JPMorgan

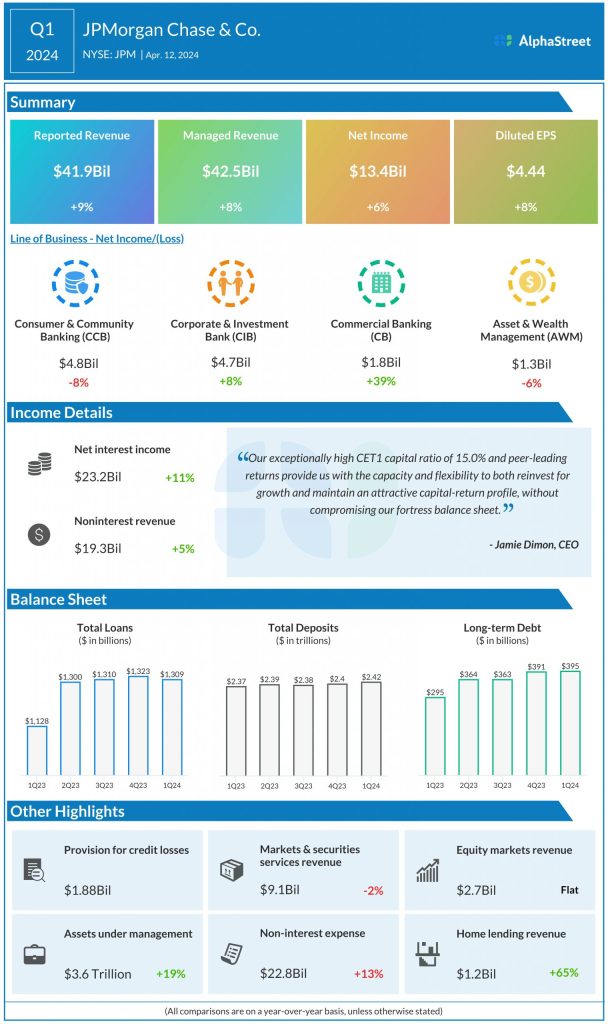

Net interest income grew 11% to $23.2 billion while non-interest revenue increased 5% to $19.3 billion. Non-interest expense rose 13% to $22.8 billion.

Net revenue in the Consumer & Community Banking (CCB) segment increased 7% YoY to $17.6 billion. Corporate & Investment Bank (CIB) revenues remained flat at $13.6 billion. Revenues from Commercial Banking (CB) rose 13% to $3.9 billion while revenues in Asset & Wealth Management (AWM) grew 7% to $5.1 billion.

Shares of JPMorgan fell over 5% amid inflation warnings from CEO Jamie Dimon.

“Many economic indicators continue to be favorable. However, looking ahead, we remain alert to a number of significant uncertain forces. First, the global landscape is unsettling – terrible wars and violence continue to cause suffering, and geopolitical tensions are growing. Second, there seems to be a large number of persistent inflationary pressures, which may likely continue. And finally, we have never truly experienced the full effect of quantitative tightening on this scale. We do not know how these factors will play out, but we must prepare the Firm for a wide range of potential environments to ensure that we can consistently be there for clients.” – Jamie Dimon, CEO, JPMorgan

Wells Fargo

Wells Fargo generated total revenue of $20.8 billion for the first quarter of 2024, which rose 1% from the same period a year ago. Net income decreased 7% to $4.6 billion while EPS fell 2% to $1.20. The top and bottom line numbers surpassed projections.

Net interest income decreased 8% to $12.2 billion while non-interest income grew 17% to $8.6 billion. Non-interest expense increased 5% to $14.3 billion.

Total revenue in the Consumer Banking and Lending segment decreased 3% year-over-year to $9 billion in the quarter. Revenue in Commercial Banking fell 5% to $3.1 billion. Corporate and Investment Banking revenue rose 2% to $4.9 billion while revenue from Wealth and Investment Management also rose 2% to $3.7 billion.

Like its peers, Wells Fargo’s shares stayed red on Friday.

Citigroup

Citigroup delivered total revenues of $21.1 billion in Q1 2024, which was down 2% year-over-year. Excluding divestiture-related impacts, revenues were up 3%, driven by growth across Banking, US Personal Banking, and Services.

Net income decreased 27% to $3.4 billion while EPS dropped 28% to $1.58 compared to last year. Despite the YoY declines, revenue and earnings managed to surpass estimates.

Net interest income rose 1% to $13.5 billion while non-interest revenues fell 6% to $7.6 billion. End-of-period loans were up 3% while end-of-period deposits were down 2% in the quarter.

Services revenues rose 8% to $4.8 billion in Q1 while Markets revenues decreased 7% to $5.4 billion. Banking revenues increased 49% to $1.7 billion while Wealth revenues fell 4% to $1.7 billion. US Personal Banking revenues grew 10% to $5.2 billion while All Other (Managed Basis) revenues decreased 9% to $2.4 billion.

Citigroup’s stock was down over 2% in midday trade.