Micron Technology Inc. (NASDAQ: MU), a leading provider of memory and storage solutions, is all set to report first-quarter 2024 earnings next week, after reporting losses every quarter in fiscal 2023. Of late, the tech firm has been hit by the slowdown in the memory industry and a ban on its products in the Chinese market.

After falling to a one-year low in the final weeks of 2022, shares of the troubled chipmaker entered an upward spiral and maintained that momentum since then, despite the company’s bottom line slipping into negative territory during that period. The stock outperformed the market quite often this year. Going by experts’ positive outlook, MU has the potential to make strong gains in 2024 and return to the record highs seen about two years ago.

Q1 Estimates

The report for the first three months of fiscal 2024 is expected to be released on December 20, at 4:00 p.m. ET. The bottom line is unlikely to emerge from the negative territory this time – analysts forecast a loss of $0.91 per share for Q1, compared to a loss of $0.04 per share in the year-ago quarter. Meanwhile, it is estimated that revenues increased 4% year-over-year to $4.27 billion in Q1. Recently, the management said it is looking for a loss of around $1.07 per share for the November quarter, on revenues of $4.40 billion.

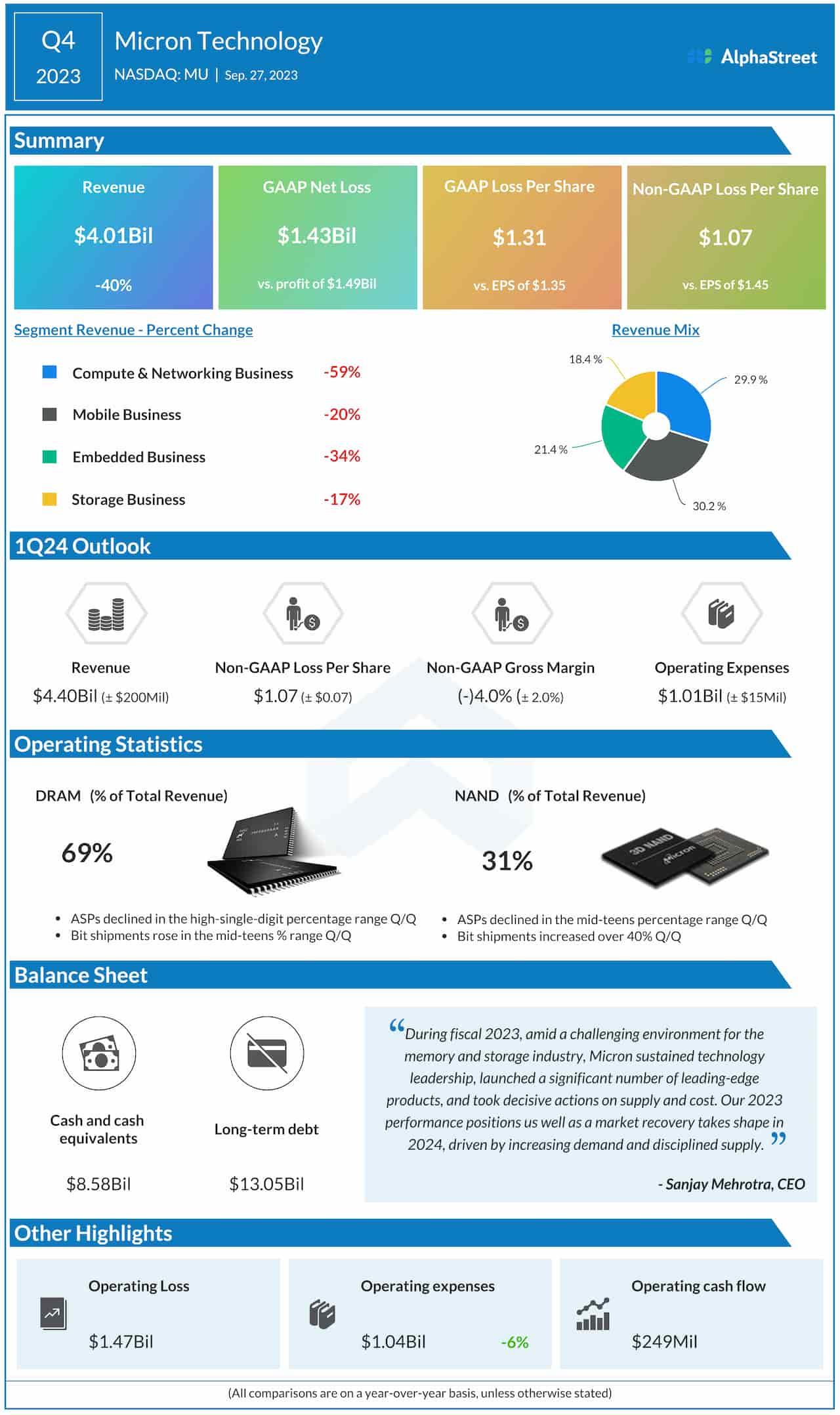

Micron reported negative earnings throughout fiscal 2023, with the Q1 loss being the first in around six years. In Q4, the bottom line beat estimates for the second time in a row, after two consecutive misses. Adjusted loss per share narrowed to $1.07 in the final three months of the year from $1.45 a year earlier. Fourth-quarter revenues fell a dismal 40% annually to $4.01 billion as all four operating segments suffered double-digit declines.

“We continue to expect record industry TAM in calendar 2025 with more normalized levels of profitability. Fiscal 2023 was a challenging year for the memory and storage industry as the revenue TAM reached a multiyear low, resulting in a significant impact on financial performance. Despite this difficult backdrop, the Micron team stayed focused on our strategy, executed well, and accomplished several important milestones,” said Micron’s CEO Sanjay Mehrotra at the last earnings call.

Road Ahead

The general improvement in performance in the second half of the year indicates that Micron is benefitting from the slow but steady recovery in memory demand and improvements in the supply chain. Margins should continue to benefit from the management’s cost-reduction efforts. Operating expenses dropped 6% to around $1.0 billion in the most recent quarter.

MU traded up 3% on Thursday afternoon, continuing the upswing seen since last week. This year, the stock has gained 57% so far.