Better-than-expected results

Business performance

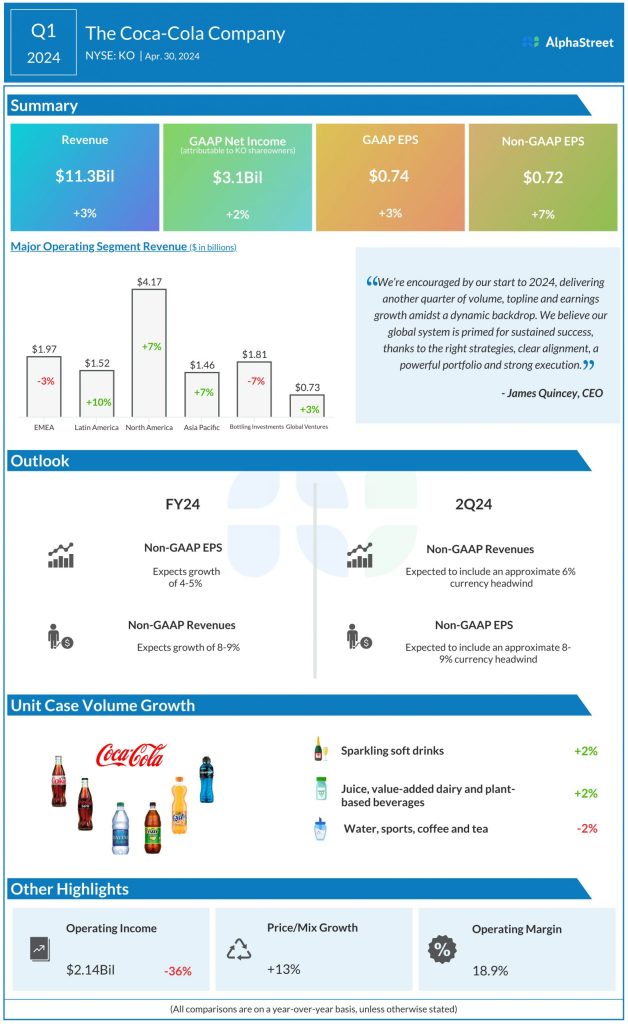

Coca-Cola recorded revenue increases, on a reported basis, across all its segments during Q1, barring Europe, Middle East & Africa (EMEA) and Bottling Investments. On an organic basis, revenue grew across all segments. On its quarterly call, the company stated that geopolitical and economic challenges in Eurasia and the Middle East continue to affect its business in the region.

Consolidated unit case volume grew 1% in Q1, with developed markets remaining flat, and developing and emerging markets seeing low single digit growth. Unit case volumes for sparkling soft drinks, and juice, value-added dairy and plant-based beverages both grew 2% while water, sports, coffee and tea saw a drop of 2%.

Unit case volume remained flat in North America as growth in juice, value-added dairy and plant-based beverages and Trademark Coca-Cola was offset by a decline in water, sports, coffee and tea. Unit case volume grew 2% and 4% in EMEA and Latin America respectively, driven by growth in water, sports, coffee and tea, as well as sparkling flavors, and Trademark Coca-Cola. Unit case volume declined 2% in Asia Pacific.

Updated guidance

Coca-Cola updated its full-year 2024 guidance for organic revenue growth and comparable currency neutral EPS growth. The company now expects organic revenues for the year to grow 8-9% versus the previous estimate of 6-7%. Comparable currency-neutral EPS is now expected to grow 11-13% versus the prior outlook of 8-10%. The outlook for comparable EPS growth remains unchanged at 4-5%.