JPMorgan Chase & Co. (NYSE: JPM) beat revenue and earnings estimates for the fourth quarter of 2019, allowing the stock to gain 1.9% in premarket hours on Tuesday. The consensus estimate was for earnings of $2.33 per share on revenue of $27.8 billion.

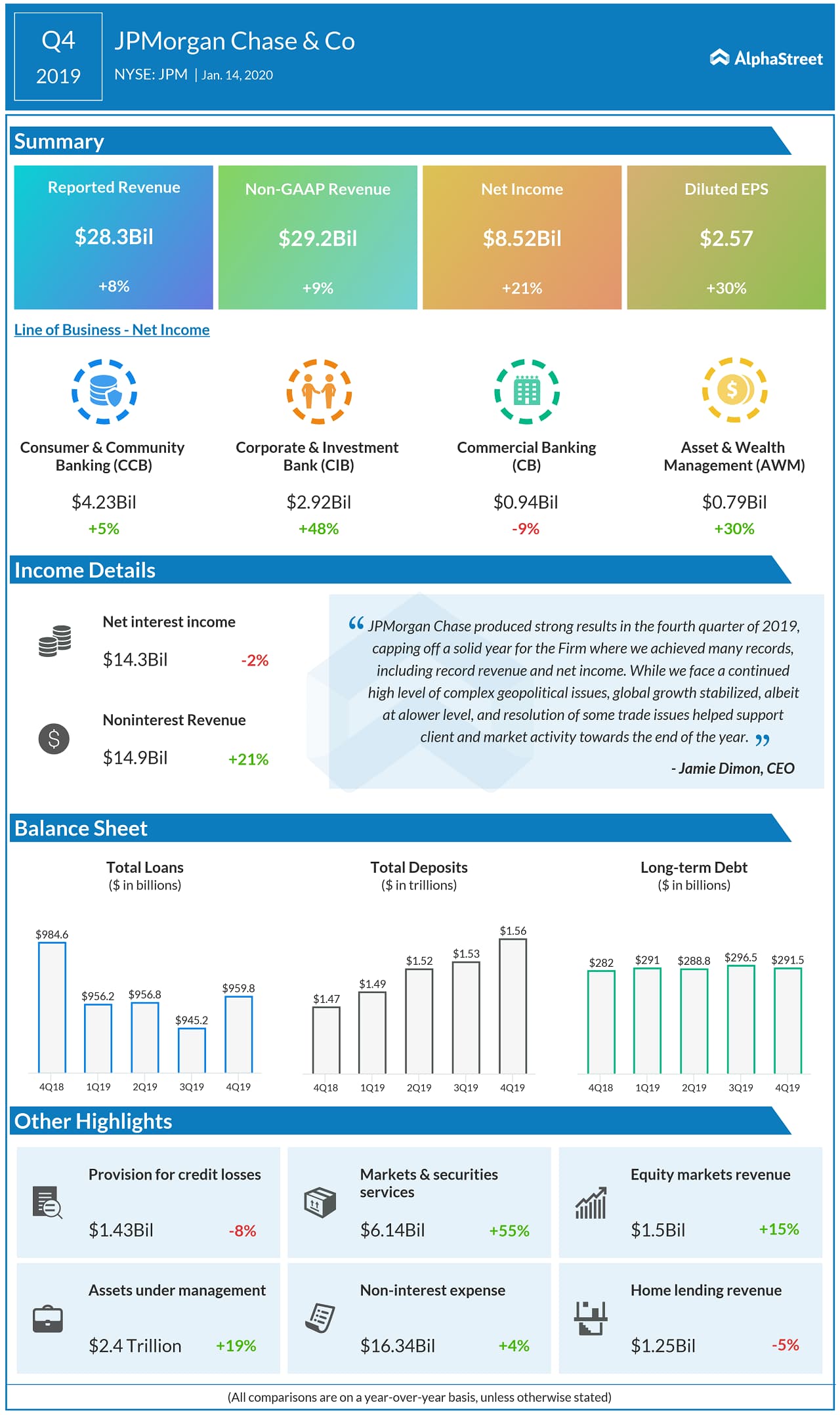

On a reported basis, revenue rose 8% to $28.3 billion from the same period last year. Managed revenue was $29.2 billion, up 9% year-over-year.

Net income rose 21% to $8.5 billion while EPS grew 30% to

$2.57 from last year.

Jamie Dimon, Chairman and CEO, said, “While we face a

continued high level of complex geopolitical issues, global growth stabilized,

albeit at a lower level, and resolution of some trade issues helped support

client and market activity towards the end of the year. The U.S. consumer

continues to be in a strong position and we see the benefits of this across our

consumer businesses.”

Net interest income dropped 2% to $14.3 billion due to lower rates. Non-interest revenue jumped 21% to $14.9 billion, mainly driven by higher revenue in Fixed Income and Equity Markets, Asset & Wealth Management, Home Lending, and Auto. Non-interest expense rose 4% to $16.3 billion, due to higher volume- and revenue-related expense.

Book value per share rose 8% to $75.98 while tangible book

value per share grew 8% to $60.98. Basel III common equity Tier 1 capital ratio

was 12.4%.

In Consumer & Community Banking, net revenues grew 3% year-over-year

to $14 billion. Corporate & Investment Bank revenues increased 31% to $9.5

billion. In Commercial Banking, revenues fell 3% to $2.2 billion due to lower

net interest income and lower deposit margin. Asset & Wealth Management

revenues were $3.7 billion, up 8%, driven by higher investment valuations and average

market levels, as well as by growth in loans and deposits.

JPMorgan’s peers Citigroup (NYSE: C) and Wells Fargo (NYSE: WFC) are also reporting their earnings results today.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.