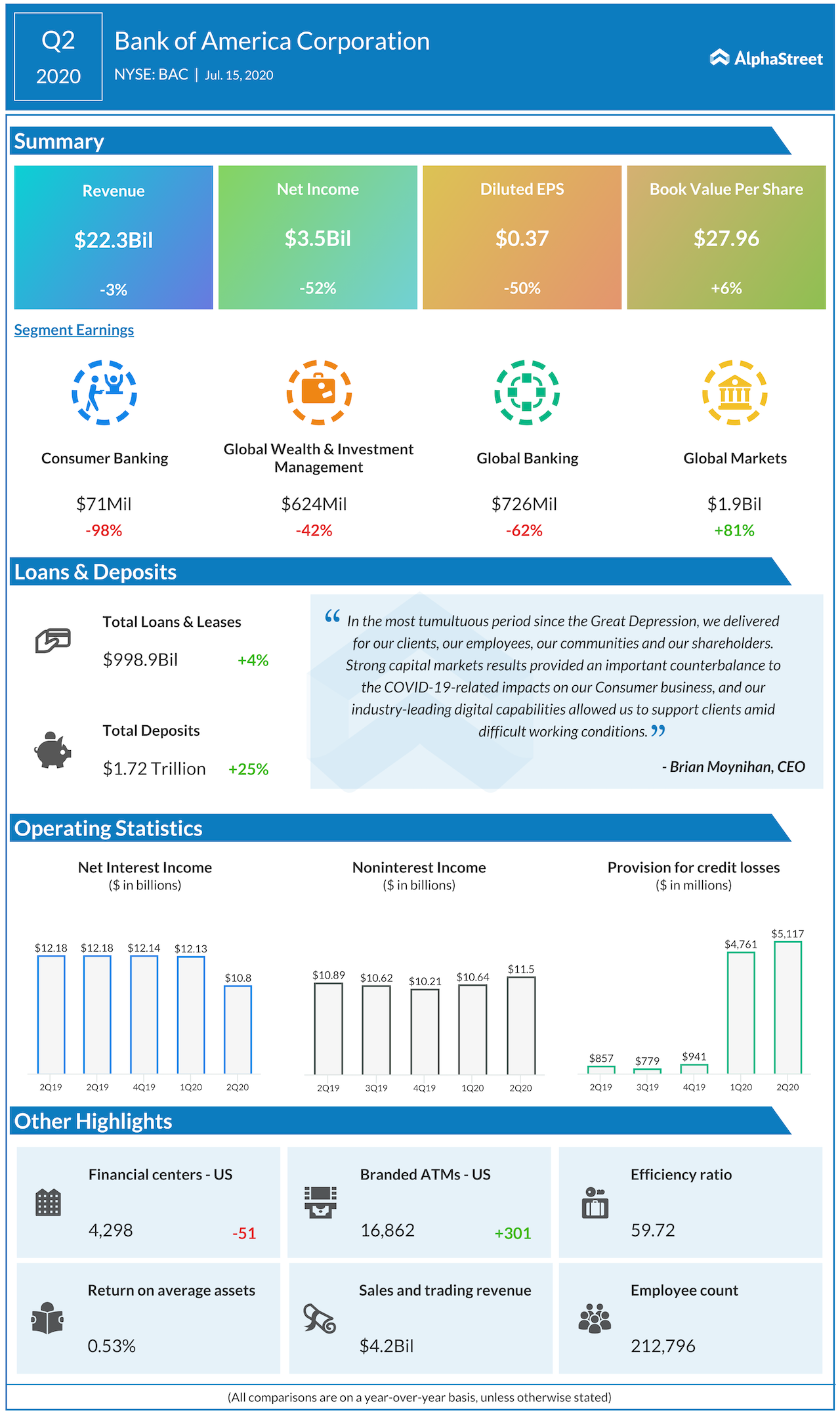

Bank of America (NYSE: BAC) reported second-quarter financial results before the regular trading hours on Thursday. The banking giant reported a 3% dip in the quarterly revenue, and net income that got halved year-over-year. However, these results were better than what the street had anticipated.

BAC shares were down 2% immediately following the announcement, on concerns relating to the rising amount set aside for loan losses driven by the pandemic. Provision for credit losses in Q2 was $5.1 billion, compared to $857 million a year ago.

