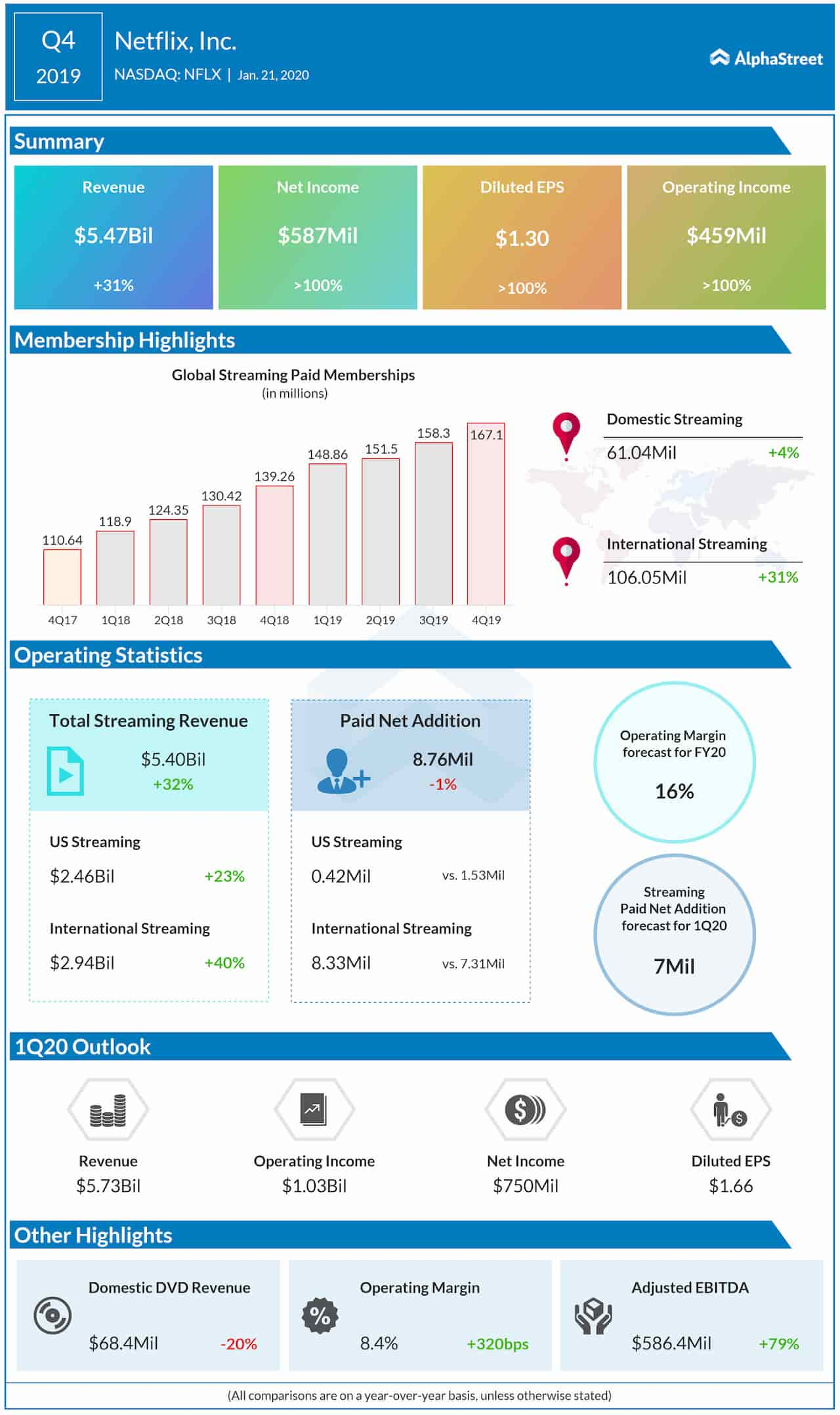

Earlier this week, Netflix Inc. (NASDAQ: NFLX) reported healthy results for the final quarter of 2019 which topped market expectations. Revenue rose 31% coupled with a significant increase in profits. The number of paid members increased 20% to 167 million at the end of the period. The company also saw increases in average revenue per user and average streaming paid memberships.

However, the company saw only 0.42 million paid net adds in the US, possibly due to price changes and the entry of new players in the field. Netflix has been downplaying the impact from the launches of competitive services since last quarter but with more rivals like HBO Max set to enter the space, the risk of losing ground increases.

Disney +, for one, is a rival with a huge library of content

which can, going forward, poach more subscribers from Netflix. The same holds true

for HBO Max. Although net adds in the US and Canada region were down from the

year-ago period at 0.55 million, Netflix said it saw growth in net adds across

all the other regions – EMEA, Latin America and Asia-Pacific.

Netflix also changed the way it reports viewership. The

company will now calculate views based on users watching the content for two

minutes. Most analysts are not pleased with this move and believe this is

likely to distort the viewership metrics going forward.

Netflix continues to believe in its strategy of investing in original content and will go on increasing its investments in this area. This will continue to increase its debt load which is another cause of concern. All in all, it appears that going forward we might see a tiny dent in Netflix’s foundation as the competition increases.