The company continues to make investments to target market share gains over the long term. Also, the company will incur additional charges related to the closure of its locations and voluntary role reduction program. However, digital demand is likely to accelerate driven by strong growth from Kohl’s app, its app visits, and conversion.

Analysts expect the company’s earnings to drop by 12.20% to $0.86 per share and revenue will decline by 5% to $4.39 billion for the third quarter. The company has surprised investors by beating analysts’ expectations thrice in the past four quarters. The majority of the analysts recommended a “hold” rating with an average price target of $56.

Read: Vipshop Holdings Q3 earnings snapshot

ADVERTISEMENT

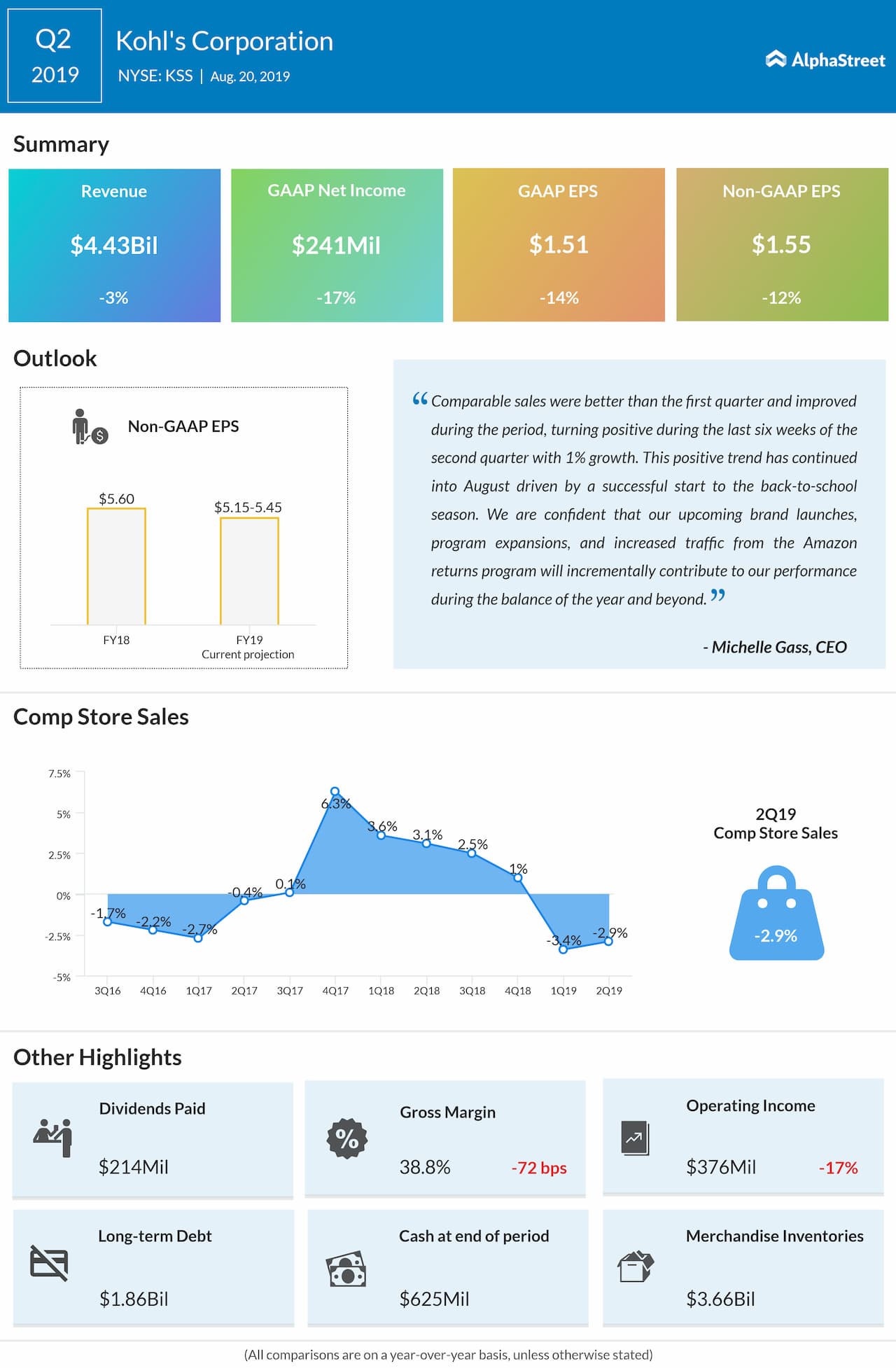

For the second quarter, Kohl’s posted a 17% decrease in earnings as a 2.9% decline in comparable sales hurt the top line. Comparable sales were better than the first quarter and improved during the period, turning positive during the last six weeks of the second quarter with 1% growth.

For the full year 2019, the company expects earnings in the range of $5.15 to $5.45 per share. This excludes $0.26 per share related to impairments, store closing and other costs recognized in the first six months of 2019.