After a relatively weak year, the company’s future prospects would depend on its ability to strike the right balance between pricing and promotional offers. It also needs to take measures to ease the unhealthy inventory build-up.

Read management/analysts’ comments on quarterly reports

“…Target’s exclusively owned brands provide tremendous quality at incredibly competitive prices, a great combination anytime, but never more so than in an inflationary environment. So, as we turn our focus to Q4, we’ll do what we always do: work tirelessly to deliver value and solutions to our guests while also delivering affordable joy at a time when they need it most. As we’ve outlined this morning, we’re taking a prudent approach to our inventory planning and sales expectations for the fourth quarter in light of the concerning industry trends we’ve seen over the past several weeks,” said Target’s CEO Christina Hennington at the last earnings call.

Target’s fourth-quarter report is scheduled for publication on February 28 before the opening bell. According to estimates, the bottom line continues to be under pressure from elevated costs, and experts have said that earnings more than halved to $1.40 per share in the January quarter. The weakness reflects an estimated 1% year-over-year decline in sales to $30.7 billion. The projection is in line with the management’s cautious outlook for the quarter.

Financials

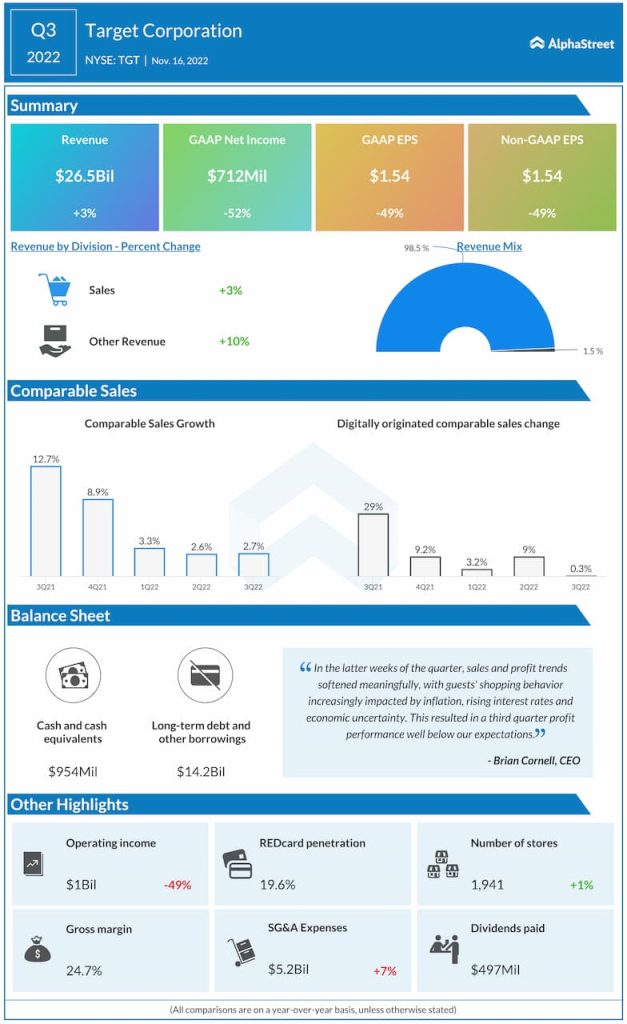

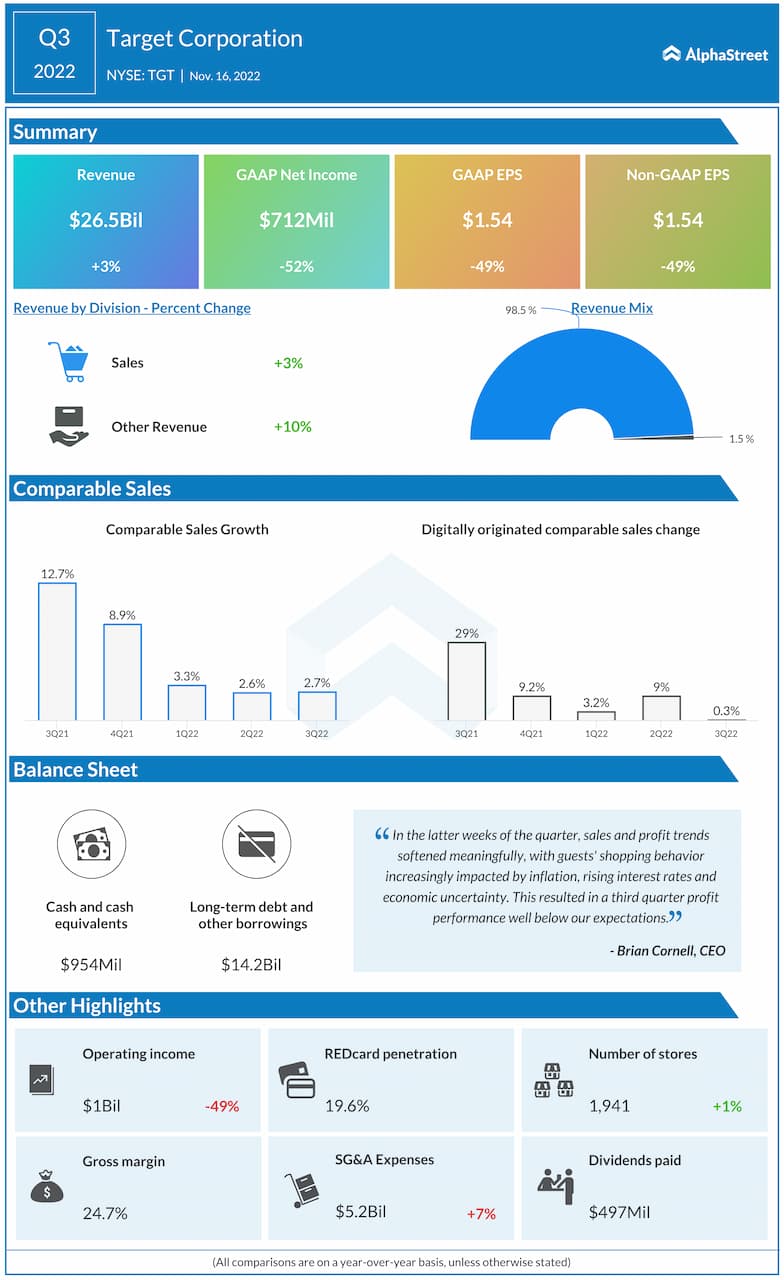

In the third quarter, a 3% sale growth drove up revenues to $26.5 billion, which also exceeded the consensus forecast. But that did not reflect in the company’s earnings, which dropped 49% from last year to $1.54 per share. More worryingly, earnings missed the market’s estimates for the third consecutive quarter. Comparable sales growth decelerated sharply to $2.7% from 12.7% in the corresponding period last year.

Earnings: Walmart Q4 results beat estimates; US comps up 8.3%

Target’s stock opened Tuesday’s session slightly below $170. It traded lower throughout the session and lost about 3%. In the past six months, it declined by more than 15%.