Broadcom, Inc. (NASDAQ: AVGO), a diversified semiconductor and software company, once again reported strong quarterly results and raised guidance, aided by a surge in the demand for its AI chips and growing revenue contribution from VMware, which was acquired last year.

The positive second-quarter outcome triggered a rally and the stock set a new record. AVGO, which is one of the most expensive and best-performing Wall Street stocks, has gained an impressive 40% in the past two months alone. The stock price nearly doubled in the past twelve months. The company has a good track record of returning value to shareholders, mainly through its dividend program. Regular dividend hikes, with the latest being a 14% rise, and above-average yield make the stock a good long-term bet.

Valuation

Having expanded its AI chip portfolio significantly, the company has entered a high-growth trajectory, signalling continued strong value creation for shareholders. However, the high valuation calls for a careful assessment before investing. Meanwhile, the management announced a 10-for-1 forward stock split to make Broadcom shares more accessible to investors.

The company expects a sharp increase in AI chip sales in the second half and sees AI revenue reaching about $11 billion in fiscal 2024. Infrastructure software revenue is expected to grow at an accelerated pace, aided by contributions from VMware. At the same time, non-AI semiconductor revenue is seen recovering from the recent slowdown and gathering momentum towards the end of the year.

Bullish Outlook

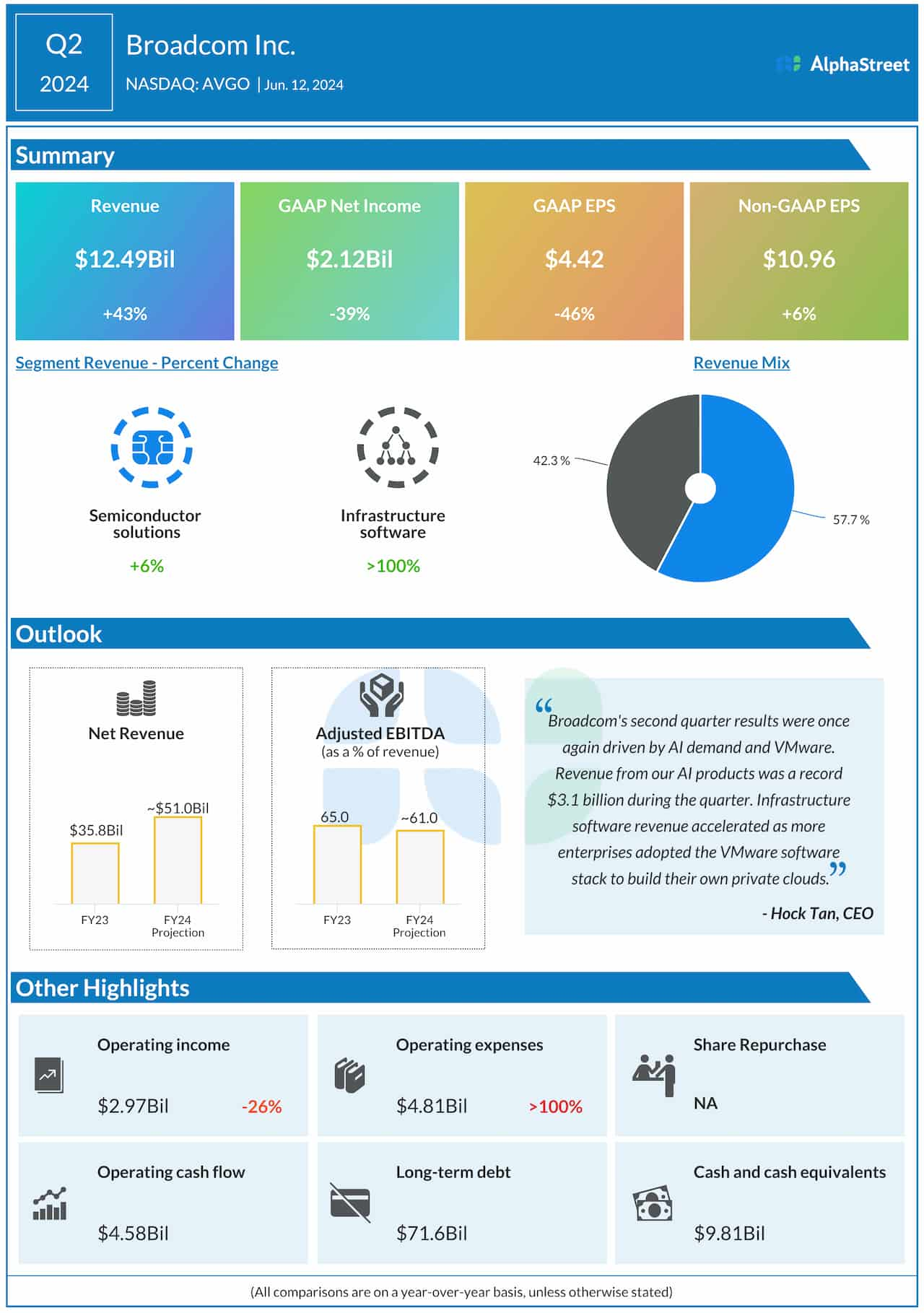

The management raised its total full-year revenue guidance to $51 billion. The revised guidance for Adjusted EBITDA, as a percentage of revenue, is 61%, compared to the previous forecast of 60%. Networking revenue is expected to increase at a faster pace of 40% than the 35% growth estimated earlier. The integration of VMware is progressing, with a focus on transitioning to a subscription licensing model and simplifying the go-to-market flow.

Broadcom’s CEO Hock Tan said at the earnings call, “It’s interesting to note that as AI data center clusters continue to deploy, our revenue mix has been shifting toward an increasing proportion of networking. We doubled the number of switches we sold year-on-year, particularly the Tomahawk 5 and Jericho3, which we deployed successfully in close collaboration with partners like Arista Networks, Dell, Juniper, and Supermicro. Additionally, we also doubled our shipments of PCI Express switches and NICs in the AI back-end fabric.”

Q2 Results Beat

For the April quarter. Broadcom reported an adjusted profit of $10.96 per share, higher than $10.32 per share the company earned in the year-ago quarter. The bottom line came in above estimates, after beating in every quarter since early fiscal 2020. On an unadjusted basis, net income was $2.12 billion or $4.42 per share in Q2, compared to $3.48 billion or $8.15 per share in the second quarter of 2023. Revenue came in at $12.49 billion in the April quarter, compared to $8.73 billion a year earlier. Revenue exceeded Wall Street’s projection, continuing the long-term trend.

Extending the upswing that followed the earnings announcement, Broadcom’s stock traded sharply higher on Friday afternoon. It has stayed well above its 52-week average so far this year.