Shares of PepsiCo, Inc. (NASDAQ: PEP) were down over 2% on Tuesday, despite the company delivering better-than-expected results for the first quarter of 2024. The top and bottom line numbers grew year-over-year and surpassed projections, despite certain challenges in the Quaker Foods segment and tough year-ago comparisons. Here are the key takeaways from the report:

Results beat estimates

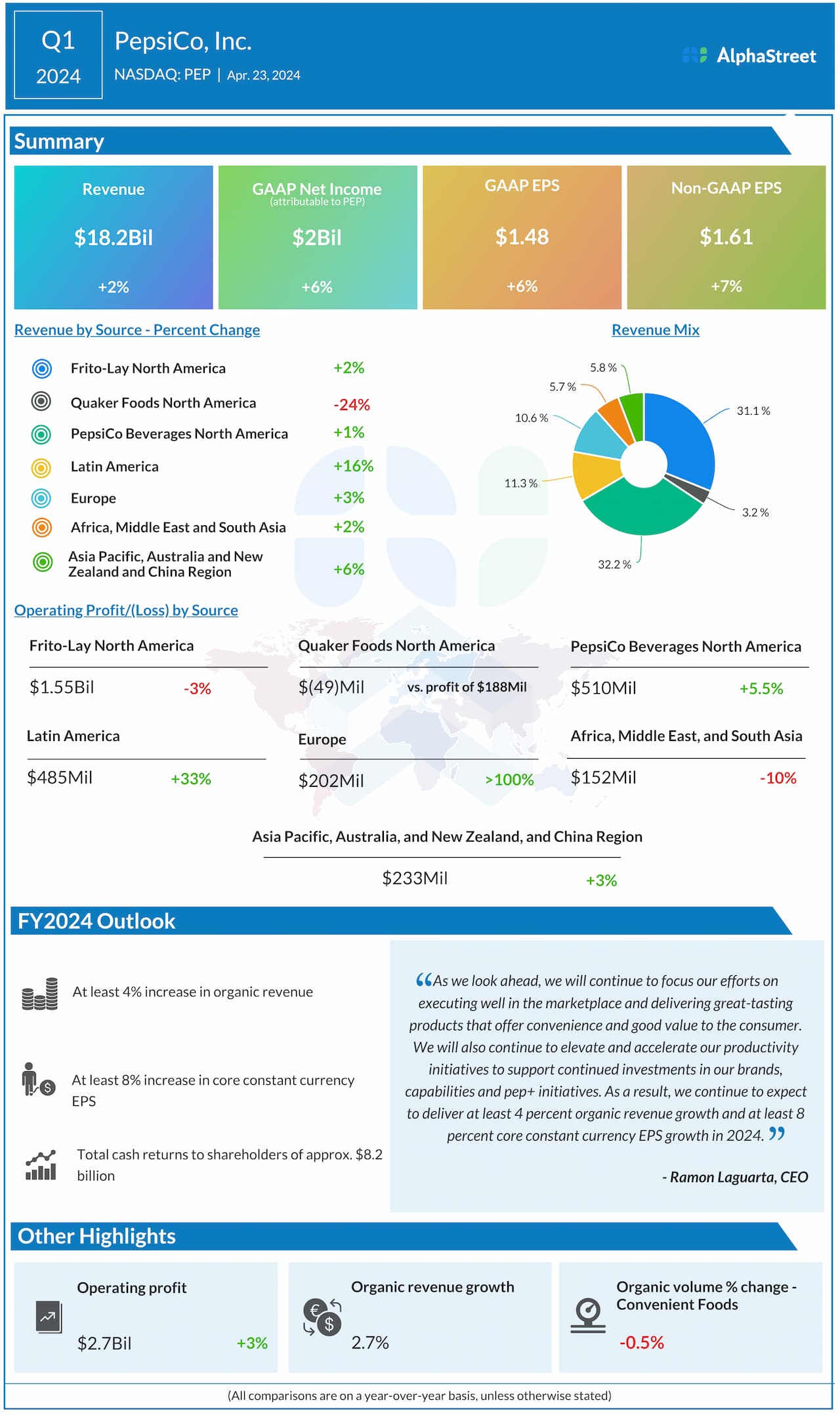

PepsiCo reported net revenue of $18.2 billion for Q1 2024, which rose 2.3% year-over-year and beat expectations of $18.1 billion. Organic revenue growth was 2.7%. GAAP net income increased 6% to $2 billion, or $1.48 per share. Core EPS grew 7% to $1.61, beating projections of $1.52.

Segment performance

In Q1, PepsiCo recorded revenue growth across all its segments, both on a reported and organic basis, barring Quaker Foods North America, which saw a double-digit decline, mainly due to product recalls.

The Frito-Lay North America segment saw organic revenue growth of 2%, helped by brands such as Cheetos and Doritos, which delivered mid-single-digit revenue growth. Brands that target specialty snacking occasions or positive choices, such as Miss Vickie’s and BARE, witnessed double-digit revenue growth. The company also recorded gains from brands such as SunChips, PopCorners, and Stacy’s during the quarter.

Quaker Foods North America saw organic revenues fall 24% due to product recalls and soft category growth. In its report, PepsiCo said it plans to close the manufacturing facility involved in the recalls and that it has resumed limited production on certain products affected by the recalls through other facilities. The company expects production to pick up in the coming months and the financial impacts of these recalls to moderate as the year moves on.

PepsiCo Beverages North America saw organic revenue growth of 1%, helped by gains in Pepsi, Mountain Dew, Propel, bubbly, and Gatorade. PepsiCo’s International business delivered organic revenue growth of 9% in the quarter.

Outlook

Looking ahead, PepsiCo expects its international businesses to perform well on the back of strong category growth in developing and emerging markets. It also expects a gradual improvement in its North America businesses as comparisons ease and the impact of product recalls moderate.

PepsiCo continues to expect organic revenue growth of at least 4% and core constant currency EPS growth of at least 8% for the full year of 2024. Core EPS is expected to be at least $8.15, representing a growth of 7% from 2023.