $4.72 billion.

For the full fiscal year, Broadcom executives project revenues of around $50 billion, which represents a sharp increase from last year — aided by strong contributions from the VMware business. It is estimated that the semiconductor business will sustain its mid-to-high-single-digit revenue growth in fiscal 2024.

Outlook

Reflecting the strong adoption of the company’s AI-based solutions, revenue from generative AI is expected to increase to 25% of semiconductor revenue in 2024 from 15% last year. That will be partially offset by a decline in server storage revenue by mid-to-high-teens percentage, due to the ongoing cyclical weakness.

Last month, Broadcom completed the acquisition of cloud computing company VMware. Post-merger, VMware became a private entity and is focused on its core business of creating private and hybrid cloud environments. The integration of the new business is expected to take about a year and will require close to $1 billion in transition spending.

From Broadcom’s Q4 2023 earnings call:

“We are now refocusing VMware on its core business of creating private and hybrid cloud environments among large enterprises globally and divesting noncore assets. Reflecting the consolidation of a restructured VMware into our 2024 outlook, we forecast our fiscal year ’24 consolidated revenue to be $50 billion. We expect the integration to take about a year and will require close to $1 billion in transition spending, which will largely be done as we exit fiscal ’24. Regardless, we expect our fiscal year 2024 adjusted EBITDA to be approximately 60% of revenue.”

AVGO traded slightly higher on Friday afternoon and continued to stay sharply above its long-term average. It has gained 15% in the past six months.