Sales

Looking ahead into FY2023, Macy’s believes the allocation of consumer spending will continue to move away from discretionary categories. Despite this shift, the company believes there is opportunity as trends like the hybrid work model provides flexibility for personal travel and that consumers’ desire to take vacations or attend events has not reduced, and therefore gift-giving and occasion-based demand is likely to continue.

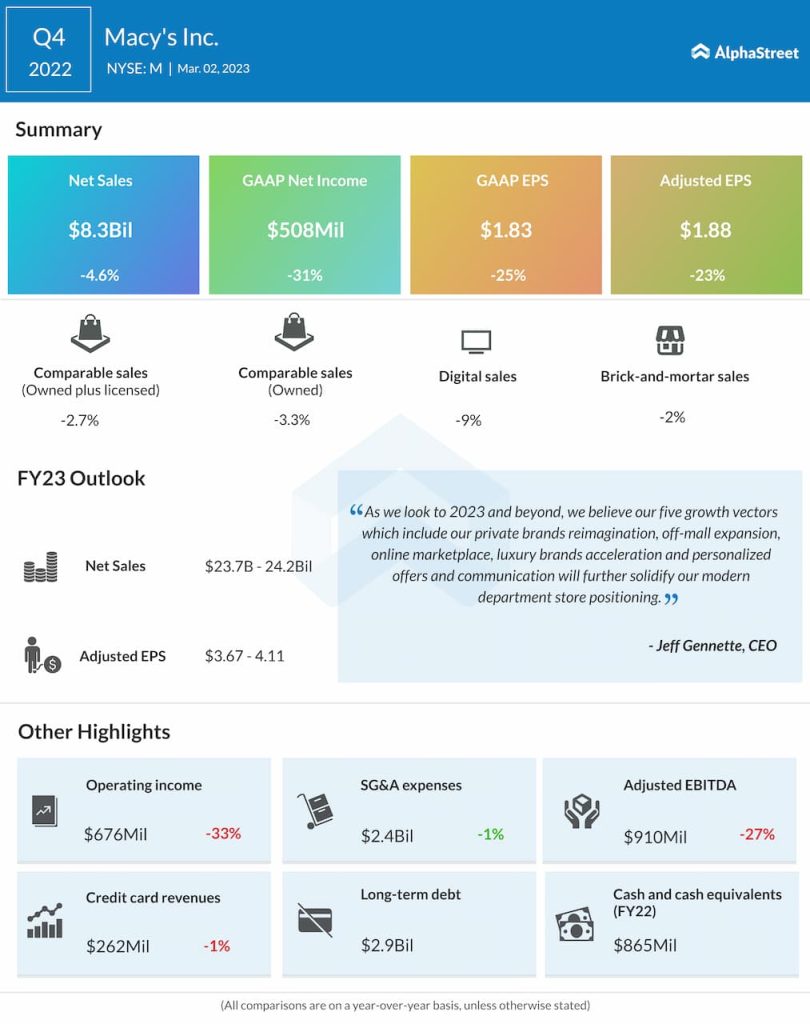

For FY2023, Macy’s expects net sales to range between $23.7-24.2 billion, representing a low single-digit decline on a year-over-year basis. The outlook reflects the company’s belief that the consumer will face more pressures in 2023 compared to 2022. Comparable sales on a 52-week owned plus licensed basis is expected to be down around 2-4% YoY.

Macy’s expects year-over-year sales performance to be softer in the first half of 2023 versus the second half. For the first quarter of 2023, the company expects net sales of $5.0-5.1 billion.

Profitability

In Q4 2022, Macy’s GAAP EPS fell 25% to $1.83 while adjusted EPS declined 23% to $1.88 compared to the previous year. Adjusted EPS is expected to be $3.67-4.11 in FY2023. For Q1 2023, the company expects adjusted EPS of $0.42-0.48.

In the fourth quarter, Macy’s gross margin dropped to 34.1% from 36.5% last year. Merchandise margin declined during the quarter mainly due to higher markdowns and promotions. These higher markdowns were part of the company’s efforts to end the year with the right level of inventories. For FY2023, gross margin is estimated to be 38.7-39.2%.

Off-mall stores

On its quarterly conference call, Macy’s mentioned that one of its key growth vectors was its off-mall smaller-format stores, which play an important role in supporting its omni-channel capabilities. The company currently has eight Market by Macy’s and two Bloomies off-mall stores, which are roughly one-fifth the size of its on-mall locations.

For the five Market by Macy’s and the one Bloomies stores that have been open for over a year, comparable owned plus licensed sales increased by 8% and 12% respectively in Q4 2022. The company is seeing significantly higher conversion at its off-mall locations compared to its mall locations. On its call, it said off-mall centers have 2.5 times more visits than on-mall. It has also seen lower cannibalization in existing markets and higher new customer acquisition rates for these stores.

In 2023, Macy’s plans on opening four Market by Macy’s stores and one Bloomies store. Based on the performance of these new stores, the company will move forward with its plan of accelerating off-mall openings from 2024.

Private brands

Another growth vector is private brands. Private brands play a key role in driving customer loyalty and gross margin. Macy’s currently has 24 private-label brands, which altogether made up around 16% of its sales in FY2022. Over the next three years, Macy’s plans to evaluate these brands and refresh and replace them to improve and develop its portfolio.

CEO change

Earlier this week, Macy’s announced that its CEO Jeff Gennette plans to retire in February 2024. The company has appointed Executive Vice President Tony Spring to succeed him. With a new CEO at the reins, Macy’s can expect new strategies and initiatives in the coming years.