The Stock

Back-to-back price hikes have been denting the demand for Conagra’s products lately, as consumers tend to drift away from branded food products and buy cheaper private-label alternatives due to high inflation and pressure on family budgets. Meanwhile, on a relative value basis, Conagra products seem to be giving good value despite the price rise. A lot of Americans prefer eating at home to dining out because it is more affordable, a trend that bodes well for the company.

Mixed Outcome

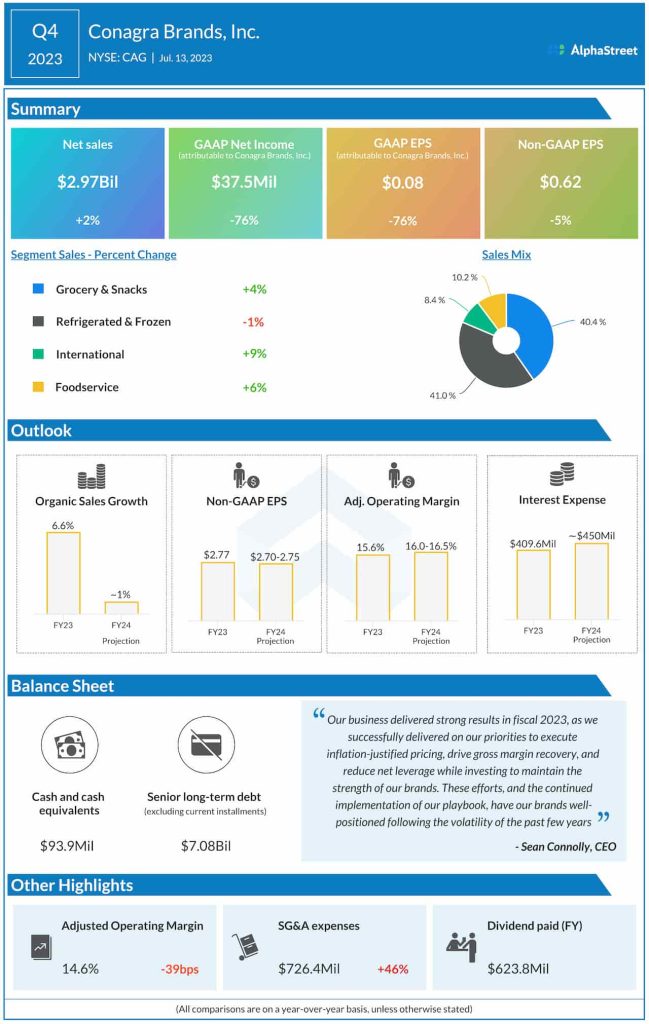

In the final three months of fiscal 2023, adjusted profit declined 5% year-over-year to $0.62 per share but surpassed experts’ average estimates, after beating in each of the trailing five quarters. The bottom line was negatively impacted by higher SG&A expenses. In contrast, sales increased modestly to $2.97 billion but fell short of expectations. There was an increase in Grocery & Snacks sales, while sales of Refrigerated & Frozen products declined, restricting the topline growth to just 2%.

Guidance

Looking ahead, Conagra executives see a marked deceleration in full-year organic sales growth and a modest decrease in adjusted profit, compared to the prior fiscal year. Meanwhile, margin performance, on an adjusted basis, is expected to improve year-over-year. The forecasts are below analysts’ consensus estimates. In fiscal 2024, the company expects to transition toward a more normalized operating environment and commitment to its long-term financial algorithm.

Commenting on Conagra’s CapEx target, CFO David Marberger said at the earnings call,“ We have the inventory that we need, so as we look at fiscal ’24, we guided to expected net leverage of 3.4 times. We expect to pay down debt with discretionary cash flow in fiscal ’24 and in ’24 we’re working capital has been a headwind, we expect it to actually be a slight tailwind for fiscal ’24, so if you look at Conagra with modest working capital improvement $500 million in CapEx, which we guided to, we should approximate a 90% free-cash-flow conversion in ’24 on this business. So that’s how we look at it and that drives all that assumptions on debt pay-down and dividend payout and everything else. On the capital allocation.”

CAG traded slightly higher in the early hours of Thursday after a weak start to the session. The stock has lost 15% in the first half of the year.