Shares of Lowe’s Companies (NYSE: LOW) were down over 2% on Friday. The stock has dropped 18% year-to-date. The company saw strong earnings growth in the second quarter of 2022 although sales declined slightly year-over-year. Despite the mixed results, there is a positive sentiment surrounding the stock. Here are a few points to note if you have an eye on this home improvement retailer:

Sales and profitability

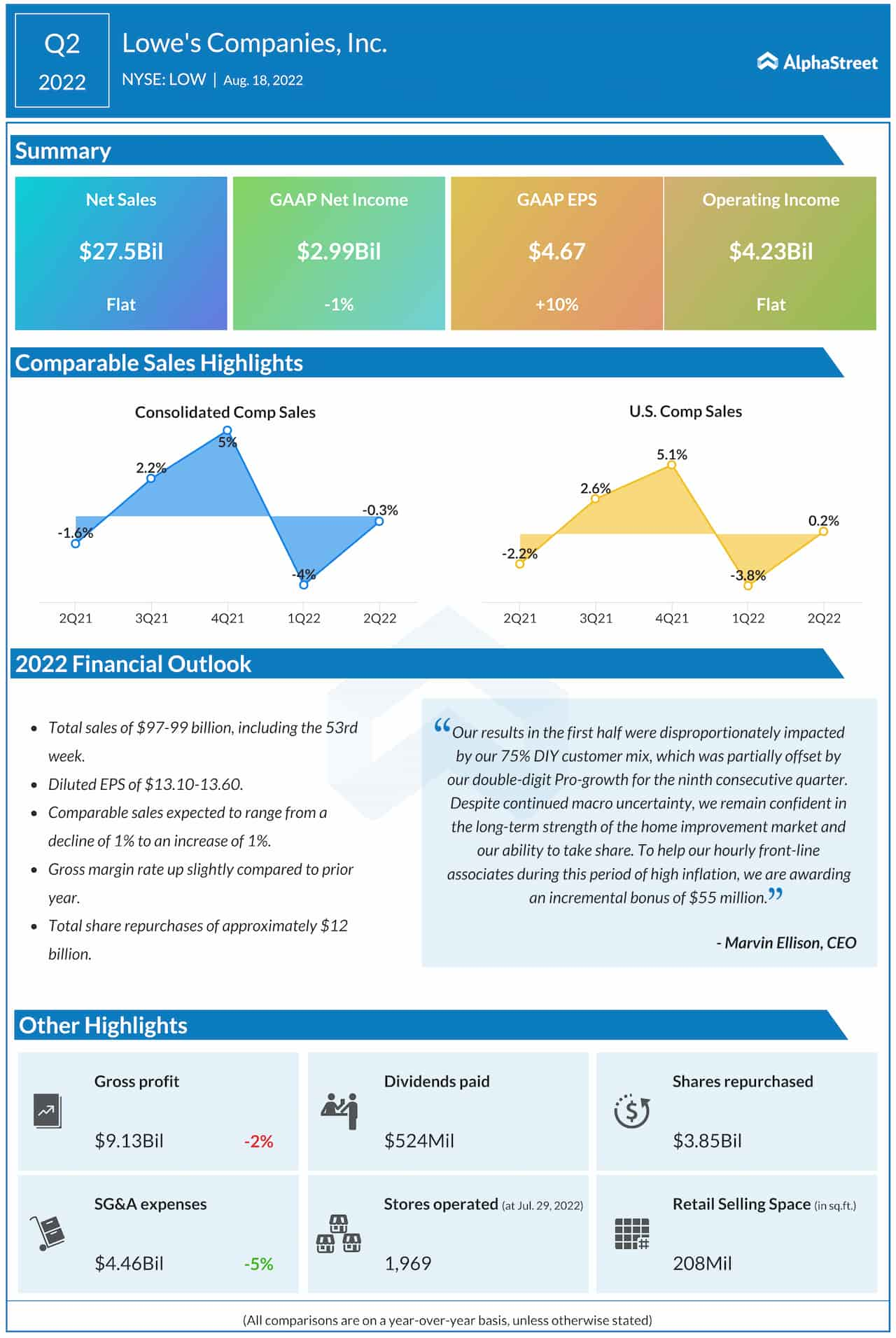

Lowe’s total sales for Q2 2022 dipped slightly to $27.5 billion from $27.6 billion in the year-ago period. Comparable sales were down 0.3% for the quarter. A 6.1% increase in comparable average ticket, driven by higher sales in the Pro segment and product inflation, was offset by a 6.4% decline in comp transactions. The top line results were impacted by a short spring season, reduction in lumber prices and lower demand in some DIY discretionary categories.

At the same time, the company delivered EPS of $4.67, which was up 9.9% from the prior-year quarter and better than what analysts had projected. The retailer’s inventory management and cost reduction efforts helped drive an improvement in operating margins during the quarter. Operating profit of $4.2 billion was up slightly versus last year.

Market trends

The majority of Lowe’s sales comes from the DIY segment with the remainder coming from the Pro segment. DIY sales were lower than expected in the second quarter as the relatively short spring season impacted categories like lawn and garden which are more heavily concentrated in this segment. Despite the slower sales in certain discretionary categories, the DIY segment remains resilient, reflecting strong demand for home improvement.

The three factors that influence home improvement demand are home price appreciation, housing age and disposable personal income. Despite a slowdown in housing turnover, home prices remain high thereby guaranteeing a return on investment. The second factor is housing age. On its quarterly conference call, Lowe’s stated that more than half of the homes in the US are over 40 years old and millions more built during the housing boom in the early 2000s are starting to turn 20 years old which means that they are due for big-ticket repairs.

Looking at disposable personal income, consumer savings are higher compared to pre-pandemic levels and most of these savings are concentrated in middle and high income households who are more likely to own homes. Amid a low housing supply and high interest rates, people are more likely to invest in renovating their current homes rather than move to new ones. This is another factor that can drive demand for home improvement.

Outlook

Lowe’s expects momentum to continue in the Pro segment and DIY sales to improve during the second half of 2022. For full-year 2022, sales are expected to range between $97-99 billion while comparable sales are expected to be down 1% to up 1%. Operating margin is estimated to be 12.8-13% for the year while EPS is projected to be $13.10-13.60.

Click here to read the full transcript of Lowe’s Q2 2022 earnings conference call