Shares of Philip Morris International Inc. (NYSE: PM) were down over 2% on Thursday after the company delivered mixed results for the fourth quarter of 2023. Revenue beat estimates but earnings fell short. The stock has dropped 12% over the last 12 months. Here are the key takeaways from the report:

Mixed results

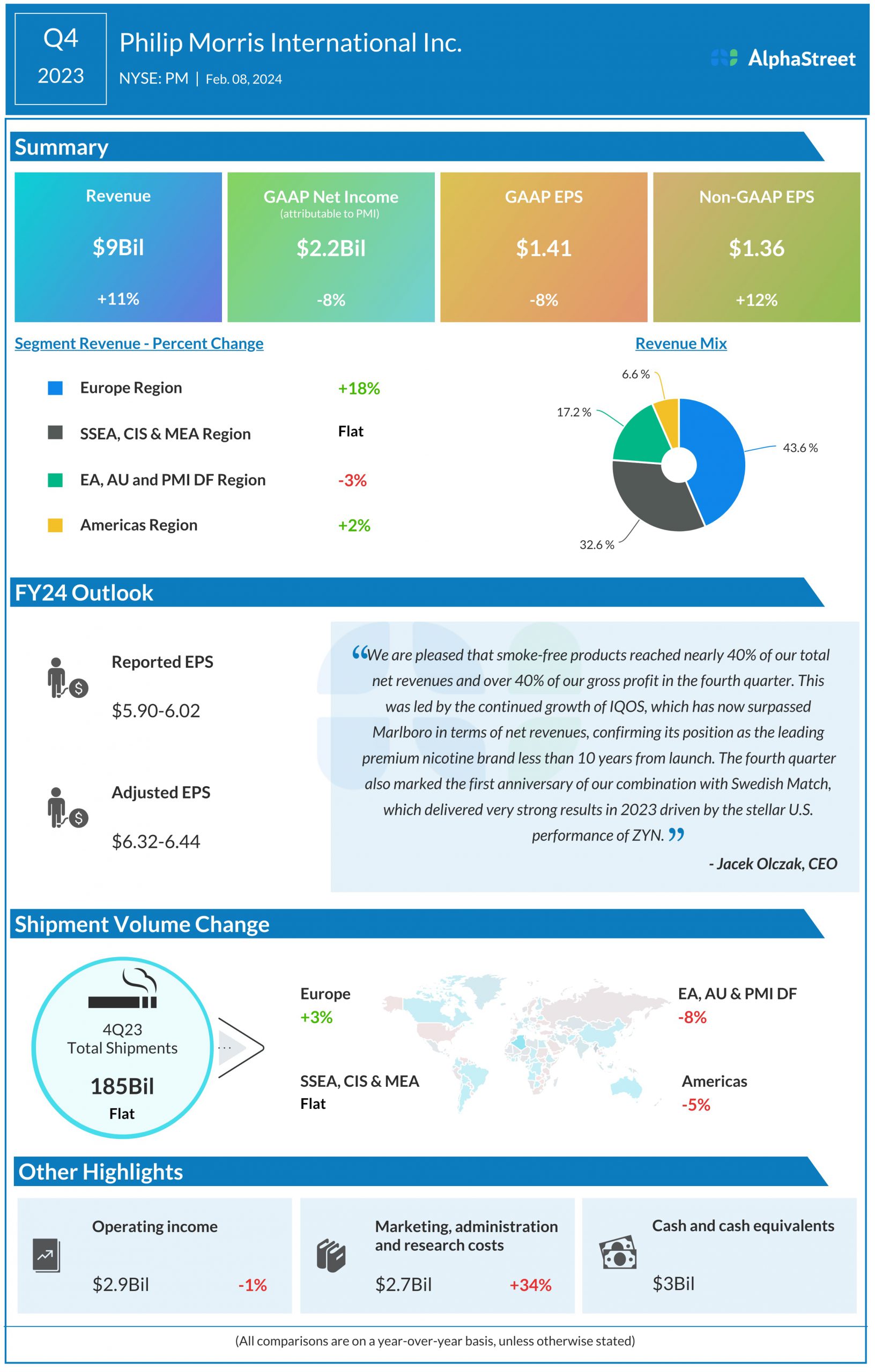

Philip Morris’ net revenues grew 11% year-over-year to $9.05 billion in Q4 2023, beating estimates of $9.01 billion. GAAP net income decreased 8% to $2.2 billion, or $1.41 per share, in the quarter. Adjusted EPS grew 12% to $1.36 but missed projections of $1.45.

Smoke-free products performance

In Q4, smoke-free products reached nearly 40% of PMI’s total revenues and made up over 20% of volumes. On its quarterly conference call, the company said it has reached 25 markets where smoke-free products exceed 50% of its top line. It aims to reach 60 markets by 2030 as it strives to exceed two-thirds of group net revenues.

PMI continues to see strong performance from IQOS, with its revenues surpassing Marlboro during the fourth quarter. IQOS users are estimated to have grown by 1.2 million during the quarter to reach 28.6 million as of December 31, 2023. The company continues to see strong share gains in developed countries along with promising growth in low and middle-income markets for IQOS.

The tobacco giant is seeing momentum from IQOS ILUMA, which is now available in 51 markets, excluding Russia and Ukraine, and has over 17 million estimated adult users as of December 31. The company expects ILUMA to drive strong IQOS user growth in 2024 and beyond.

Another growth driver was the nicotine pouch brand ZYN, which recorded US shipment volume of 116.3 million cans in Q4, up 78.2% from last year. In 2024, PMI will continue to invest in the growth and capacity expansion of ZYN.

Outlook

For the first quarter of 2024, Philip Morris expects adjusted EPS to range between $1.37-1.42. For the full year of 2024, the company expects reported EPS to range between $5.90-6.02 and adjusted EPS to range between $6.32-6.44. Revenues are expected to grow 6.5-8.0% on an organic basis for the year.

In 2024, PMI expects its total cigarette, HTU and oral smoke-free product shipment volume growth to be flat to up 1%, fueled by smoke-free products. Nicotine pouch shipment volume in the US is expected to be approx. 520 million cans.