US futures are pointing to a mixed open today after ending lower on Tuesday, as investors are cautiously looking forward to the quarterly figures from big shot firms. Traders are closely monitoring the US-France summit and the outcome on other global allies. Markets are impacted by the continued rise in oil prices and the 10-year Treasury yields made another push above 3%.

The S&P futures tumbled 0.26% to 2,628.50, and Nasdaq fell 0.29% to 6,508. Meanwhile, Dow futures moved up 0.10% to 24,008. Elsewhere, shares at Asian markets closed lower on Wednesday and European stocks are trading in the red.

On the European economic front, data from the INE showed that Spain’s producer price inflation rose to 1.3% in March from 1.2% in February. The Central Statistical Office data revealed that Poland’s unemployment rate fell to 6.6% in March from 6.8% in February. Credit Suisse and the CFA Society Switzerland data showed that Switzerland’s investor confidence tumbled to 7.2 in April from 16.7 in March.

Insee data revealed that France consumer confidence rose to 101 in April from 100 in March. Destatis data showed that Germany’s construction orders increased 9.9% on month in February. Statistics Austria data revealed that Austria’s production index expanded 5.1% on year in February, industrial output rose 4.6%, and construction output grew 7.6%.

On the Asian economic front, data from the Ministry of Economy, Trade, and Industry showed that Japan’s all industry activity rose 0.4% on month in February after falling 0.1% in January. Bank of Korea data revealed that South Korea’s consumer confidence fell to 107.1 in April from 108.1 in March.

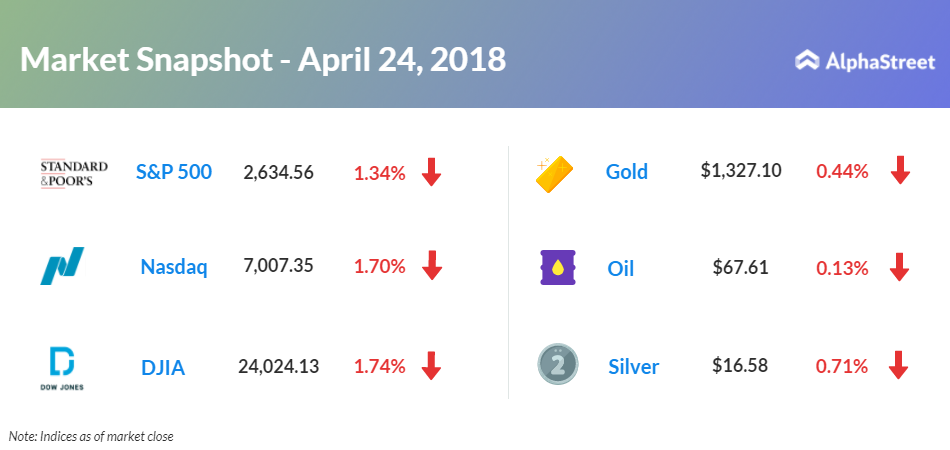

On April 24, US ended lower, with Dow down 1.74% to 24,024.13. Nasdaq fell 1.70% to 7,007.35, and the S&P 500 slipped 1.34% to 2,634.56. Traders turned cautious as they ignored initial positive reaction to earnings news from several companies. A Commerce Department report showed that new home sales rose 4% to an annual rate of 694,000 in March after increasing 3.6% to 667,000 in February. A Conference Board report showed that consumer confidence index grew to 128.7 in April from 127 in March.

Meanwhile, key economic events scheduled for today include the Energy Information Administration’s petroleum status report.

Key companies reporting earnings today include T. Rowe Price Group (TROW), Comcast (CMCSA), eBay (EBAY), PayPal (PYPL), Las Vegas Sands (LVS), Advanced Micro Devices (AMD), Qualcomm (QCOM), General Dynamics (GD), Citrix Systems (CTXS), Rockwell Automation (ROK), Ford Motor (F), Landstar System (LSTR), TE Connectivity (TEL), Sempra Energy (SRE), Wipro (WIT), Northrop Grumman (NOC), Silicon Laboratories (SLAB), STMicroelectronics (STM), Visa (V), Norfolk Southern (NSC), O’Reilly Automotive (ORLY), Facebook (FB), Nasdaq (NDAQ), Cheesecake Factory (CAKE), AT&T (T), and Chipotle Mexican Grill (CMG).

On the corporate front, Alphabet Inc. (GOOGL) stock moved up 0.23% in the premarket after brokerage firm Stifel Nicolaus upgraded the shares to “buy” from “hold”. Twitter (TWTR) rose 1.15% in premarket trading after better-than-expected first-quarter results. Viacom (VIAB) inched up 1.23% in the premarket following upbeat second-quarter results. Boston Scientific (BSX) moved up 0.35% before the opening bell, as it lifted its 2018 forecast and reported upbeat first-quarter earnings. Boeing Co (BA) stock grew 3.04% in the premarket after raising 2018 outlook and upbeat first-quarter results.

Crude oil futures are down 0.13% to $67.61. Gold is trading down 0.44% to $1,327.10, and silver is down 0.71% to $16.58. On the currency front, the US dollar is trading up 0.36% at 109.202 yen. Against the euro, the dollar down 0.41% to $1.2182. Against the pound, the dollar is down 0.27% to $1.3939.