Morgan Stanley (NYSE: MS) had a slow start to 2019 after its fourth quarter was marred by the slump in the equity market, which had a negative impact on the entire banking sector. The financial services firm is all set to release second-quarter 2019 results Thursday before the opening bell.

The lingering weakness in the stock market is estimated to have affected Morgan Stanley’s trading revenue in the to-be-reported quarter also. Since trading-related activities contribute significantly to the bank’s top line, the impact will be relatively high. Also, other factors like the renewed trade tension, uncertainty related to Brexit and concerns of the global economy cooing off will likely weigh on the bank’s equity underwriting fees and advisory fees.

Though Morgan Stanley has been making solid efforts to reduce costs, all along maintaining operating expenses at sustainable levels, the effect of the initiatives might not be significant in the June quarter. However, it is expected that the challenges will be partially offset by the strong positive M&A environment, an area where the bank has been performing well.

The results could be impacted by the trade tension, uncertainty over Brexit and concerns of the global economy cooing off

While the management recently predicted a weak top-line performance for the second quarter, with trading revenues dropping both annually and sequentially, Wall Street analysts predict a 5.8% decline in revenues to about $10 billion. They also see a 12% fall in earnings to $1.14 per share. Nevertheless, the company is looking for trading revenues that is much above the market’s forecast.

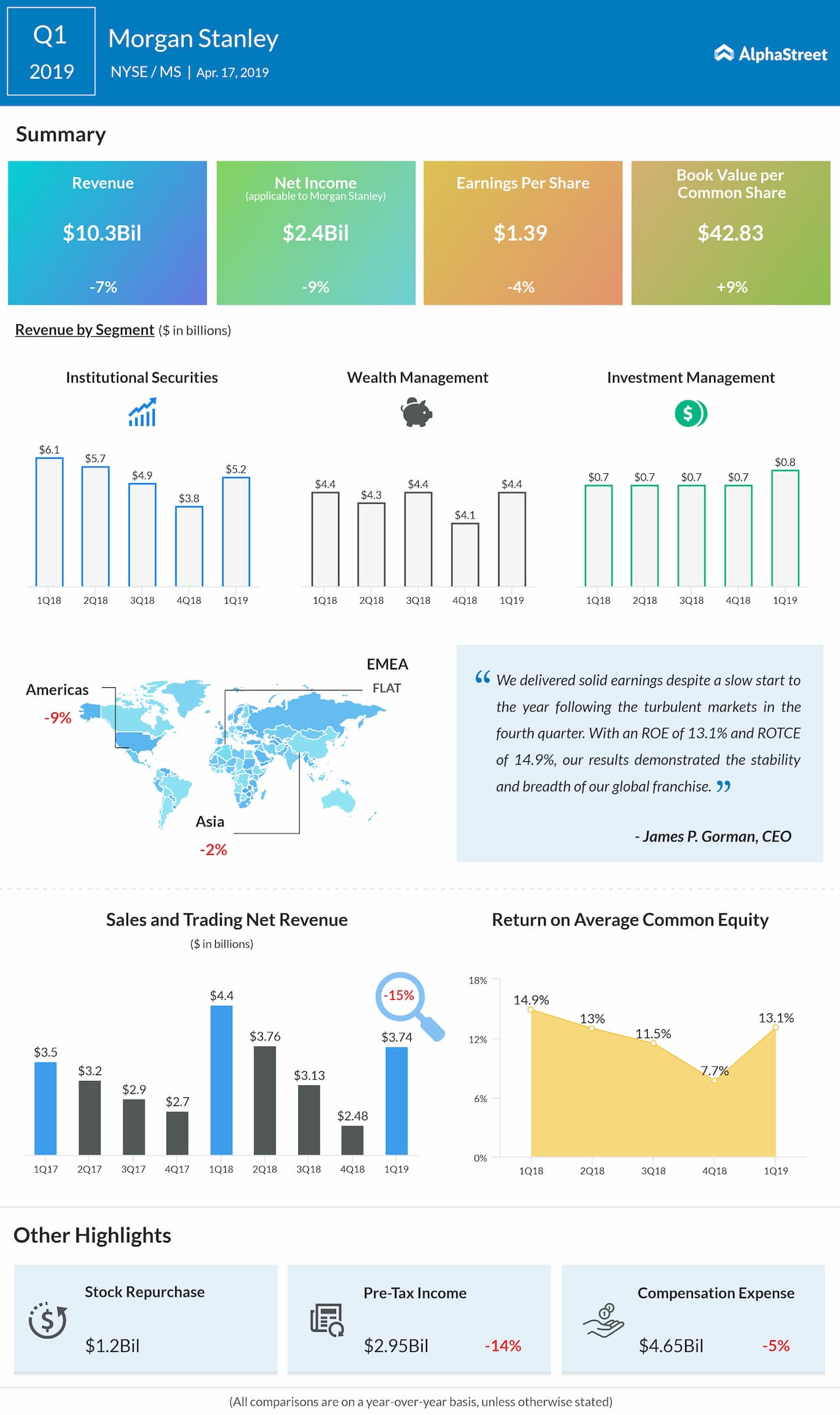

In the March quarter, revenues declined 7% annually to $10.3 billion, mainly reflecting a double-digit fall in trading revenue. Consequently, earnings declined 4% to $1.39 per share but exceeded the estimates.

Earlier, Citigroup (C) reported a 20% increase in second-quarter earnings, helped mainly by the strength of the consumer banking segment. Similarly, earnings of JPMorgan Chase (JPM) climbed 23% to $2.82 per share in the second quarter when a double-digit growth in consumer banking lifted overall revenues. Meanwhile, Goldman Sachs (GS) suffered from broad-based weakness and reported a 3% decrease in second-quarter earnings.

The recovery of Morgan Stanley shares from the multi-year lows seen towards the end of last year was hampered in May when it lost momentum. The stock, which gained 10% since the beginning of the year, dropped about 12% in the past twelve months.