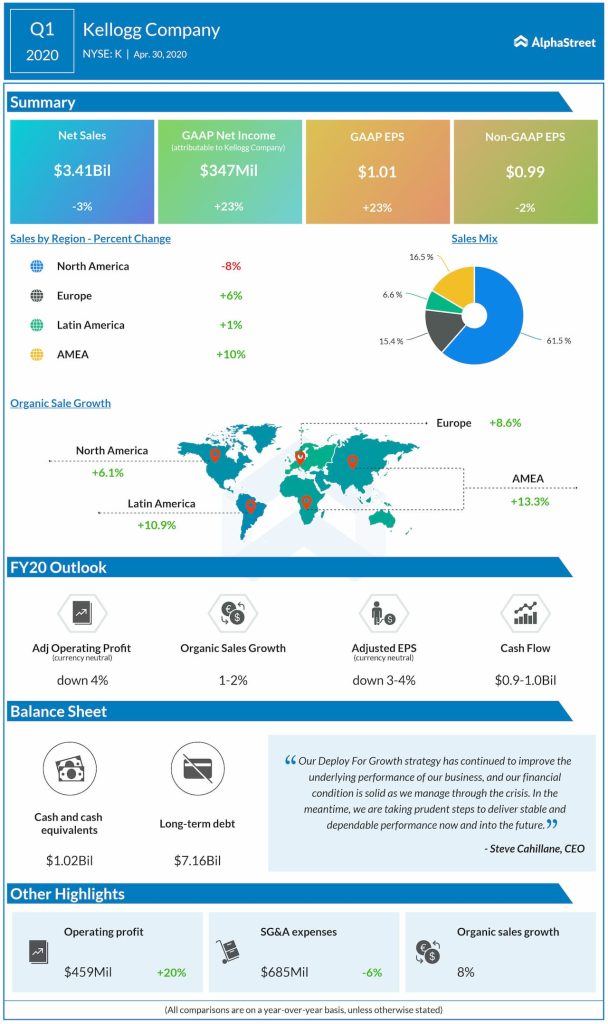

The bottom line jumped by 23% owing primarily to favorable swing in mark-to-market adjustments and lower business and portfolio realignment charges. On an adjusted basis, earnings per share declined by 2% due to the absence of results from the divested businesses as well as adverse currency translation.

Kellogg affirmed its full-year financial guidance, with sales and profit delivery shifting toward the first half of the year. Organic net sales are expected to grow 1-2% from last year while adjusted earnings per share, on a currency-neutral basis, are anticipated to fall by 3-4% as the absence of results from divested businesses more than offsets growth in the base business.

Past Performance

Kellogg Q4 2019 Earnings Results

Kellogg Q3 2019 Earnings Performance