Earnings Beat

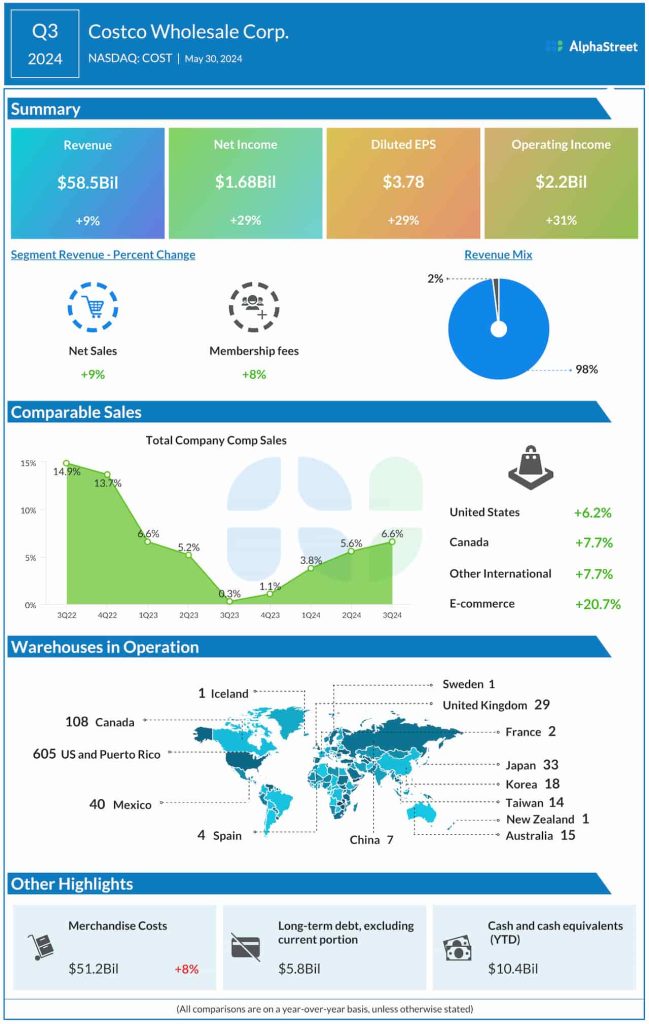

In the third quarter, revenues rose to $58.52 billion from $53.65 billion in the corresponding period of 2023. Total comparable store sales were up 6.6% year-over-year. Net income came in at $1.68 billion or $3.78 per share in Q3, compared to $1.30 billion or $2.93 per share in the third quarter of 2023. The bottom line surpassed Wall Street’s estimates, marking the fourth beat in a row.

Costco has long been the preferred choice for shoppers looking for affordability and convenience, and the retailer attracts customers by maintaining competitive prices and membership fees despite elevated inflation. There has been an uptick in discretionary sales lately amid strong traffic growth, driving up margin growth.

Road Ahead

The company targets a total of 30 new store openings for fiscal 2024, including two relocations, and expects capital expenditures in the range of $4.4 billion to $4.6 billion for the year. While its aggressive e-commerce push is yielding good results, continued investments in the platform with a focus on discretionary items will likely accelerate growth in the coming quarters. Online sales grew an impressive 21% in the most recent quarter.

Costco’s CEO Ron Vachris said at the Q3 earnings call, “I’ve got to tell you that the discretionary spend we’re seeing, I mean, we’re definitely winning in consumables as we see the food business and, you know, dining away from home has softened up a bit, and people are eating, and we’re seeing that in our fresh foods. But I have to tell you that categories such as the home division and toys are categories that have lagged quite a bit post-COVID that — with great excitement. I mean our buyers have come out and delivered some great items at phenomenal values, have really rejuvenated those categories.”

CEO Change

Vachris, a 40-year Costco veteran, took the helm as the CEO a few months ago, succeeding Craig Jelinek who stepped down as part of a long-standing succession plan. More recently, the company named Gary Millerchip as the new CFO. Millerchip comes from The Kroger Co. where he held senior executive positions.

Shares of Costco have gained 20% since the beginning of 2024. They traded slightly higher in early trading on Monday, recovering from the post-earnings slide.