Quarterly performance

General merchandise grew 45%, marking the highest growth in nine quarters, led by supermarkets and healthcare. The supermarket category, including FMCG and fresh produce, was the largest contributor to revenue in the first half of 2020. The company saw robust consumer demand for fresh produce products in the second quarter, leading to a growth of more than 140% in the number of sales orders year-over-year.

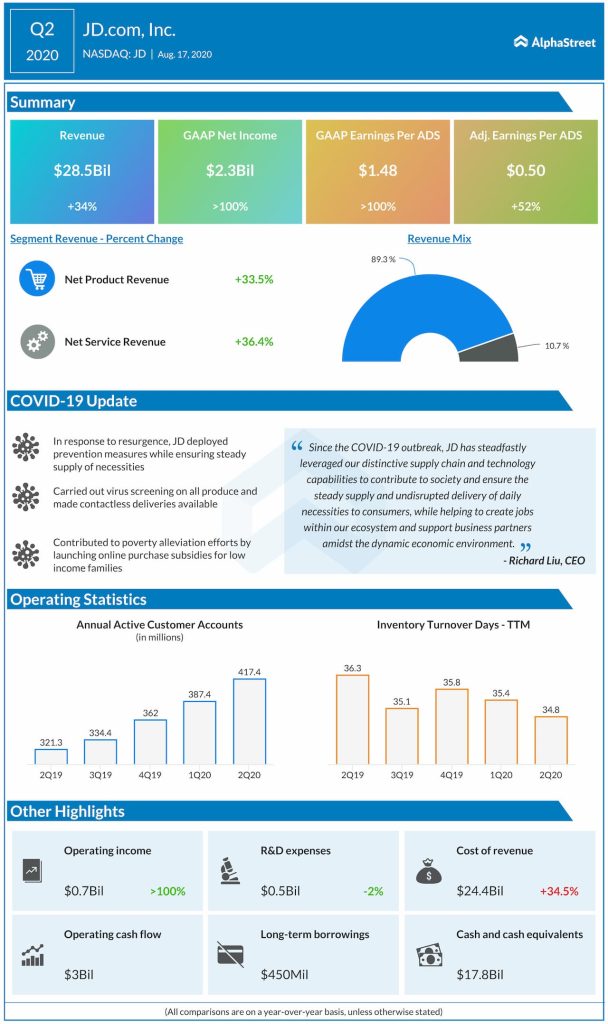

Electronics and home appliances continued to gain market share, growing 28% year-over-year. JD saw a significant improvement in user engagement, with 80% of its new users coming from lower-tier cities. Annual active customers in the past 12 months increased 20% from a year ago.

“Our scale advantages and cost efficiency enabled us to provide attractive prices during our June 18 sales promotions, benefiting consumers and society as China’s economy emerges from the difficult pandemic period, and helped drive solid top and bottom line results for the second quarter. Our strong financial and operating performance form the basis for JD’s continued investment in innovative supply chain capabilities and a superior customer experience to support our long term growth.” – Sandy Xu, Chief Financial Officer

ADVERTISEMENT

The company’s long-term strategy of investing in its technological and logistics capabilities and in the expansion of its product offerings yielded good results in the quarter. JD will continue to build its online supermarket JD Super, which has become the largest retailer in that category, both online and offline.

JD is investing in the nationwide warehouse network construction through its JD Logistics unit and is working on bringing down its fulfillment costs. The company is also working on the development of its omnichannel solutions.

JD Health

JD’s online pharmacy sales saw strong revenue growth in the second quarter. Online medical consultation service volumes grew 400% year-over-year in the first half of 2020. JD Health has witnessed rapid growth since the coronavirus outbreak in terms of user penetration and engagement.

Outlook

Looking ahead into the second half of the year, JD will continue to work on the development of its supply chain capabilities through various partnerships. The company is also working on deepening its development in the lower-tier cities and its collaboration with its industrial belts in China.

JD will continue its investments in its omnichannel solutions, technological capabilities and its product categories. The company expects to see strong seasonality in the second half. JD is seeing strong demand and user engagement in supermarket and consumable products and expects this trend to continue.

Click here to read the full transcript of JD.com Q2 2020 earnings conference call