The airline industry was one of the worst-affected by the COVID-19 pandemic and recovery is anticipated to take some time. Even as travel restrictions slowly ease, the lockdown period brought about quite a few changes, many of which are here to stay, and this in turn is expected to lead to changes in overall travel trends.

The latest development in the airline industry is the strategic partnership between JetBlue Airways (NASDAQ: JBLU) and American Airlines (NASDAQ: AAL) to improve connectivity and offer more choices to customers in the Northeast. The alliance will provide new and expanded routes to customers and also allow the sharing of loyalty benefits. It is expected to help both companies recover faster from the effects of the health crisis.

A tough quarter

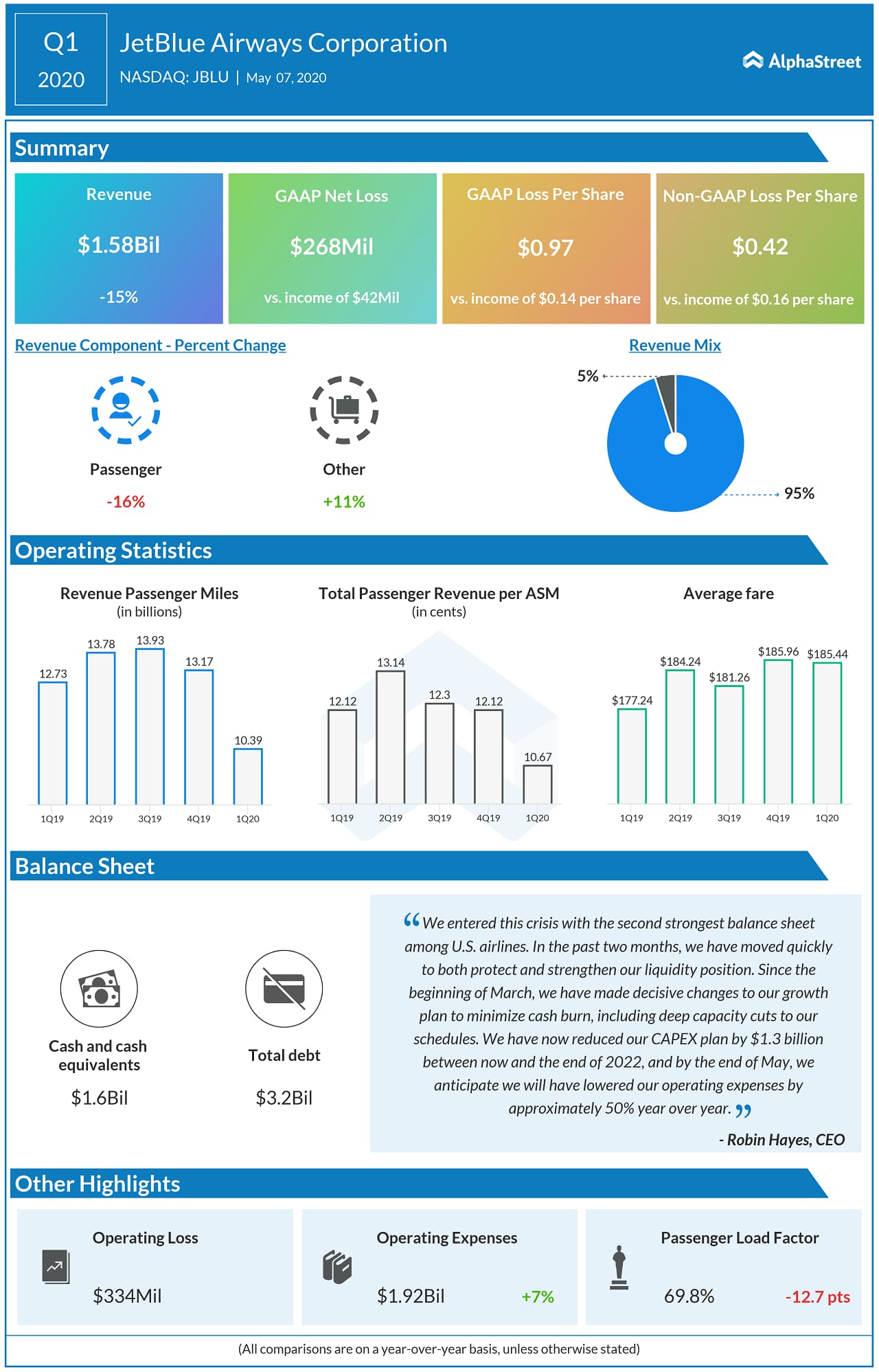

The first quarter of 2020 was particularly tough for JetBlue as the company reported a 15% decline in revenue and an adjusted loss of $0.42 per share. The COVID-19 pandemic led to lower demand which in turn caused a 52% drop in revenue in March. JetBlue cut its capacity by 19% in March and during its first quarter results announcement projected an 80% capacity reduction for the second quarter.

The coronavirus pandemic and the associated travel restrictions brought about changes to the business environment where more companies moved to remote work and video conferencing, thus limiting the need for business travel. The trend of opting for technological methods to stay connected as opposed to traveling for business meetings is likely to continue going forward due to cost efficiency. This has led to uncertainty in terms of recovery in business travel.

In June, JetBlue said it was adding 30 new domestic routes in markets where it was seeing a pickup in leisure travel as well as more people visiting friends and family. With the uncertainty in the business travel recovery, this gives the airline a chance to increase its revenue.

Looking ahead

The general outlook for the airline industry is not encouraging. According to a report by Travel Pulse, IATA has forecasted the damage to the airline industry to continue for the next three years. It believes there will not be a rebound in passenger traffic to pre-crisis levels until at least 2023. Global passenger demand in 2021 is estimated to be down 24% from 2019 levels.

The bleak outlook is attributable to fears surrounding the reoccurrence of the pandemic, the economic downturn, and general reluctance on the part of people to fly.

JetBlue faced a high level of uncertainty concerning its second quarter. The company took several steps to minimize its cash burn and improve liquidity. For the second quarter of 2020, JetBlue projected average all-in price per gallon of fuel of $0.76. The company aimed to reduce its operating expenses by around 50% year-over-year in May.

JetBlue is scheduled to report its second quarter 2020 earnings results on Tuesday, July 28, 2020. Analysts estimate revenues will decline 90% year-over-year to $208 million while loss per share is expected to be $1.85.

Click here to read JetBlue Q1 2020 earnings conference call transcript