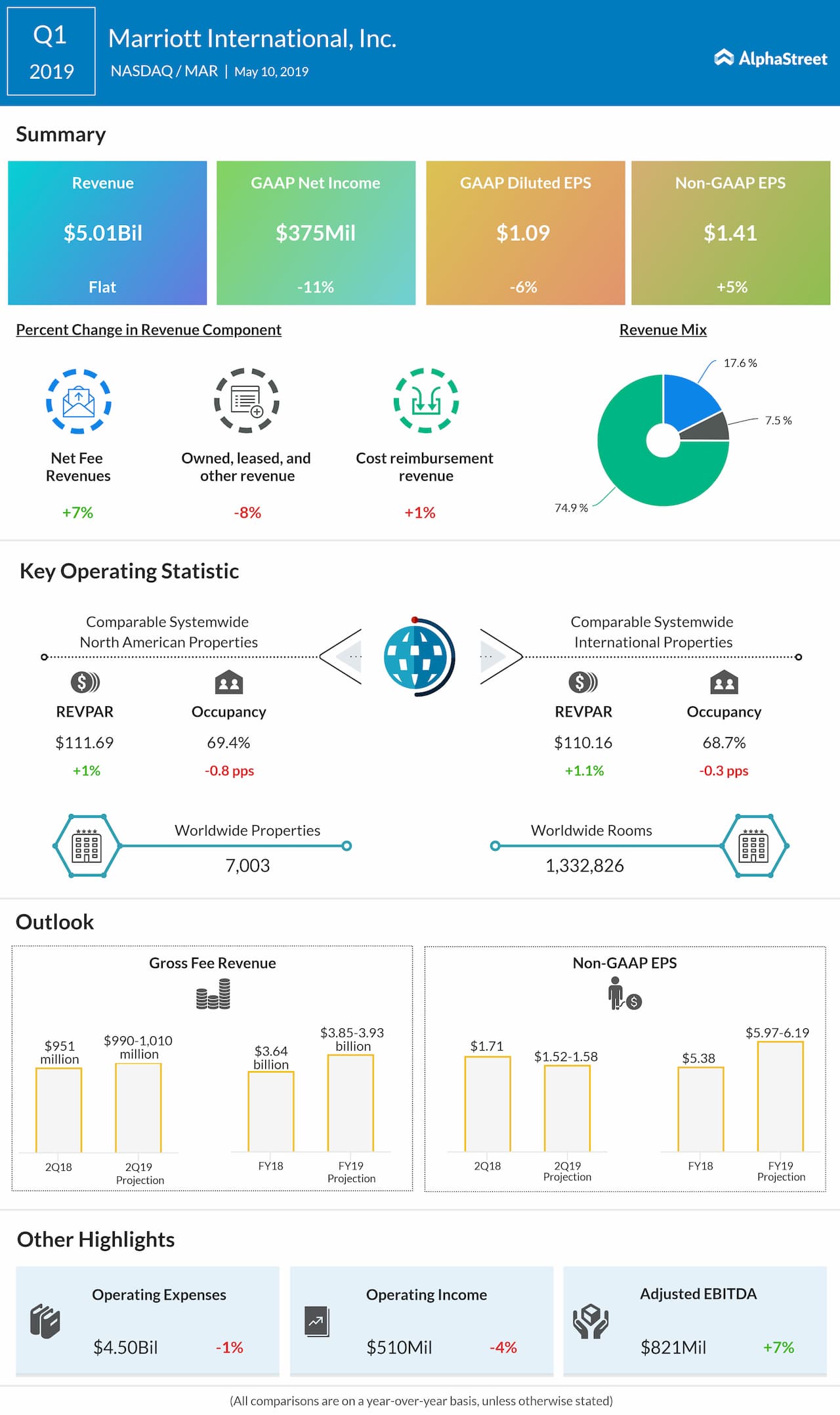

Meanwhile, revenues were broadly unchanged from last year at $5.01 billion. The market’s expectation was for a higher top-line number.

“Despite modest RevPAR growth and higher labor costs, we increased North American house profit margins by 30 basis points and held worldwide house profit margins flat at our company-operated hotels through cost synergies, leading to strong incentive management fee performance in the quarter,” said CEO Arne Sorenson.

Overall comparable RevPAR, a measure of revenues generated from room occupancy, rose 1.1% globally, on a constant currency basis. RevPAR grew 0.8% in North America and 1.9% elsewhere. During the three-month period, Marriott added around 19,000 rooms.

Overall comparable RevPAR, a measure of revenue from room occupancy, rose 1.1% globally in the quarter, on a constant currency basis

For the second quarter, the company expects earnings in the range of $1.52 per share to $1.58 per share. Gross fee revenues are estimated to be between $0.99 billion and $1.01 billion. The forecast for operating income is $770-$795 million.

The management is looking for full-year earnings between $5.97 per share and $6.19 per share and gross fee revenues in the range of $3.85 billion to $3.93 billion. Operating income is estimated to be in the $2.93-$3.03 billion range. The guidance, meanwhile, fell short of Wall Street’s prediction.

Shares of Marriott closed the last trading session slightly higher. The stock has gained 26% so far this year and is currently trading slightly above the $135-mark.