With the holiday season underway, it is the busiest time of the year for parcel delivery firms like FedEx (NYSE: FDX) and United Parcel Service (NYSE: UPS). With more and more people turning to online platforms for their shopping needs, the demand for freight movement is growing steadily.

Unlike in the past, when FedEx and UPS fought among themselves for market share, this time they also have to deal with new entrants in the cargo space like Amazon (AMZN). The e-commerce firm, which recently cut ties with FedEx, is increasingly using its own infrastructure for deliveries. In the changed scenario, it is crucial for the traditional players to ensure that cargo is delivered in time, and the key to achieving that is to speed-up the process.

Downtrend

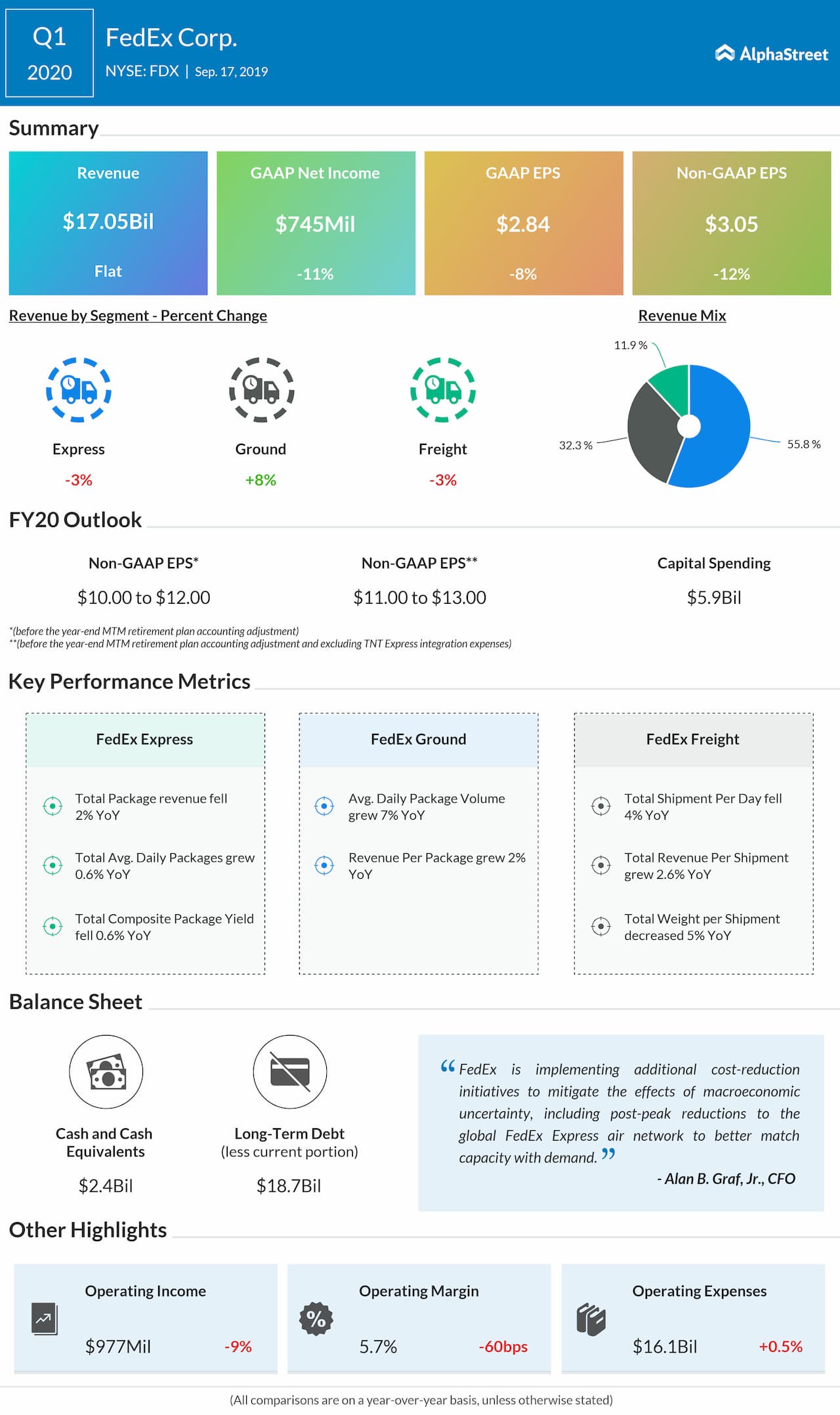

FedEx’s financial performance has not been very encouraging in recent quarters, mainly due to the volatility in the global economy and uncertainties related to the trade war. The management is treading a familiar path to tackle the issue – hike shipping rates by as much as 6% starting next year. The company had not-so-impressive start to the new financial year, after closing the last fiscal on a disappointing note.

The market was not amused by the sharp fall in first-quarter earnings on flat revenues. The weaker-than-expected results forced the management to trim its earnings outlook. Nothing much has changed while the company is preparing to publish its second-quarter results next week, as analysts predict a 30% fall in earnings on a flat top-line.

