Shares of Mattel, Inc. (NASDAQ: MAT) stayed green on Wednesday. The stock has dropped 4% over the past month. Over the past few years, the toymaker has been focused on transforming its business and expanding its offerings. It continues to see significant opportunity for growth in verticals close to the toy business. Here’s a look at its strategy and the value it sees in this space:

Transformation and strategy

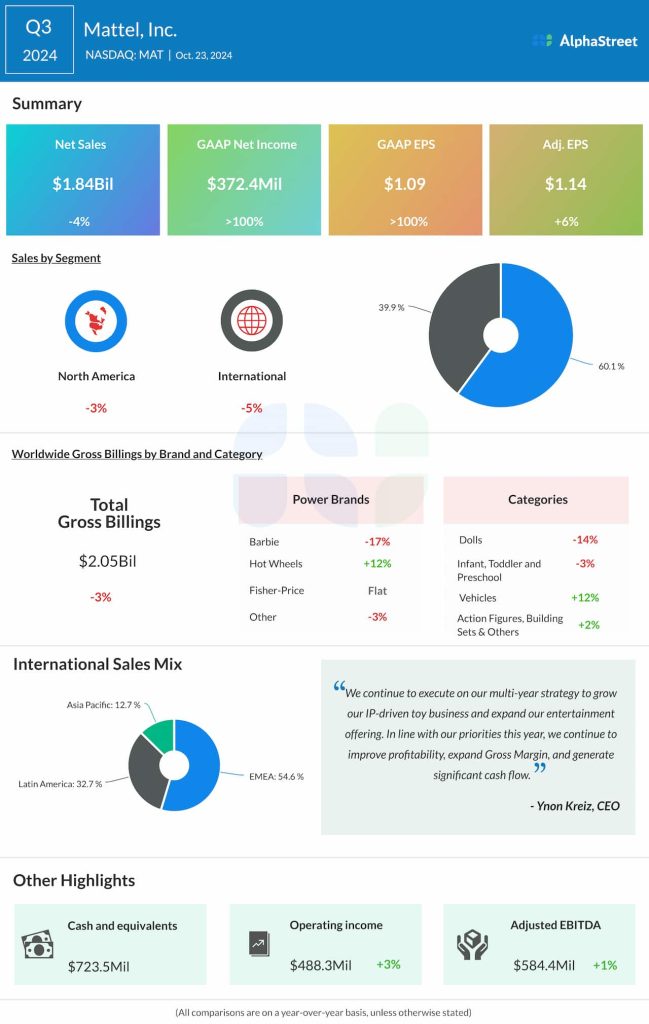

As mentioned at an analyst event last month, Mattel has been transforming itself from a toy manufacturer to an intellectual property (IP) company that manages franchises. It has been working on growing its IP-driven toy business and expanding its entertainment offerings.

Alongside value in the toy business, the company sees opportunity for further growth in business verticals adjacent to the toy business. Its strategy involves expanding the power of its brands across multiple entertainment verticals and consumer touch points.

The toy industry has remained resilient and seen steady growth. It has strong fundamentals and it is a strategic category for retailers as it drives traffic. Mattel is seeing a pickup in demand for toys and movies are helping to drive this demand. The company’s partnerships with major entertainment companies position it well to take advantage of this trend. MAT has been seeing gains on toys based on movies like Wicked and Moana and it has a strong slate for 2025 with movies like Minecraft.

Brands to franchises

Mattel continues to see strong momentum across its brands. Barbie has always been a popular brand and the movie helped broaden its appeal to an even larger audience that includes families and adult collectors. The dolls portfolio continues to expand with dolls based on movies such as Wicked, Moana, and Monster High.

Hot Wheels and Fisher-Price are seeing growth and these brands continue to evolve through product innovation and the expansion of offerings. The addition of new brands like Barney to its portfolio is also expected to generate gains. Mattel has a significant opportunity to turn its toy brands into franchises that can connect with fans in multiple categories.

Non-toy business

MAT continues to expand its entertainment offerings and it sees meaningful opportunity outside the toy business. In digital games, the company is gaining good traction with Mattel163, its joint venture with NetEase. Mattel owns 50% of this business and it is expected to have generated $200 million of revenue in 2024 at high margins with just three games – Uno, Phase 10, and Skip-Bo.

Mattel expects the expansion into these entertainment verticals to be highly accretive to both the top line and margins. It will also give it a significant competitive advantage in the marketplace.