Shares of Procter & Gamble (NYSE: PG) gained over 4% on Tuesday despite the company posting mixed results for the second quarter of 2024. Earnings beat expectations while revenue fell short of estimates. The consumer goods firm also lowered its full-year earnings guidance due to an impairment charge. Here are the key takeaways from the earnings report:

Mixed results

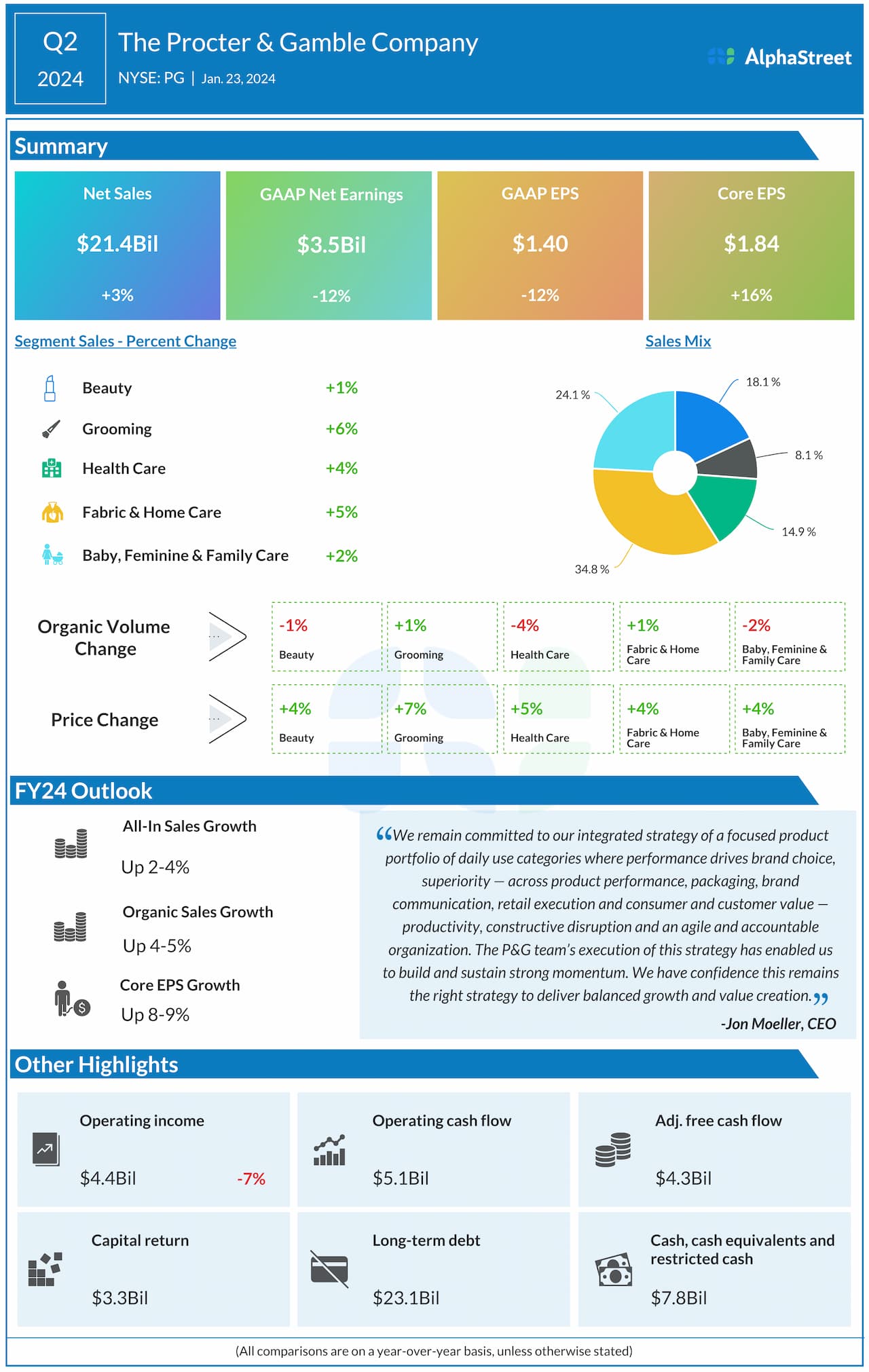

Procter & Gamble’s net sales in Q2 2024 grew 3% year-over-year to $21.44 billion, but narrowly missed estimates. Organic sales rose 4%, helped by higher pricing, partly offset by a 1% drop in shipment volumes. GAAP EPS decreased 12% to $1.40, mainly due to an impairment charge related to its Gillette business. Core EPS grew 16% to $1.84, surpassing expectations.

Category performance

P&G saw sales growth across all its segments during the second quarter, both on a reported and organic basis. Organic sales in the Beauty segment grew 1% YoY, with high-single-digit growth in Hair Care, driven by higher pricing, product mix, and volume growth. However, volume declines and unfavorable mix led to a mid-single-digits sales decline in Skin and Personal Care.

Organic sales in Grooming rose 9%, driven by higher pricing, premium product mix and volume growth. The Health Care segment witnessed organic sales growth of 2%, with mid-single-digit growth in Oral Care. Personal Health Care organic sales fell in the low single digits, hurt by a decline in respiratory products.

Fabric and Home Care saw organic sales grow 6%, with mid-single-digit growth in Fabric Care and high-single-digit growth in Home Care. Baby, Feminine and Family Care saw organic sales growth of 3%.

Outlook

For fiscal year 2024, P&G expects all-in sales growth of 2-4% and organic sales growth of 4-5%. The company revised its outlook for GAAP EPS and now expects it to be down 1% to flat versus last year. The previous expectation was for a growth of 6-9%. The updated earnings guidance reflects the Gillette impairment charge and a restructuring program announced last month.

PG raised its core EPS guidance for the year based on strong quarterly performance. Core EPS is now expected to grow 8-9% YoY versus the prior range of 6-9%. This amounts to a range of $6.37-6.43 per share.