Investing in Merck

The company’s fundamentals are quite strong and it has a promising pipeline, led by flagship cancer drug Keytruda. It is one of the best-selling medicines globally, with sales volumes growing consistently, and is being investigated for additional indications. Merck’s animal health division is also growing steadily. Its coronavirus therapy — developed jointly with Ridgeback Biotherapeutics — has shown positive results in advanced-stage clinical trials.

Read management/analysts’ comments on Merck’s Q1 2022 earnings

Currently, business development is the main priority for Merck’s executives. Recently, the company acquired Acceleron Pharma Inc. (NASDAQ: XLRN) in a move aimed at expanding its cardiovascular portfolio and pipeline further.

From Merck’s Q1 2022 earnings conference call:

“We’ve taken important steps to provide increased transparency into the opportunities we see in our portfolio and our business, including through two recent investor events. Earlier this month, we provided a detailed description of our growing cardiovascular portfolio and pipeline. At Merck, we’re focusing our efforts where the needs are greatest and where we have the best opportunity to positively impact patients’ lives, including in heart failure, pulmonary arterial hypertension, thrombosis, and atherosclerosis.”

Q1 Performance

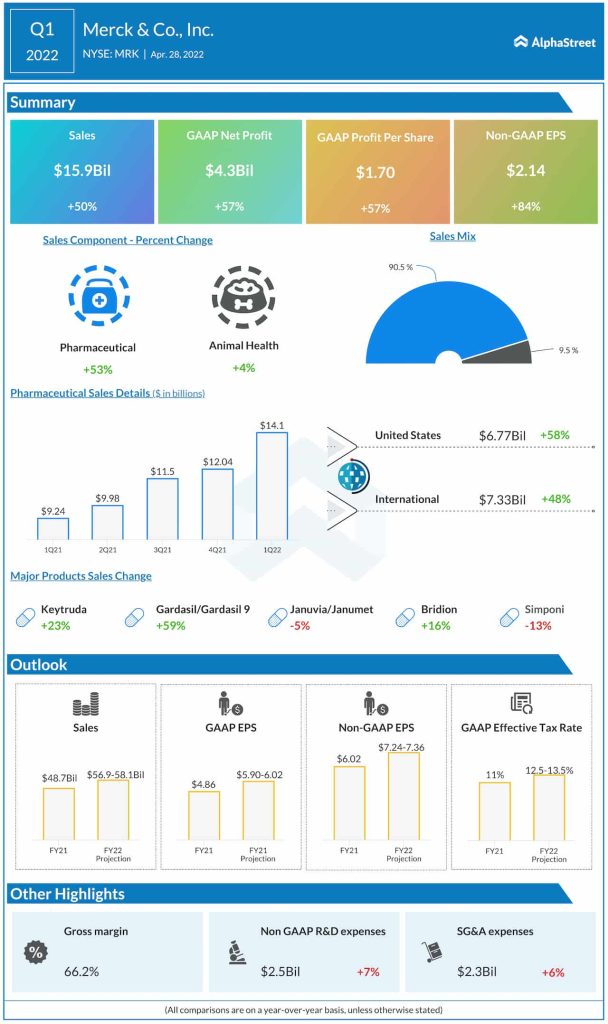

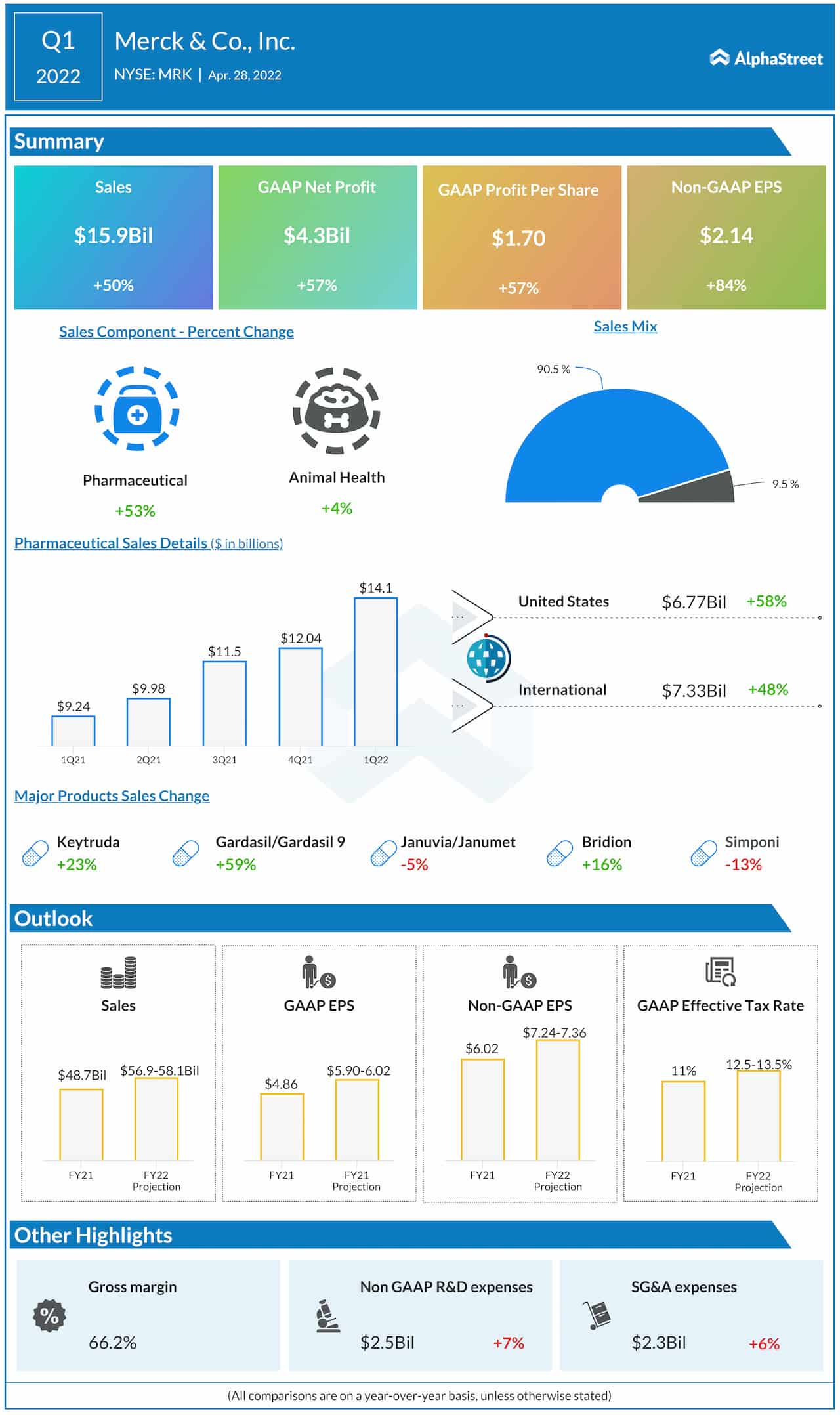

In the first quarter of 2022, worldwide sales from continuing operations jumped 50% annually to $15.9 billion and surpassed consensus estimates. Sales of leading products increased in double digits, aided by the market reopening and improvement in the COVID-19 situation. Earnings, excluding special items, surged 84% to $2.14 per share and topped expectations.

Anticipating the strong momentum to continue during the remainder of the year, Merck’s management raised full-year earnings and revenue guidance. It is particularly bullish on the progress in development programs across the oncology portfolio which has witnessed multiple approvals, both at home and overseas. It is estimated that Merck is on track to receive at least eight cardiovascular approvals by 2030.

Stock Watch: Should you invest in Eli Lilly (LLY) after Q1 earnings?

Merck’s stock has gained about 14% this year and often outperformed the market. It traded slightly lower early Wednesday after closing the previous session higher.