McDonald’s Corporation (NYSE: MCD) is scheduled to publish its fourth-quarter report next week, after delivering impressive results so far in fiscal 2023. The company has remained largely unaffected by the challenging market conditions and economic uncertainties, which underscores its brand power and customer loyalty. However, the fast-food giant’s top-line growth moderated in recent quarters.

The Chicago-headquartered company’s stock has gained about 19% since slipping to a one-year low in mid-October. Maintaining the positive momentum, the shares are currently trading close to the record highs seen more than a week ago, when they crossed the $300 mark briefly. Being a recession-proof dividend aristocrat, MCD has been a favorite among income investors. After regular hikes, the dividend has reached $1.67 per share and offers a better-than-average yield of 2.4%.

Q4 Report on Tap

When McDonald’s reports fourth-quarter results on February 5, before the opening bell, the market will be looking for earnings of $2.60 per share, up by a penny compared to the same period of last year. The consensus revenue estimate is $5.95 billion, which is broadly unchanged from the prior-year quarter.

Going forward, elevated inflation and the squeeze on consumer spending will likely be a drag on McDonald’s sales, with recent price hikes adding to the problem. Meanwhile, the company’s top line benefited from higher menu prices in recent quarters, and the trend is expected to continue.

From McDonald’s Q3 2023 earnings call:

“As we had expected early in the year and have talked about on prior earnings calls, it’s clear that consumers continue to be more discriminating about what and where they spend. Between inflation remaining high, the elevated cost of fuel, interest rates, housing affordability pressures, and more, consumers all over the world are having to pay more and more for everyday goods and services, proving time and time again in difficult economic times, the McDonald’s brand and our positioning on value is an opportunity for us.”

Sales Jump

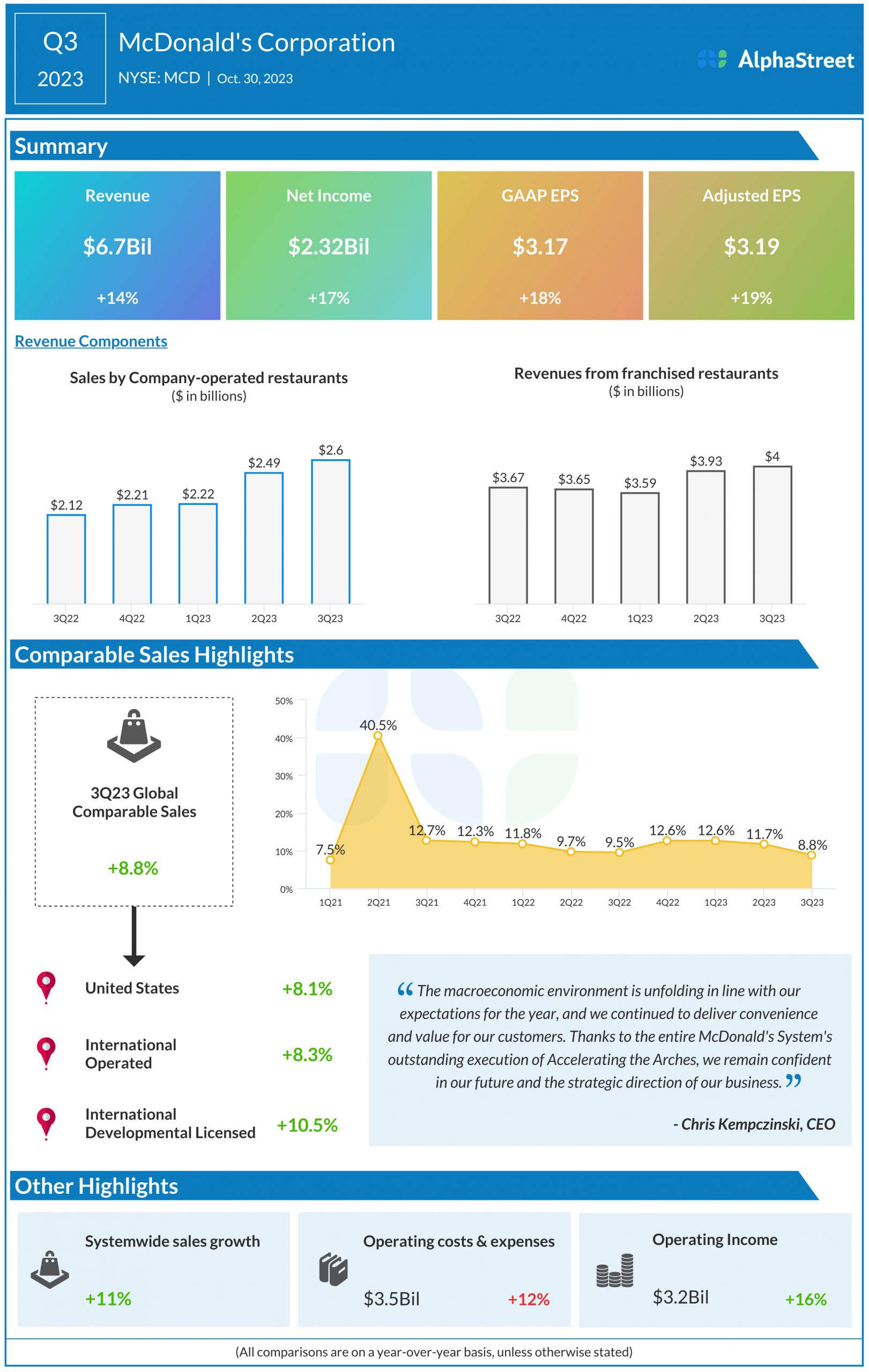

In the third quarter, revenues increased 14% from the prior-year period to $6.7 billion and topped expectations. While comparable sales rose 8.8% year-over-year, growth decelerated for the second consecutive quarter. Sales by company-owned stores continued to grow and franchised restaurant sales rose for the second time in a row. At $3.19 per share, adjusted earnings were up 19% year-over-year. Earnings beat estimates for the seventh quarter in a row.

Shares of McDonald’s ended the last session up 1%, after trading higher throughout the day. MCD has gained 11% in the past twelve months.