Quarterly performance

Trends

Kroger continues to take advantage of the food-at-home trend with the company launching 72 new Our Brands items during the fourth quarter. Most of these include quick meal solutions such as the Simple Truth skillet meals for two and Kroger brand multi-serve tray meals. It also completed the initial phase of in-store End-to-End Fresh initiative and is expanding the program to targeted stores across the country.

Kroger continues to build its digital capabilities by expanding its fulfillment network. In Q4, new seamless pickup and delivery household acquisitions increased 25% on a sequential basis. Digital sales grew 105% on a two-year stack.

The company delivered gross margin of 22.2% during the quarter. The FIFO gross margin rate, excluding fuel, increased 3 basis points YoY helped by sourcing benefits. Higher supply chain costs and strategic price investments partly offset these benefits. Kroger’s cost savings initiatives helped it surpass its annual savings goal of $1 billion for the fourth consecutive quarter.

Outlook

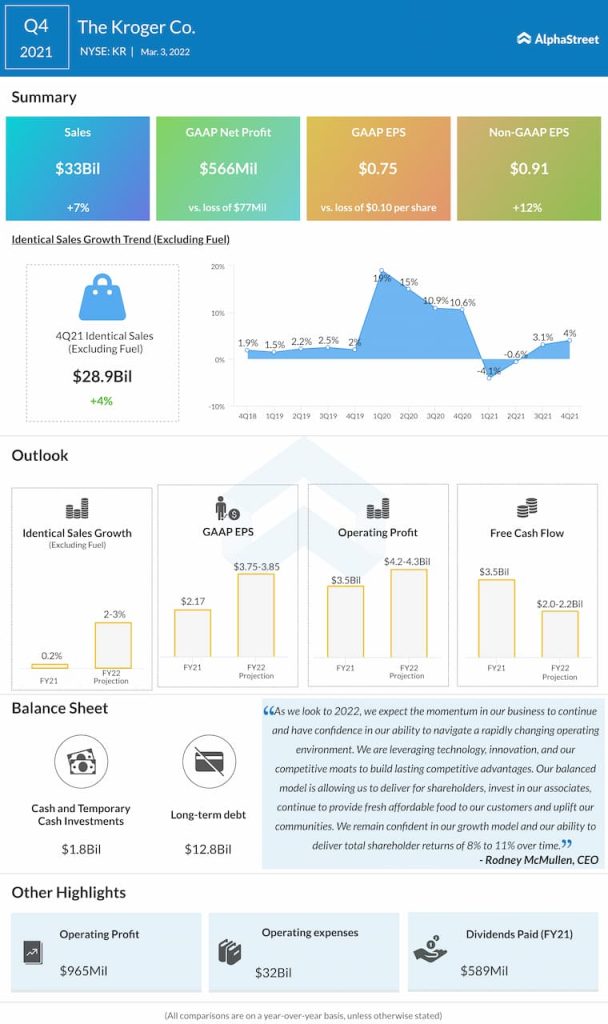

Kroger expects the momentum in its business to continue in the coming year and it is confident it can navigate a challenging operating environment. For the full year of 2022, the company expects identical sales, without fuel, to grow 2-3% while adjusted EPS is expected to range between $3.75-3.85. Both these metrics were better than what analysts had been estimating.

Operating profit is expected to range between $4.2-4.3 billion and free cash flow is estimated to come between $2.0-2.2 billion. Capital expenditures are estimated to be $3.8-4.0 billion.

In 2022, Kroger plans to increase its capital investments in strategic priorities that will help drive growth in earnings over the long term. The company expects to generate strong free cash flow and it remains confident in its ability to generate total shareholder returns of 8-11% over time.

Click here to access the full transcript of Kroger’s Q4 2021 earnings conference call