Railroad operator Kansas City Southern (KSU) reported a 70.7% dip in earnings for the fourth quarter from the last year, which included an income tax benefit. The company did not meet the expectations of its customers or shareowners, particularly in the areas of customer service and growth. The results exceeded analysts’ expectations.

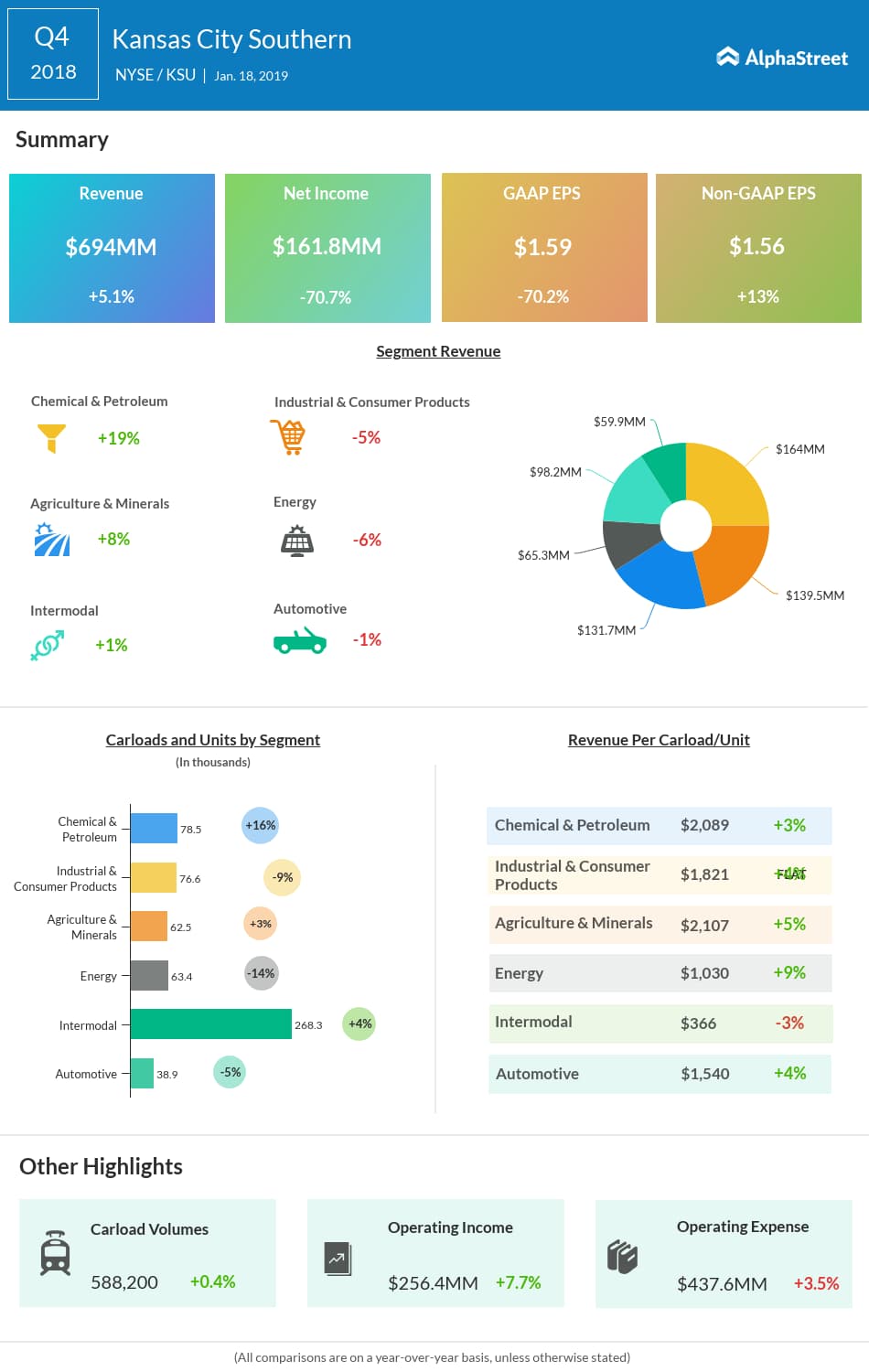

Net income plunged 70.7% to $161.8 million and earnings dipped 70.2% to $1.59 per share. Adjusted earnings grew 13% to $1.56 per share.

Revenue rose 5.1% to $694 million. The top line benefited from the double-digit growth in Chemical & Petroleum and a high-single-digit increase in Agriculture & Minerals. This is partially offset by the single-digit decline in Industrial & Consumer Products and Energy.

Carloads volumes remained flat while the operating ratio fell to 63.1% from 64% in the previous year quarter.

Operating expenses for the fourth quarter rose 3.5% to $437.6 million. Excluding a gain on insurance recoveries related to damage and service interruptions from Hurricane Harvey in 2017, adjusted operating expenses were $446 million, 6% higher than a year ago.

Revenue from Chemical & Petroleum grew 19% year-over-year on positive momentum at Petroleum and Plastics divisions. Revenue from Agriculture & Minerals rose 8% on double-digit growths in Grain and Glass. Intermodal revenue inched up by 1% while Automotive revenue inched down by 1%.

Related: Kansas City Southern Q4 2018 Earnings Transcript

However, revenue from Industrial & Consumer Products declined by 5% due to weaker performance across all the divisions. Energy revenue decreased by 6% due to weaker performance at Utility Coal and Frac Sand.

Looking ahead, the company said it is confident of the top line growth and strong operational improvement. This supported its outlook for an operating ratio of 60% to 61% by the year 2021.

Shares of Kansas City Southern ended Thursday’s regular session up 2.15% at $104.14 on the NYSE. The stock has fallen over 6% in the past year while it has risen over 8% in the past month.