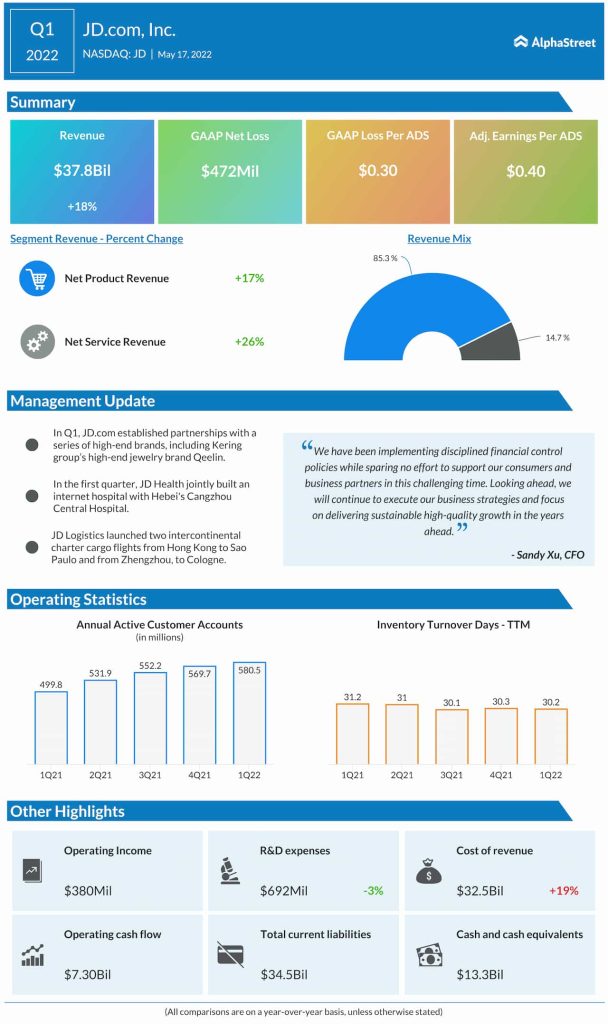

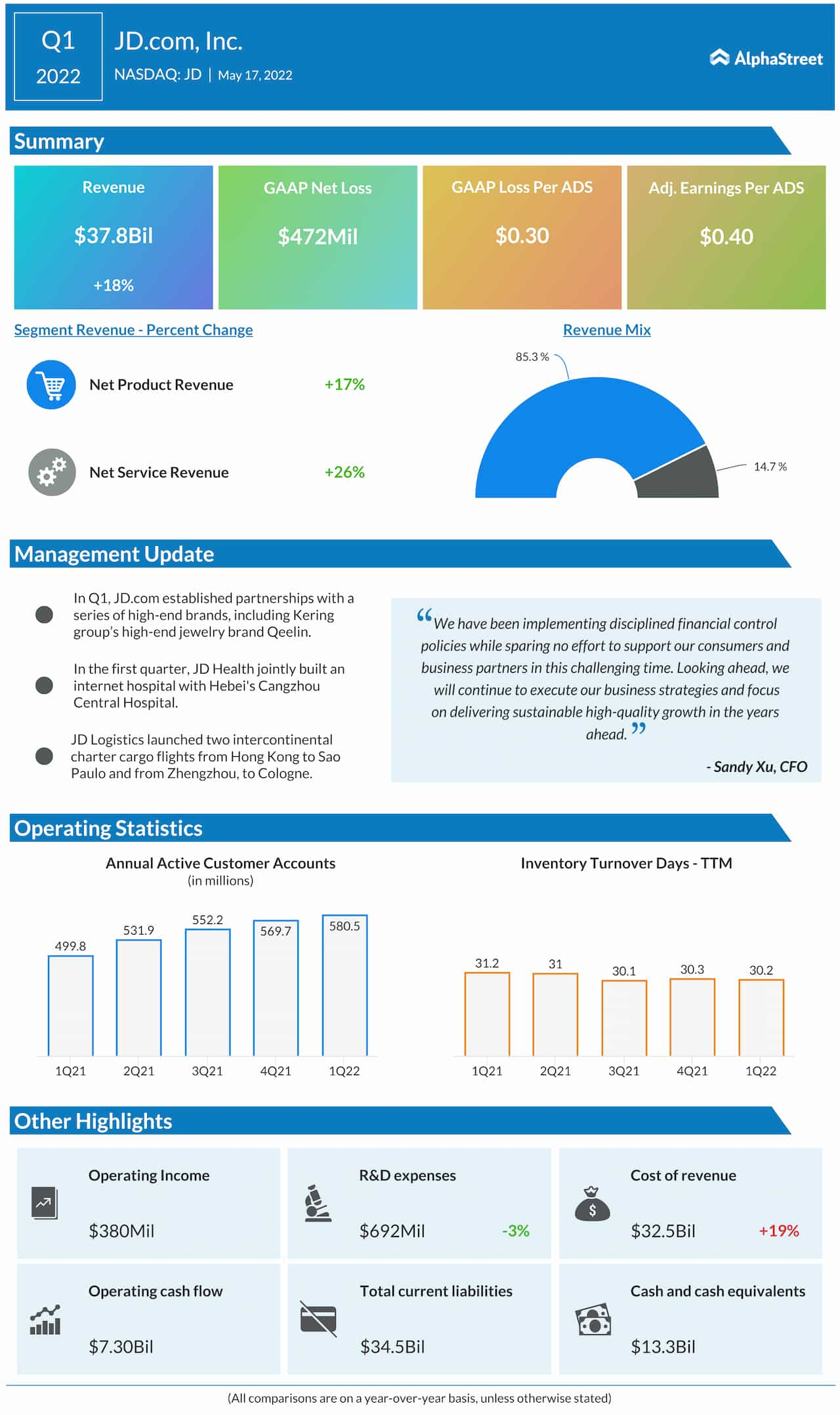

On an adjusted basis, earnings increased 2% year-over-year to $0.40 per ADS. on an unadjusted basis, it was a net loss of $472 million or $0.30 per ADS, which marked a deterioration from the prior-year period when the company reported a profit.

At $37.8 billion, first-quarter revenues were up 18% from the corresponding period of 2021. At the end of March 2022, JD.com had a total of 580.5 million active customer accounts, up 16% year-over-year.

Check this space to read JD.com’s Q1 2022 Earnings Call Transcript

“We are encouraged to see user engagement metrics continue to improve, demonstrating our strengthened brand image and expanded consumer mindshare. We have been implementing disciplined financial control policies while sparing no effort to support our consumers and business partners in this challenging time. Looking ahead, we will continue to execute our business strategies and focus on delivering sustainable high-quality growth in the years ahead” said Sandy Xu, Chief Financial Officer of JD.com.