Shares of Philip Morris International Inc. (NYSE: PM) stayed green on Thursday after the company reported second quarter 2023 earnings results that surpassed projections. The stock has gained 3% over the past one month. Here’s a look at the key points from the earnings report:

Better-than-expected results

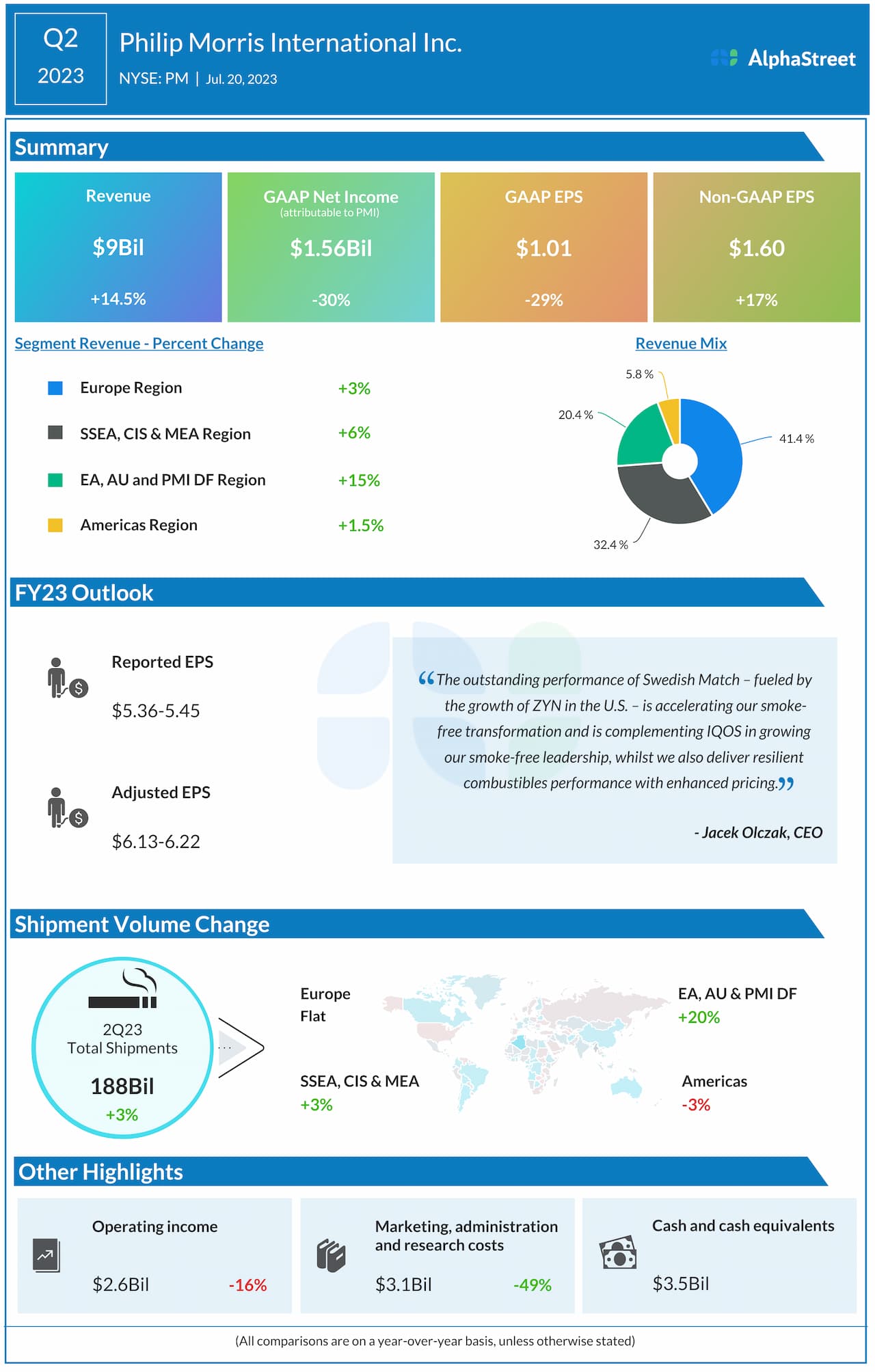

Philip Morris’ Q2 2023 revenue increased 14.5% year-over-year to $9 billion, beating estimates of $8.6 billion. Adjusted EPS grew 17% to $1.60, exceeding expectations of $1.47.

Organic revenues grew 10.5% in the quarter, driven by a 3% growth in cigarette and HTU shipment volume, favorable product mix associated with more smoke-free products in the portfolio, and pricing.

Business performance

In Q2, IQOS continued to perform well, driven mainly by IQOS ILUMA, which makes up about two-thirds of the IQOS business by volume. As stated on PMI’s quarterly conference call, there were an estimated 27.2 million IQOS users as of June 30, reflecting a growth of 1.4 million adult users in the second quarter. In Europe, IQOS users are nearing 12 million, with the further roll-out of ILUMA, which is available to about 70% of users in the region.

Another growth driver is ZYN nicotine pouches, which grew volumes in the US by over 50% during Q2. This growth was driven by increases in distribution and a rise in store velocities. These two products are playing a meaningful role in driving Philip Morris’ smoke-free transformation.

During Q2, HTU shipment volumes totaled 31.4 billion units, reflecting a growth of 26.6% YoY, fueled by strong performance in Europe and Japan. Cigarette volumes declined 0.4% in the quarter.

Revised outlook

PMI increased its full-year 2023 guidance for organic revenue growth to 7.5-8.5% based on strength in IQOS and ZYN and the resilience of its combustible business. It also revised its outlook for adjusted EPS to a range of $6.13-6.22 from the previous range of $6.10-6.22.

For the third quarter of 2023, the company expects high single-digit organic top line growth. Adjusted EPS is expected to be $1.60-1.65.