Regional performance

In the US, the company saw positive comps during each month of the quarter, with September reaching low double-digits boosted by strength in the dinner offerings. McDonald’s currently has 2,000 dining rooms open in the US and the company has rolled out a couple of menu changes as well to woo customers.

Comps sales remained positive in Australia and the company grew market share helped by momentum in delivery and drive-thru, which drove around 75% of sales. In the UK, the delivery channel has performed consistently well over the past few years and this year, the sales percentage in this channel rose from high single digits to mid-teens.

In Canada, comp sales remained negative due to weakness in the breakfast category but the company managed to grow market share helped by restaurant re-openings. Europe took the biggest hit from the pandemic during the earlier part of the year and in the third quarter, markets like France, Germany, and Spain saw negative comp sales due to restaurant closures and limited operations.

France and Germany generate 70% of their sales from dine-in and therefore weakness persists in these markets. Markets like Spain and Italy which depend largely on tourism are also seeing a slow recovery.

The three Ds

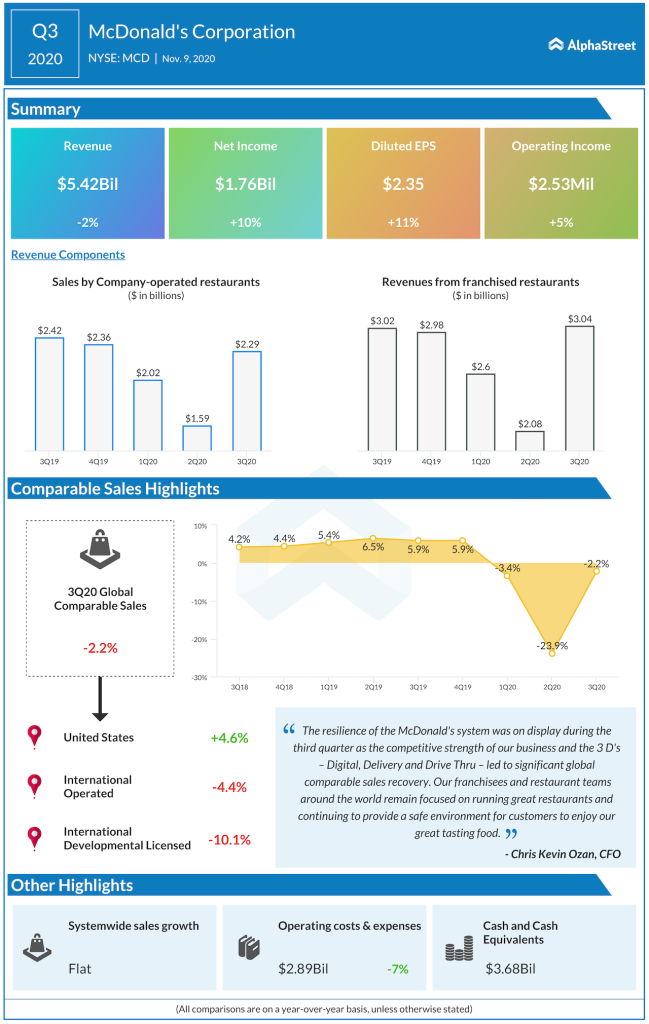

McDonald’s has announced a new growth strategy and one of the pillars of this initiative is to double down on the three D’s – digital, delivery and drive-thru. The drive-thru channel remains an exceptionally strong part of the business while delivery sales have also gained meaningfully across most of the key markets.

McDonald’s expects digital sales to surpass $10 billion or around 20% of systemwide sales across its top six markets this year. The company is launching a new tool called MyMcDonald’s, which is expected to improve the customer experience across all its channels while bringing more speed and convenience. This tool is expected to roll out in those top six markets by the end of 2021.

Looking at delivery, over the past three years, McDonald’s has expanded the delivery option to about 28,000 of its restaurants. The fact that around 75% of people across its top markets live close to a McDonald’s restaurant gives the company a significant advantage.

In terms of drive-thru, McDonald’s has drive-thru in about 95% of its locations in the US and in around 65% of its restaurants globally which has proven beneficial during the pandemic. The momentum is expected to continue going forward.

Outlook

Looking ahead, McDonald’s expects systemwide sales to grow in the mid-single digits for 2021 and 2022. For 2021, growth is comparable to 2019 while in 2022, unit expansion is estimated to contribute 1.5-2% to systemwide sales growth. Capital expenditures are projected to amount to about $2.3 billion, and around half of this is expected to go towards the expansion of new units.

Click here to read the full transcript of McDonald’s Q3 2020 earnings results