The Lisle, Illinois-based truck maker has been focused on preserving liquidity through effective cost management. But that doesn’t prevent the company from pursuing its expansion goals. According to the executives, they are on track to implement the Navistar 4.0 program as planned, though certain activities are expected to get delayed.

On Track

Work on Navistar’s most advanced production facility is progressing fast at San Antonio, despite the challenging market conditions. In a landmark deal, the company last month clinched a partnership with San Diego-based autonomous driving technology company TuSimple to produce self-driving trucks.

While the virus attack caused a general slump, Navistar’s manufacturing facilities remained mostly operational during the crisis days, which helped in limiting its impact on operations. After the core Trucks segment, the next big operating division is Parts, for which the company launched an e-commerce site last year. The platform is going to play a key role in the coming months when operating conditions return to normal and more trucks hit the roads.

Moderate Buy

Currently, the stock carries a moderate buy rating with a target price of around $32, which represents a 4% upside. The strong momentum seen in recent weeks – 9% gain this month alone – should encourage investors to go for NAV, but the stock’s future is as unpredictable as that of the market itself. Though the valuation looks right, some experts believe the stock is overpriced.

“On cash, we ended the second quarter with $1.5 billion of manufacturing cash. Walter will provide more details in his comments, but we took a number of actions to conserve cash, reduce costs, and enhance liquidity in the quarter. This was necessary to ensure we could proceed with our plans for Navistar 4.0. These actions will assure we have the liquidity and resources to endure the current crisis and position the company for profitable growth, as demand returns,” said chief executive office Troy Clarke in his opening remarks at the second-quarter earnings call.

Resilient to Crisis

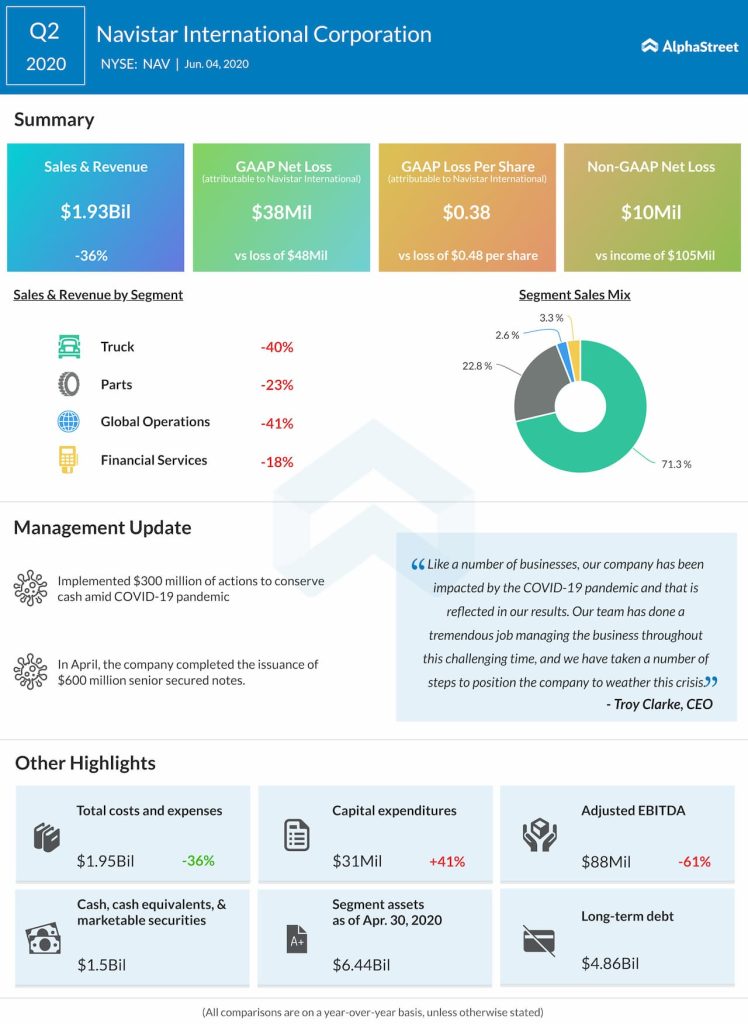

In the April-quarter, the company generated revenues of about $2 billion, though all the business divisions witnessed double-digit decline in sales. Interestingly, the second-quarter loss narrowed to $0.38 per share from $0.48 per share last year, helped by the management’s cost-reduction initiatives. A sharp decline in delivery volumes of the core Class-6-8 trucks in the U.S. and Canada resulted in a 36% fall in sales.

Navistar is a leading producer of trucks –- both medium and heavy-duty — military vehicles and school buses. It mainly serves the North American and South American markets through 37 subsidiaries and 130 branches.

Want to read management/analysts’ comments on Navistar’s Q2 results? Click here

Navistar’s shares started 2020 on an upbeat note, recovering from the lows seen towards the end of last year. In the early days of the virus outbreak, they plunged to the lowest level in more than four years but regained most of the lost momentum in the following weeks. The stock closed the last trading session at $31.72, which is slightly above the value recorded a year earlier.