BAC shares have declined 31% since the beginning of this year.

CEO Brian Moynihan said in a statement, “We provided billions in credit to clients; announced a $1 billion, four-year commitment to drive economic and racial equality in our communities.”

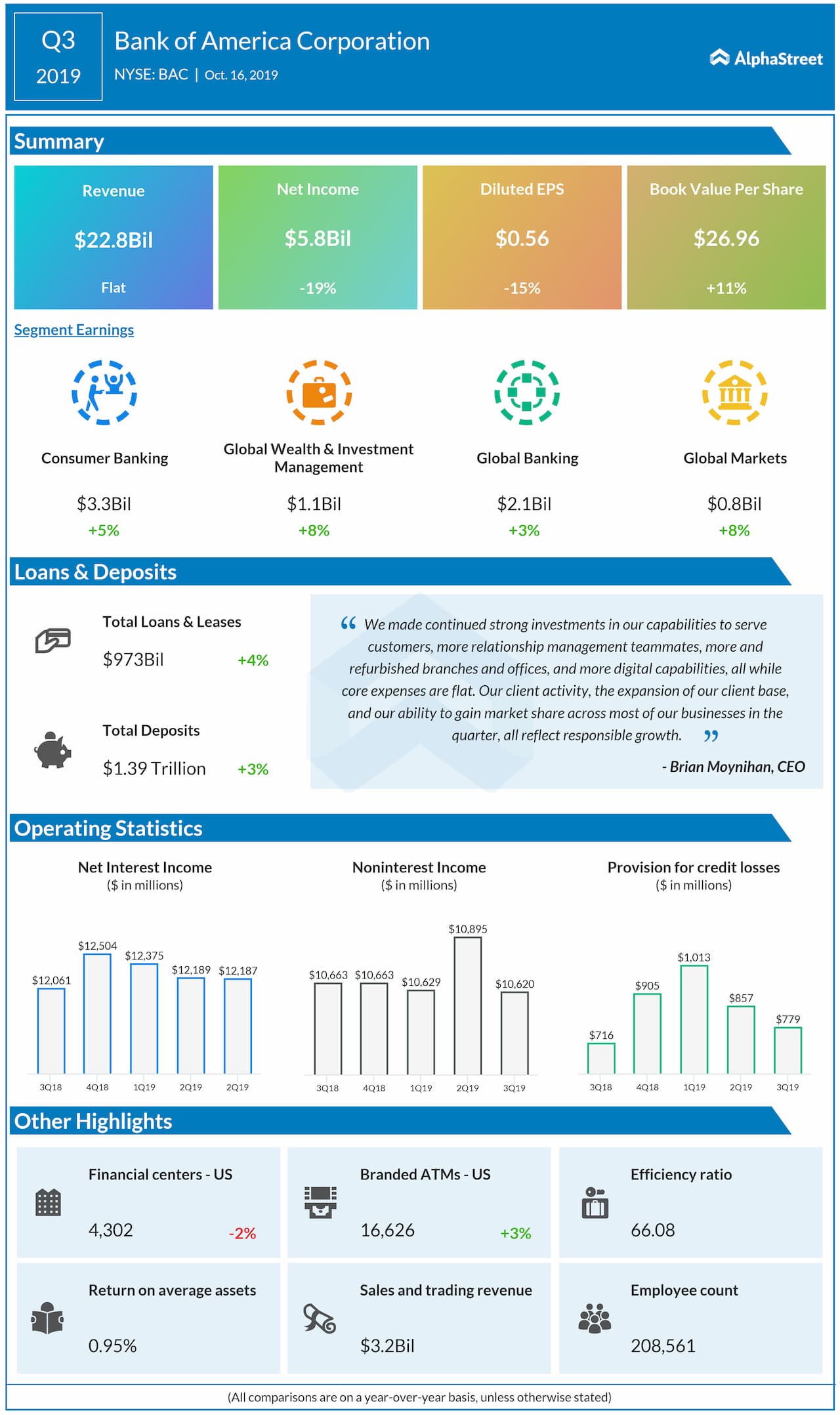

Prior performance

Related: An earnings season where trading business played god