JetBlue Airways Corporation (NASDAQ: JBLU) reported a 5% decline in earnings for the fourth quarter of 2019 due to higher income tax expense. However, the results exceeded analysts’ expectations.

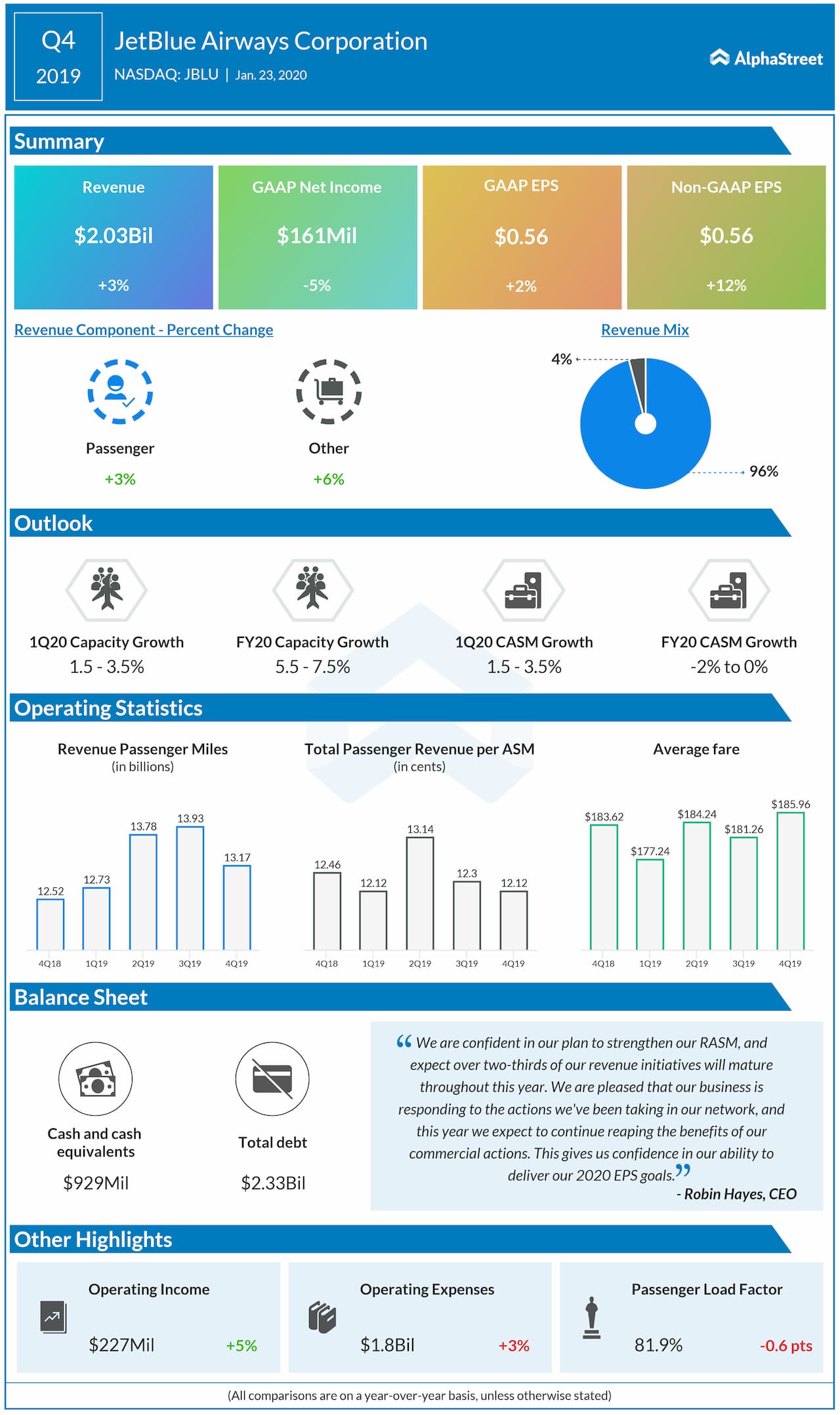

Net income declined by 5% to $161 million while earnings increased by 2% to $0.56 per share due to lower weighted average shares outstanding. Adjusted earnings grew by 12% to $0.56 per share. Revenue rose by 3.2% year-over-year to $2.031 billion. Analysts had expected EPS of $0.55 on revenue of $2.03 billion for the fourth quarter.

Looking ahead into the first quarter of 2020, the management expects earnings in the range of $0.10-0.20 per share and capacity growth of 1.5-3.5%. RASM growth is predicted to be 0% to 3% and CASM ex-fuel is projected to increase 1.5-3.5%.

For fiscal 2020, the CASM ex-fuel is now expected to be between down 2% and 0%. Furthermore, the company’s 2020 plan reflect its commitment to deliver on its 3-year CAGR goal of 0% to 1%. Earnings are anticipated to be $2.50-3.00 per share range. JetBlue expects capacity to increase between 5.5% and 7.5%.

For the first quarter, RASM is expected to improve sequentially in both its domestic and Latin markets, resulting from capacity actions, revenue initiatives, easier comps, and lower scheduled growth. The RASM guidance includes a headwind of about one-half point to its system RASM due to earthquakes in Puerto Rico.

For the fourth quarter, revenue per available seat mile declined 2.7% year-over-year. This was largely in-line with the company’s updated guidance range of down 3.5-1.5%.

Operating expenses per available seat mile, excluding fuel, was flat and at the midpoint of its guidance range of down 1% and up 1%. This was mainly driven by the compounding benefits of the Structural Cost Program.

Revenue passenger miles increased by 5.2% to 13.17 billion and available seat miles grew by 6% to 16.08 billion. The load factor declined by 0.6 percentage points to 81.9%. Revenue passengers rose by 1.7% and average fare increased by 1.3%. The average fuel cost per gallon including fuel taxes decreased by 7.6% while the fuel gallons consumed increased by 3.2%.

JetBlue has entered into forward fuel derivative contracts to hedge its fuel consumption for the first and second quarters of 2020. Based on the forward curve as of January 10, JetBlue expects an average all-in price per gallon of fuel of $2.09 in the first quarter of 2020.