New Strategy

In an attempt to reinvigorate the FedEx Express segment, amid continuing weakness, the company is on a drive to modernize the core business segment. The key to regaining the lost momentum is to focus more on business-to-customer deliveries and tap into the online shopping boom. Long-term partnerships with leading retail firms having online platforms, especially Amazon-rivals like Walmart (WMT), will be a good idea.

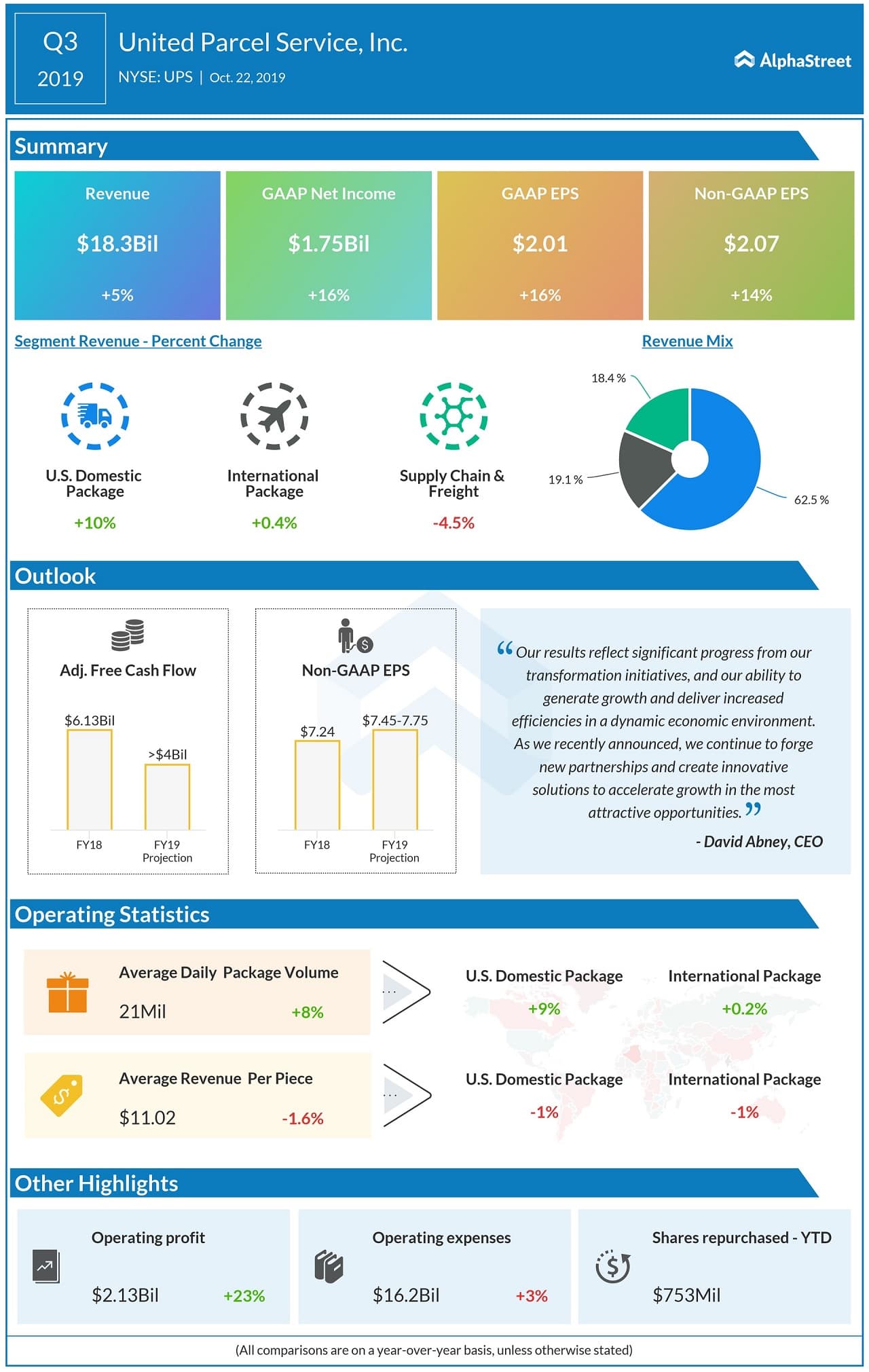

UPS Better off?

UPS fared better in its latest fiscal period, with both revenues and profit registering year-over-year increase in the third quarter, broadly in line with the analysts’ projection. Citing the improvement in macroeconomic conditions, UPS also reaffirmed its full-year outlook. However, the optimism was dented this week after the Bank of Montreal lowered its rating on the company, cautioning that the proliferation of e-commerce can have a negative impact on the business in the long term.

FedEx shares have been on a downward spiral after hitting a peak nearly a year ago. In October 2019, the stock slipped to the lowest level in two-and-half years but pared a part of the loss in the following weeks. UPS remained in recovery mode after falling to a multi-year low mid-year. The stock has gained 18% since last year, despite the volatility, but underperformed the market.