Results beat expectations

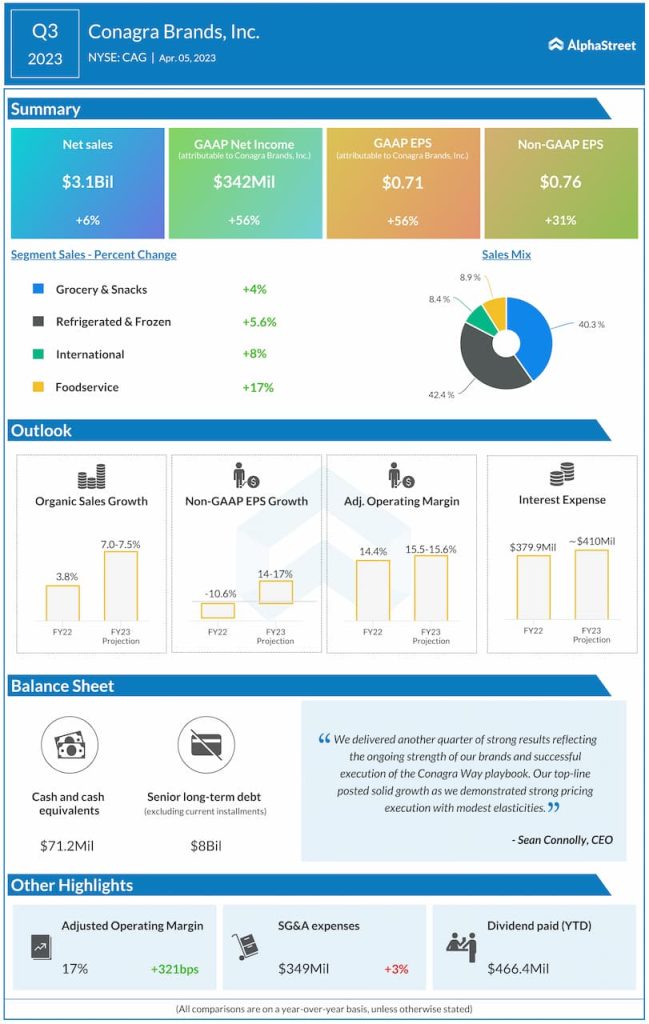

Net income increased 56% to $342 million, or $0.71 per share, versus last year. Adjusted EPS rose 31% YoY to $0.76, surpassing projections. The bottom line growth was driven mainly by an increase in gross profit.

Margin recovery

In Q3, gross profit increased 20% YoY to $839 million, helped by organic sales growth and productivity, which more than offset the negative impacts from cost of goods sold inflation. Gross margin increased 325 basis points to 27.2% while adjusted gross margin improved 409 basis points to 28.1%.

Category performance

Conagra recorded sales growth across all its segments during the third quarter. Net sales, both on a reported and organic basis, increased 3.7% and 5.6% for the Grocery & Snacks and Refrigerated & Frozen segments, respectively. Sales growth was driven by price increases but was offset by volume declines.

Within the Grocery & Snacks segment, the company gained share in snacking categories like microwave popcorn and some staples categories like Asian sauces and marinades. Within Refrigerated & Frozen, Conagra gained share in categories like plant-based protein and frozen breakfast sausage.

Net sales in the International segment increased 7.7% on a reported basis and 9.5% on an organic basis in Q3. Net sales in the Foodservice division rose 17% on a reported and organic basis. These divisions also benefited from price increases but saw volumes drop during the quarter.

Outlook raised

Based on the continued business momentum, Conagra raised its adjusted EPS guidance for the full year of 2023 and narrowed its ranges for organic sales growth and adjusted operating margin. The company now expects organic sales growth to be in the range of 7-7.5% versus the prior range of 7-8%.

Adjusted EPS is now expected to range between $2.70-2.75, representing a growth of 14-17% versus FY2022. The previous range for EPS was $2.60-2.70. Adjusted operating margin is now expected to be 15.5-15.6% compared to the prior range of 15.3-15.6%.