Tough 2020

American Express’ relatively high exposure to the entertainment and travel market made matters worse for it. It is worth noting that the stock performance of Visa, Inc. (V) and Mastercard, Inc. (MA) was much better last year. Those rivals issue cards through banks, unlike American express that gives credit to customers directly. That puts the company at a higher risk of defaults — but write-offs and delinquency rates decreased and reached sustainable levels towards the end of 2020.

Spending Recovers

After slowing down in the early months of the pandemic, cardmember spending bounced back, led by non-travel and entertainment spend. Also, the increasing availability of coronavirus vaccines is having a positive effect on people’s spending habits and that is expected to reflect in the company’s transaction volumes, going forward. Though the merchant network continues to expand, uncertainty looms over market reopening, especially the travel and accommodation sectors where the company has co-branding agreements with airline companies and hotels.

Read American Express Company’s Q4 2020 Earnings Call Transcript

American Express is preparing to release its first-quarter numbers on April 23 before the opening bell, amid expectations of a sharp increase in earnings to $1.57 per share. Meanwhile, experts see revenues falling 11% to about $9 billion.

Given this environment, we are looking at 2021 as a transition year during which our focus will be on building/rebuilding growth momentum. By rebuilding growth momentum, we mean firing up our core acquisition and retention engines, scaling key next horizon opportunities, and retaining the flexibility in our financial model. To accomplish this, we plan to aggressively increase investments in our core strategic business areas, with a specific focus on the following.

Stephen Squeri, chief executive officer of American Express

Mixed Q4

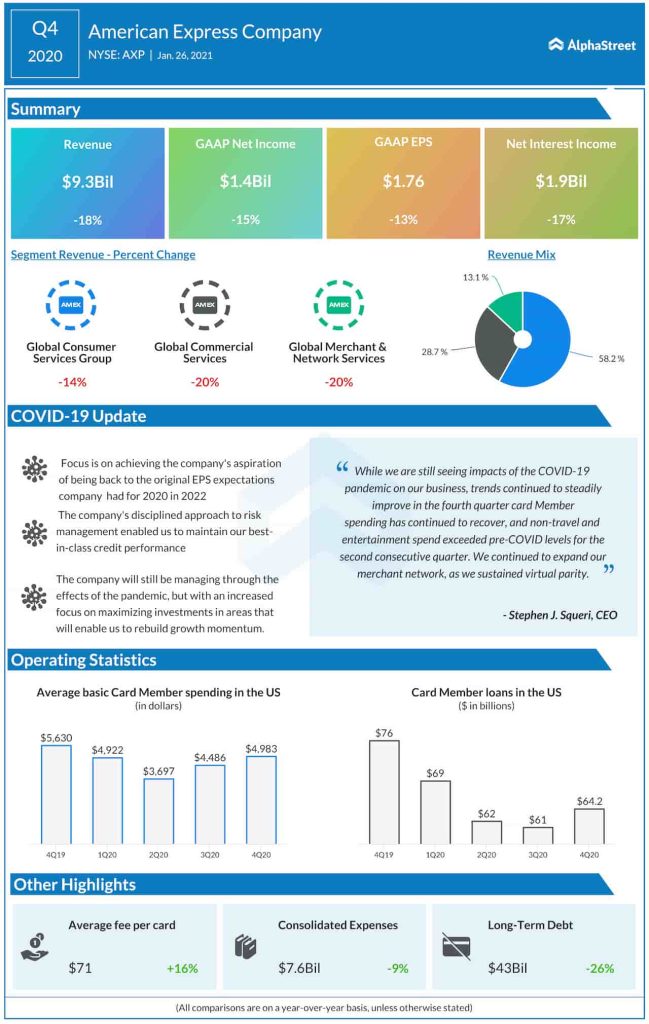

In the past few years, the company reported positive earnings that regularly beat the market’s forecast. The trend was maintained in the most recent quarter also, though earnings dropped 13% to $1.76 per share. The bottom line was hurt by an 18% fall in revenues to $9.3 billion, reflecting double-digit contraction across all business segments.

The company’s share value breached the $150-mark for the first time last month, continuing its recovery from the post-earnings slump earlier this year. The stock closed the last session slightly higher but traded lower early Thursday.