The earnings season has kicked off with several major banks reporting their financial results for the fourth quarter of 2024. JPMorgan (NYSE: JPM), Goldman Sachs (NYSE: GS), Citigroup (NYSE: C), and Wells Fargo (NYSE: WFC) released their Q4 reports on Wednesday. Here’s a look at how these banking giants ended the fiscal year:

JPMorgan

JPMorgan’s reported revenue increased 11% year-over-year to $42.7 billion in the fourth quarter of 2024. Managed revenue grew 10% to $43.7 billion. Earnings per share rose 58% to $4.81. Revenue and earnings beat estimates.

Net interest income was $23.5 billion, down 3% while noninterest revenue was $20.3 billion, up 29% YoY. Noninterest expense was $22.8 billion, down 7%.

In Q4, revenues in the Consumer & Community Banking (CCB) segment rose 1% YoY to $18.4 billion. In the Commercial & Investment Bank (CIB) segment, revenues increased 18% to $17.6 billion. Asset & Wealth Management (AWM) revenues were up 13% to $5.8 billion.

Goldman Sachs

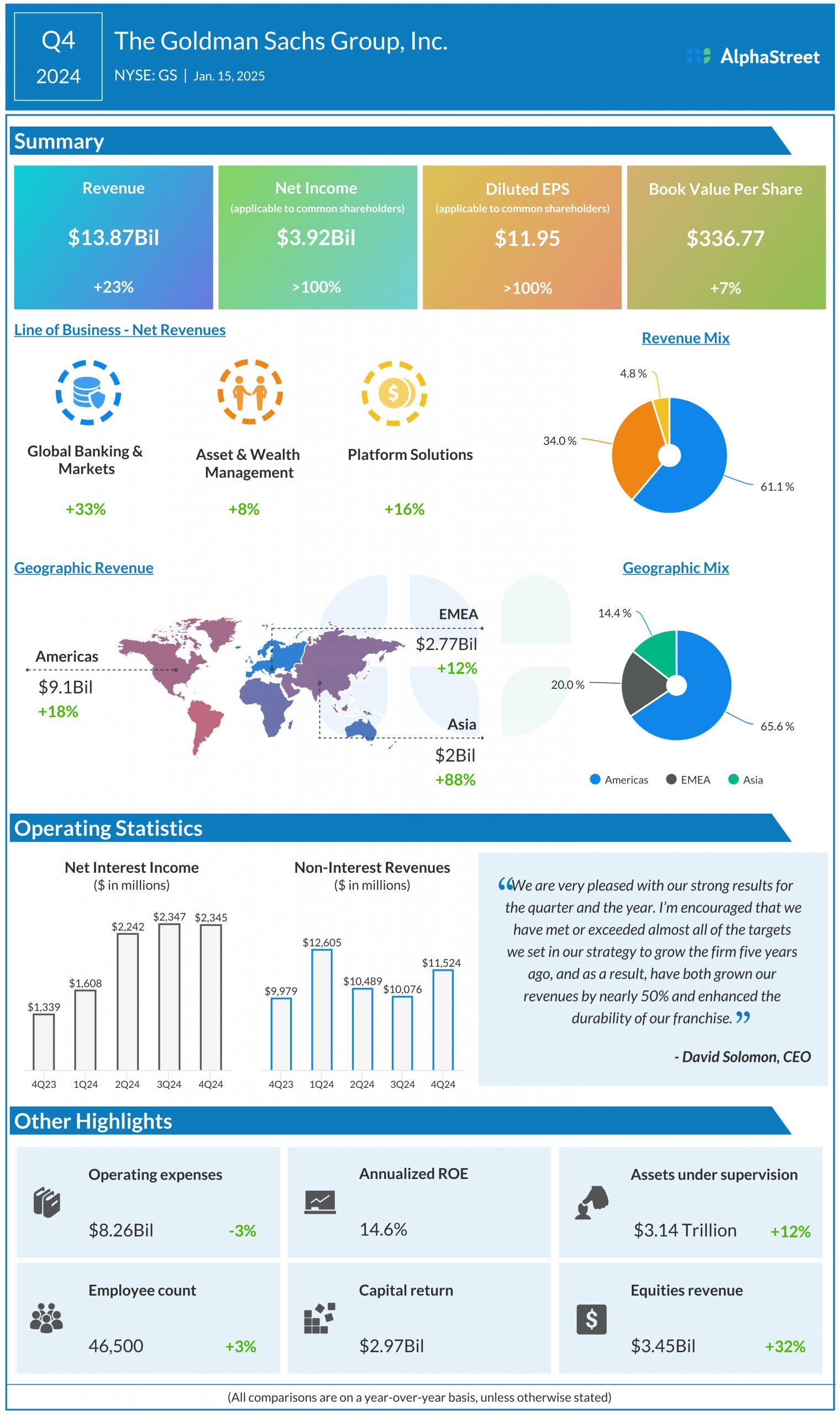

Goldman Sachs reported revenues of $13.87 billion for Q4 2024, reflecting a YoY growth of 23%. Earnings per share more than doubled to $11.95. Both numbers surpassed projections.

Net interest income grew 75% to $2.34 billion and non-interest revenues increased 15% to $11.5 billion compared to last year.

GS recorded revenue growth across all its segments during the quarter. Revenues in Global Banking & Markets were $8.48 billion, up 33% YoY. Revenues in Asset & Wealth Management grew 8% to $4.72 billion. Platform Solutions revenues grew 16% to $669 million.

Citigroup

Citigroup posted revenues of $19.6 billion in Q4 2024, up 12% YoY. The company reported earnings of $1.34 per share compared to a loss of $1.16 per share last year. Both the top and bottom line numbers came above expectations.

Citigroup saw double-digit revenue growth across most of its segments. Services revenue grew 15% YoY to $5.2 billion in Q4. Markets revenues increased 36% to $4.6 billion. Banking revenues of $1.2 billion were up 27% YoY. Wealth revenues grew 20% to $2 billion. Revenues in US Personal Banking rose 6% to $5.2 billion.

Wells Fargo

Wells Fargo reported revenues of $20.4 billion for the fourth quarter of 2024, which was relatively flat compared to the year-ago period. Earnings per share jumped 66% to $1.43. While earnings beat estimates, revenues fell short.

Net interest income decreased 7% to $11.8 billion while non-interest income grew 11% to $8.5 billion compared to last year. Non-interest expense decreased 12% to $13.9 billion.

Wells Fargo saw revenues decline across most of its segments. Revenues in Consumer Banking and Lending decreased 6% YoY to $8.9 billion. Commercial Banking revenues fell 6% to $3.2 billion. Corporate and Investment Banking revenues were down 3% to $4.6 billion. Revenues in Wealth and Investment Management increased 8% to $3.95 billion.

Shares of JPMorgan were up 2% on Wednesday while shares of Goldman Sachs rose 5%. Citigroup’s stock jumped 7% while Wells Fargo’s stock was up 5%.